by Calculated Risk on 10/21/2011 01:50:00 PM

Friday, October 21, 2011

Misc: Solid Auto Sales seen in October, Merrill Lynch ups GDP Forecast

From the LA Times: October auto sales expected to rise

Auto research company J.D. Power and Associates estimates an annual industry sales pace of 13.1 million vehicles for the month, about the same as September and a big jump from earlier in the year.Auto sales in Q3 were up about 3% over Q2. Even though this estimate for October is about the same as September, sales in Q4 would be up about 5% over Q3 even if sales were flat all quarter (because July and August were weak). This will give a boost to Q4 GDP.

And from Merrill Lynch this morning:

Our tracking model of third quarter GDP has been running well ahead of our former official estimate of 1.8% growth. Today, in our US economic weekly, we officially revise up our Q3 forecast to 2.7%. We expect some of this strong momentum to carry over into the fourth quarter. We bumped up our Q4 estimate to 2.3% from 2.0%.I'm including this because most of the revisions have been down in recent quarters. But it is important to remember this is still sluggish growth.

Dean Baker writes: Is the Double Dip Drifting Away?

The economy looks to be growing in a range of 2-3 percent. This is roughly fast enough to keep even with the growth of the labor force. That implies that we are making zero progress in putting people back to work.Dr. Baker makes some key points: Sluggish growth isn't good, beating "incredibly low expectations" isn't great, and employment is just keeping "even with the growth of the labor force". And we need to remember there are still significant downside risks.

Unfortunately ... this slow growth is likely to be seen as good. It isn't ...

State Unemployment Rates "little changed" in September

by Calculated Risk on 10/21/2011 10:19:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

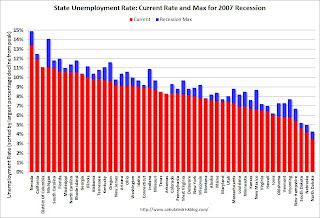

Regional and state unemployment rates were generally little changed in September. Twenty-five states recorded unemployment rate decreases, 14 states posted rate increases, and 11 states and the District of Columbia had no rate change, the U.S. Bureau of Labor Statistics reported today. Thirty-eight states registered unemployment rate decreases from a year earlier, 10 states and the District of Columbia had increases, and 2 states experienced no change.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to report the highest unemployment rate among the states, 13.4 percent in September. California posted the next highest rate, 11.9 percent. North Dakota registered the lowest jobless rate, 3.5 percent, followed by Nebraska, 4.2 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Two states and D.C. are at 2007 recession highs: Arkansas (8.3%), D.C. (11.1%), and Texas (8.5%).

From the BLS: "Forty-six states recorded unemployment rates that were not appreciably different from those of a year earlier."

The fact that 46 states have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.

Europe: Finance Ministers expected to approve aid for Greece, Most Major Decisions Delayed

by Calculated Risk on 10/21/2011 08:58:00 AM

Via the Financial Times Eurozone crisis: live blog from Peter Spiegel in Brussels:

Jean-Claude Juncker, the Luxembourg prime minister who chairs today’s meeting of eurozone finance ministers, has entered the gathering and was characteristically blunt on his way in.There will still be news on Sunday, but the important news will probably be later in the week - or delayed even more.

He said he believed that the ministers will sign off on the €8bn aid tranche for Greece – “at least I hope it will happen this way” – but warned that because of the decision to hold a second summit, most every other major decision may have to be delayed.

Fed Officials discuss buying more MBS, Bernanke talks with Senators

by Calculated Risk on 10/21/2011 12:22:00 AM

For discussion ... from the WSJ: Fed Is Poised for More Easing

Federal Reserve officials are starting to build a case for a new program of buying mortgage-backed securities to boost the ailing economy, though they appear unlikely to move swiftly.Here is the speech by Dan Tarullo: Unemployment, the Labor Market, and the Economy

...

"I believe we should move back up toward the top of the list of options the large-scale purchase of additional mortgage-backed securities," Federal Reserve governor Dan Tarullo said in a speech Thursday at Columbia University.

A new Fed mortgage-bond-buying program isn't a certainty.

I believe we should move back up toward the top of the list of options the large-scale purchase of additional mortgage-backed securities (MBS), something the FOMC first did in November 2008 and then in greater amounts beginning in March 2009 in order to provide more support to mortgage lending and housing markets.And from the WaPo: Bernanke shares concerns on European debt, action on housing

...

A large-scale MBS purchase program has many of the benefits associated with purchases of longer-duration Treasury securities, such as inducing investors to shift to other assets, including bonds and equities. But it could also have more direct effects on the housing market. By increasing demand for MBS, such a program should reduce the effective yield on those MBS, which in turn should put downward pressure on mortgage rates. The aggregate demand effect should be felt not just in new home purchases, but also in the added purchasing power of existing homeowners who are able to refinance. Indeed, homeowners who refinance get the equivalent of a permanent tax cut.

...

[T]he effectiveness of an MBS purchase program would be amplified, perhaps significantly, if certain nonmonetary policies were changed.

Proposals for promoting refinancing have been made by many academics, policymakers, and policy analysts. Any proposals that could sensibly and effectively be implemented would increase the effect of an MBS purchase program. For example, action could be taken to bring the benefits of refinancing to underwater borrowers. ... In practice, though, numerous obstacles have kept the program from helping many potentially eligible borrowers. Underwater borrowers whose loans are not guaranteed by GSEs are essentially unable to refinance at all. Policy changes directed at this last, larger group of homeowners would have to be carefully designed so as not to transfer credit risk from private investors to the government, and could well require legislation.

Federal Reserve Chairman Ben S. Bernanke delivered a stern warning Thursday to Senate Democrats regarding the European debt crisis and offered insight into stabilizing the ailing housing market, according to senators and aides who attended the meeting.

... much of the senators’ conversation with Bernanke revolved around “the growing recognition from everyone—economists across the board—that there needs to be some more dramatic action in housing.”

Bernanke declined to answer questions from reporters as he emerged from the Capitol Hill meeting. But, senators said, Bernanke told the caucus that some relief could come next week when the Federal Housing Finance Agency announces new plans to try to enable homeowners who are under water to refinance.

Thursday, October 20, 2011

House Price Indexes show price declines in August

by Calculated Risk on 10/20/2011 07:05:00 PM

The Case-Shiller House Price index for August will be released Tuesday, Oct 25th. Two other indexes were released today:

• From FNC: Home Prices End Recent Seasonal Rebound with 0.8% Decline in August

FNC’s latest Residential Price Index, released Thursday, indicates U.S. home prices declined in August despite strong existing home sales during the month. This decline reverses a modest fourth-month long seasonal uptrend.The FNC index tables for three composite indexes and 30 cities are here.

...

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ 1 (RPI) indicates that single-family home prices fell in August to a seasonally unadjusted rate of 0.8%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are often sold with large price discounts due to poor property conditions.

• From Radar Logic today Radar Logic Sees Nothing But Weakness in Recent Housing Data

The seasonal decline in home prices shifted into high gear in August. The 25-metropolitan-area RPX Composite Price declined 0.8 percent from July to August, the largest decline for this time of year since the crash of 2008. The RPX Composite price declined 4.7 percent relative to August 2010 ...• CoreLogic reported earlier this month for August: Home prices decreased 0.4 percent on a month-over-month basis

Last month, we predicted that the S&P/Case-Shiller 10-City composite for July 2011 would be about 156 and the 20-City composite would be roughly 143. In fact, the 10-City composite was 156.23 and the 20-City composite was 142.77.

The August 2011 10-City composite index will be about 156, and the 20-City index will be roughly 142.

August Home Price Index (HPI) which shows that home prices in the U.S. decreased 0.4 percent on a month-over-month basis, the first monthly decline in four months. According to the CoreLogic HPI, national home prices, including distressed sales, also declined on a year-over-year basis by 4.4 percent in August 2011 compared to August 2010.... Excluding distressed sales, year-over-year prices declined by 0.7 percent in August 2011 compared to August 2010 and by 1.7 percent in July 2011 compared to July 2010. ...Case-Shiller is a 3 month average (June, July and August), but even with prices for June and July averaged in, the index will probably show price declines for August NSA. The expected seasonal decline in house prices has started.

“Although the calendar says August, the end of the summer traditionally marks the beginning of ‘fall’ for the housing market as it begins to prepare for ‘winter.’ So the slight month-over-month decline was predictable ...” said Mark Fleming, chief economist for CoreLogic.

On a Not Seasonally Adjusted (NSA) basis, as of July, the Case-Shiller composite 10 index was 3.8% above the post-bubble low. The Composite 20 index was 3.7% above the post-bubble low (NSA). Prices will probably fall to new lows (NSA) later this year or early in 2012.

Earlier:

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

• Existing Home Sales graphs