by Calculated Risk on 10/17/2011 11:21:00 AM

Monday, October 17, 2011

Residential Remodeling Index at new high in August

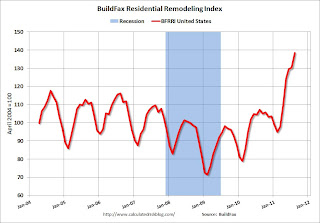

The BuildFax Residential Remodeling Index was at 138.6 in August, up from 130.4 in July. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 29% year-over-year--and for the twenty-second straight month--in August to 138.6. Residential remodels in August were significantly up month-over-month over 8 points (6.3%) from the July value of 130.4, and up year-over-year 31.2 points (29%) from the August 2010 value of 107.4.

...

In August, the West (11.9 points; 9.3%), Midwest (11.4 points; 10.8%), and South (1 point; 1%) all had month-over-month gains, while the Northeast (-.6 points; -.8%) saw a decline.

...

"As mortgage rates hit record lows, it is apparent that millions of Americans are refinancing their homes and using some of their new monthly savings to reinvest in their homes with remodeling projects," said Joe Emison, Vice President of Research and Development at BuildFax. "With remodeling activity growing at an estimated 9.5 percent in 2011 compared to 2010, this is one segment of the economy that is showing continued strength, even as other sectors struggle."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 29% from August 2010. This is the highest year-over-year increase in activity since the index started.

Even though new home construction is still moving sideways, it appears that two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Weekend:

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Industrial Production increased 0.2% in September, Capacity Utilization increased slightly

by Calculated Risk on 10/17/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

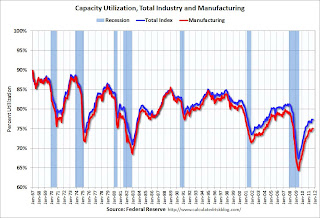

Industrial production increased 0.2 percent in September after having been unchanged in August. Previously, industrial production was reported to have stepped up 0.2 percent in August. For the third quarter as a whole, industrial production rose at an annual rate of 5.1 percent. Manufacturing output moved up 0.4 percent in September after having gained 0.3 percent in August. Production at mines advanced 0.8 percent in September, while the output of utilities decreased 1.8 percent. At 94.2 percent of its 2007 average, total industrial production for September was 3.2 percent above its year-earlier level. Capacity utilization for total industry edged up to 77.4 percent, a rate 1.7 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 94.2. July was revised up, so there was no increase in August.

After the fairly rapid increase last year, increases in industrial production and capacity utilization have slowed recently.

The consensus was for a 0.2% increase in Industrial Production in September, and an increase to 77.5% for Capacity Utilization.

NY Fed: Empire State general business conditions index "little changed" in October

by Calculated Risk on 10/17/2011 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to deteriorate in October. The general business conditions index remained negative and, at -8.5, was little changed. The new orders index hovered around zero, indicating that orders were flat, while the shipments index rose above zero to 5.3.This is the first regional manufacturing survey released for October. Expectations were for some improvement in this index.

...

The index for number of employees rose several points but was at a relatively low level of 3.4, while the average workweek index was negative for a fifth consecutive month.

Weekend:

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Sunday, October 16, 2011

Report: Homes for sale inventory at lowest level since at least 2007

by Calculated Risk on 10/16/2011 09:30:00 PM

From Nick Timiraos at the WSJ: Slim Pickings Are Latest Headache For Home Sales

There were more than 2.19 million homes listed for sale at the end of September, down 20% from a year earlier, according to a new report from the real-estate website Realtor.com. That is the lowest level since the company began its count in 2007.This is similar to the data I've been using from HousingTracker. Even though inventory levels are at the lowest level in a few years, this is still a fairly high level of inventory. As I noted yesterday: "Based on [Tom Lawler's estimate for September], [NAR reported] inventory would fall to 3.44 million in September, down from 3.58 million in August, and months-of-supply would increase to 8.6 months from 8.5 months in August. This would be the lowest level of inventory for September since 2005 (2.77 million in Sept 2005). The peak inventory for September was in 2007 at 4.37 million."

...

[R]eal-estate agents say ... people are pulling their homes off the market rather than try to sell them at today's ... prices.

...

In Detroit, the inventory of homes for sale was down by 28% from a year earlier, according to Realtor.com. Listings were down by 49% in Miami, by 48% in Phoenix and by 46% in Orlando, Fla. Housing inventory was down from one year earlier in all 146 markets tracked by Realtor.com except for Denver and El Paso, Texas.

Many of these people are probably waiting for a "better market" - and they probably will have a long wait!

Yesterday:

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Europe: Clock is ticking, Officials try to ratchet back expectations

by Calculated Risk on 10/16/2011 04:52:00 PM

From the WSJ: Europe Faces More Hurdles on Aid Plan

European leaders have primed investors to expect a sweeping euro-zone rescue plan to be unveiled within a week. But several hurdles remain, among them the details of a new Greek bailout, and clearing them could take weeks, not days. The result could be a plan broad in ambition but short on specifics.From the Financial Times: G20 calls for speedy eurozone package

...

The plan will have three pillars: a call for higher capital levels for banks, a beefing up of the euro zone's bailout fund, and a new package of aid for foundering Greece. The latter is proving particularly difficult.

Olli Rehn, the European Union's economy commissioner, said Saturday that he expects euro-zone leaders on Oct. 23 to "decide on the key principles and parameters" of the second Greek bailout, but that "technical finalization of the program will take place in the course of the subsequent weeks."

France and Germany have less than a week of frantic negotiation ahead ... The Group of 20 richest nations told the eurozone that by the European summit next Sunday it should: agree on the losses the private sector should take on Greek debt; arrange a credible plan for the recapitalisation of Europe’s banks; and install a firewall to protect other countries from Greece’s woes.Yesterday:

excerpt with permission

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th