by Calculated Risk on 10/30/2011 10:14:00 PM

Sunday, October 30, 2011

Sunday Night Futures: Japan Intervenes in foreign-exchange

From the WSJ: Japan Intervenes on Yen

[T]he Japanese government launched a new foreign-exchange intervention on Monday, Finance Minister Jun Azumi said ... The intervention came after the dollar fell to a post-World War II record low of ¥75.31 in early Asian trading.The Asian markets are mixed tonight. The Nikkei is up 0.75%, the Hang Seng is down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 5 points, and Dow futures are down about 40 points.

Oil: WTI futures are down slightly to $93.07 and Brent is down to $109.35 per barrel.

Weekend:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

• FOMC Meeting Preview

Recovery Measures

by Calculated Risk on 10/30/2011 05:33:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that most major indicators are still way below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q3 2011 and shows real GDP is finally back to the pre-recession peak. Gross Domestic Income (not shown) returned to the pre-recession peak in Q2 - GDI for Q3 will be released with the 2nd estimate of GDP. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

And real GDP has performed better than other indicators ...

And real GDP has performed better than other indicators ...

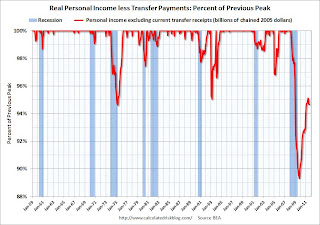

This graph shows real personal income less transfer payments as a percent of the previous peak through September.

This measure was off almost 11% at the trough!

Real personal income less transfer payments is still 5.3% below the previous peak and has declined over the last three months.

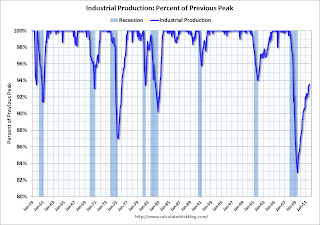

This graph is for industrial production through September.

This graph is for industrial production through September.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 6.5% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 4.8% below the pre-recession peak.

This shows that the recovery in all indicators has been very sluggish compared to recent recessions.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

FOMC Meeting Preview

by Calculated Risk on 10/30/2011 01:55:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the recently announced program to "extend the average maturity of its holdings of securities" (scheduled to end in June 2012), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities".

The FOMC statement will be released at 12:30PM and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM ET.

A couple of things to look for:

1) Fed Chairman Press Briefing. This is the third of the new press briefings. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts (these forecasts used to be released a few weeks after the FOMC meeting with the minutes). Growth forecasts have surely been revised down since June, the unemployment rate revised up, and inflation forecasts have been revised up.

Mr. Bernanke will probably also discuss some other policy options. I expect he will be asked about the possibility of a large scale MBS purchase program (as recently discussed by Fed Vice Chairman Janet Yellen, NY Fed President William Dudley, and Fed Governor Daniel Tarullo).

Here are the updated forecasts through June. The FOMC GDP forecasts for 2011 have been revised down all year, and will probably be revised down to the 1.5% to 2.0% range. The forecast for 2012 will probably be revised down again too.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| June 2011 Projections | 2.7 to 2.9 | 3.3 to 3.7 | 3.5 to 4.2 |

| November 2011 Projections | ??? | ??? | ??? |

The unemployment rate was revised down in April, but was revised back up in June. This will probably be revised up to around 9.0% to 9.2% in the November forecast. The forecasts for the unemployment rate in 2012 and 2013 will also be key. In June, the FOMC expected the unemployment rate to be in the 7.0% to 7.5% in Q4 2013 (still high), and this forecast will probably be revised up again.

Note: The first forecast for 2014 will be included too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| June 2011 Projections | 8.6 to 8.9 | 7.8 to 8.2 | 7.0 to 7.5 |

| November 2011 Projections | ??? | ??? | ??? |

The forecasts for overall and core inflation have been revised up all year and will probably be revised up again in November (PCE inflation will probably be revised up close to 3% and core PCE inflation close to 2%).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| June 2011 Projections | 2.3 to 2.5 | 1.5 to 2.0 | 1.5 to 2.0 |

| November 2011 Projections | ??? | ??? | ??? |

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| June 2011 Projections | 1.5 to 1.8 | 1.4 to 2.0 | 1.4 to 2.0 |

| November 2011 Projections | ??? | ??? | ??? |

2) Possible Statement Changes. The incoming data has been marginally better since the September meeting, so we might see some wording changes. I don't expect the key sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013" to be changed any time soon.

There will probably be some changes to the first paragraph to mention the recent improvement in economic data. I expect the phrase "Household spending has been increasing at only a modest pace" to be upgraded a little.

In the second paragraph, the sentence "there are significant downside risks to the economic outlook, including strains in global financial markets" might also be upgraded a little. There might be some other minor upgrades, but overall the statement will probably be pretty similar to the September statement.

I expect the focus will be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

Visible Existing Home Inventory continues to decline year-over-year in October

by Calculated Risk on 10/30/2011 09:27:00 AM

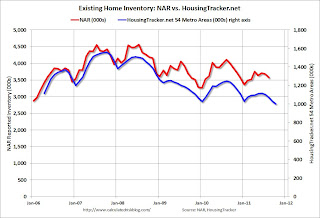

I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

• In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales revisions will be down (the NAR has pre-announced this), and the inventory is expected to be revised down too.

• Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to late 2005 / early 2006 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through September (left axis) and the HousingTracker data for the 54 metro areas through October. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the October listings - for the 54 metro areas - declined 16.4% from last year. Inventory was down 16.7% year-over-year in September.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

Saturday, October 29, 2011

Unofficial Problem Bank list increases to 985 Institutions

by Calculated Risk on 10/29/2011 09:23:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 28, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The OCC finally released some information on its actions since September 23rd. This week, also, the FDIC released its actions through September. These releases contributed to many changes to the Unofficial Problem Bank List. In all, there were seven removals and 16 additions, which leaves the list with 985 institutions with assets of $406.6 billion. A year-ago, the list had 894 institutions with assets of $410.7 billion. For the month, there were 18 additions and 19 removals with 11 from failure, seven from action termination, and one unassisted merger. It was the fourth consecutive month for the list to have fewer institutions since its month-end peak of 1,001 in June, but the serial monthly decline was only a single institution.Earlier:

Among the seven removals this week is the failed All American Bank, Des Plaines, IL ($38 million). Other removals were from action termination including Marathon National Bank of New York, Astoria, NY ($818 million); West Pointe Bank, Oshkosh, WI ($371 million); Ojai Community Bank, Ojai, CA ($125 million Ticker: OJCB); Parkway Bank, Rogers, AR ($116 million); Regal Financial Bank, Seattle, WA ($101 million); and First National Bank and Trust, Barron, WI ($44 million).

Among the 16 additions are United Central Bank, Garland, TX ($2.6 billion); Falcon International Bank, Laredo, TX ($841 million); Valley Community Bank, Pleasanton, CA ($196 million Ticker: VCBC); and Americas United Bank, Glendale, CA ($106 million Ticker: AUNB). It looks like the OCC issued its first formal action against a thrift on September 15 to Stephens Federal Bank, Toccoa, GA ($196 million).

Other changes include the FDIC issuing Prompt Corrective Action orders against Fidelity Bank, Dearborn, MI ($867 million Ticker: DEAR); and Heartland Bank, Leawood, KS ($129 million Ticker: MBR).

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th