by Calculated Risk on 10/12/2011 09:00:00 AM

Wednesday, October 12, 2011

Ceridian-UCLA: Diesel Fuel index declined in September

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Falls for the Third Month in a Row – Down 1.0 Percent in September

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, fell 1.0 percent in September on a seasonally and workday adjusted basis, following a 1.4 percent decline in August and a 0.2 percent decline in July.

...

On a year-over-year basis, the PCI was down 0.2 percent in September. This month, the year-over-year change was below last year for the first time since May 2011, or the second time since January 2010; over the past four months, the year-over-year change has been rapidly declining. “Businesses appear to be unwilling to restock for a potentially vibrant holiday season at the same time as normal and they are planning to ramp up inventories late this year, if and when the sales start to materialize,” explained [Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast].

Due to the continued weakness in the PCI, our forecast for September Industrial Production is a 0.55 percent decline when the government estimate is released on October 17.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

This index has declined for three consecutive months after increasing slightly earlier in the year.

Note: This index does appear to track Industrial Production over time (with plenty of noise).

MBA: Mortgage Purchase Application Index increases in Latest Survey

by Calculated Risk on 10/12/2011 07:34:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 1.3 percent from the previous week. The seasonally adjusted Purchase Index increased 1.1 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average loan size of all loans for home purchase in the US was $210,863 in September 2011, down from $212,736 in August 2011. The average loan size for a refinance was $237,632, down from $241,323 in August.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.25 percent from 4.18 percent ... The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.59 percent from 4.49 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was a small increase in the purchase index. This index declined sharply in August suggesting fairly weak home sales in September in October, not counting cash buyers (other reports suggest a high number of cash buyers in September).

Tuesday, October 11, 2011

Jim the Realtor: "Market is a buzz"

by Calculated Risk on 10/11/2011 11:40:00 PM

I bring you what I'm hearing - and this is an optimistic outlook from Jim the Realtor in San Diego:

"The [real estate] market is a buzz currently. The action is incredible. Offers flying everywhere. I think the buyers are scrambling knowing that these rates are incredible right now. And I think it is going to be a healthy 4th quarter.

...

I think we get into spring time - if rates are still this low - it’s going to be a real frenzy."

Jim Klinge, Oct 2011

Distressed House Sales using Sacramento Data

by Calculated Risk on 10/11/2011 06:50:00 PM

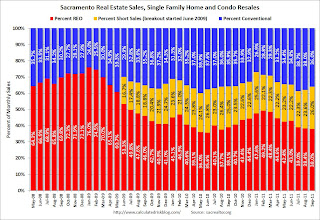

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

As I've written before: "I'm not sure what I'm looking for, but I'll know it when I see it!" (hopefully) At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in September compared to August. In September 2011, 64.0% of all resales (single family homes and condos) were distressed sales. This is up from 62.0% in August, and down slightly from 64.1% in September 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 12.9% over September 2010. Sales were up slightly compared to September 2009.

Active Listing Inventory is down 30% from last September, although "short sale contingent" has increased. Still, we are seeing a sharp decline in inventory in many areas, and that is something to watch. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

So far - no improvement!

Report: Foreclosure starts declined in September

by Calculated Risk on 10/11/2011 03:32:00 PM

This is a report for several western states ... from ForeclosureRadar: After Big Jump in August, Foreclosure Starts Fall Again

After a significant jump in foreclosure starts in August, driven primarily by Bank of America, foreclosure starts returned to levels in line with prior months, far below the numbers reached at the peak. California has seen a drop in activity of 56 percent since its peak, from 58,623 Notice of Default filings in March of 2009 to 25,778 today. Arizona shows a similar swing in Notice of Trustee Sale filings, from 14,722 in March of 2009 to 5,982 filings last month - a decrease of 59.4 percent. Washington shows the greatest decrease of all, with 71.5 percent less Notice of Trustee Sale filings today than at their peak in June of 2009.Investors are very active in most of these states with third party buying at or near record levels.

Foreclosure sales were mixed this month, with declines in Arizona, California and Nevada, while Oregon and Washington both showed increases. Despite the declines, the percentage purchased by third parties, typically investors, was at or near peak levels. In California, third parties made up a record 27.4 percent of all sales last month. In Arizona, that number was even higher at 38.3 percent, also a record. Nevada was just shy of their record, set in August at 29.1 percent. Sales to third parties was up Washington was up 15.6 percent, a record for this year. Oregon was the only state to to show a decrease, down from 15.5 percent in July to 6.0 percent today.