by Calculated Risk on 10/07/2011 10:11:00 AM

Friday, October 07, 2011

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

This was a weak report, but better than many expected. A few points:

• The Verizon labor dispute subtracted 45,000 payroll jobs in August and those jobs were added back in September. From the BLS: "The increase in employment partially reflected the return to payrolls of about 45,000 telecommunications workers who had been on strike in August."

• The household survey showed an increase of 398,000 jobs in September. This increase in the household survey kept the unemployment rate from rising, even as more people participated in the workforce (labor force increase by 423,000). The unemployment rate was unchanged at 9.1%, and the participation rate increased to 64.2% from 64.0%. The employment population ratio also increased to 58.3% from 58.2%.

• Employment for July and August were revised up. From the BLS: "The change in total nonfarm payroll employment for July was revised from +85,000 to +127,000, and the change for August was revised from 0 to +57,000." That is an additional 99,000 jobs.

This was still a weak employment report. There were only 103,000 jobs added in September. There were 137,000 private sector jobs added, and 34,000 government jobs lost.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.5%; this is at the high for the year.

The average workweek increased slightly to 34.3 hours, and average hourly earnings increase slightly - but this just reversed the decline in August. "The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour over the month to 34.3 hours following a decrease of 0.1 hour in August. The manufacturing workweek edged down by 0.1 hour in September to 40.2 hours. ... In September, average hourly earnings for all employees on private nonfarm payrolls increased by 4 cents, or 0.2 percent, to $23.12. This increase followed a decline of 4 cents in August."

Through the first nine months of 2011, the economy has added 1.074 million total non-farm jobs or just 119 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.6 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.341 million private sector jobs this year, or about 149 thousand per month.

There are a total of 13.992 million Americans unemployed and 6.24 million have been unemployed for more than 6 months. Very grim.

Overall this was a weak report, and only looked decent because expectations were so low.

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

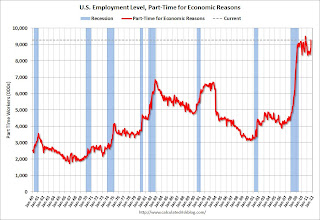

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose to 9.3 million in September.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 9.27 million in September from 8.826 million in August. This is the high for the year.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.5% in September from 16.2% in August.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.242 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.034 million in August. This is very high - near the highest level this year, and long term unemployment remains a serious problem.

• Earlier Employment post: September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

by Calculated Risk on 10/07/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment edged up by 103,000 in September, and the unemployment rate held at 9.1 percent, the U.S. Bureau of Labor Statistics reported today. The increase in employment partially reflected the return to payrolls of about 45,000 telecommunications workers who had been on strike in August.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for July was revised from +85,000 to +127,000, and the change for August was revised from 0 to +57,000

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate was unchanged at 9.1% (red line).

The Labor Force Participation Rate increased to 64.2% in September (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio increased to 58.3% in September (black line).

Note: the household survey showed a strong gain in jobs, and that is why the unemployment rate could hold steady with few payroll jobs added - and the participation rate increase.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. The red line is moving sideways - and I'll need to expand the graph soon.

This was still a weak report, but better than August (although the 45,000 Verizon workers made a big difference). There were decent upwards revisions to the July and August reports too. I'll have much more soon ...

Reis: Mall Vacancy Rates increased in Q3

by Calculated Risk on 10/07/2011 12:17:00 AM

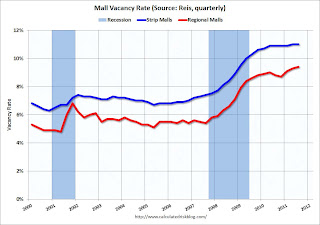

From Reuters: U.S. mall Q3 vacancy rate at 11-year high -report

Preliminary figures by real estate research firm Reis Inc show the average vacancy rate at regional malls rose to 9.4 percent in the third quarter, the highest level since Reis began tracking regional mall vacancy rates in 2000 and up from 9.3 percent in the second quarter.

...

The vacancy rate at ... local retail strips was 11 percent, flat with the second quarter, Reis said. ... "With demand remaining so weak and more new completions anticipated to come online in the remainder of 2011, there is still a good chance that the vacancy rate will match the 11.1 percent record high observed in 1990 sometime later this year," Reis senior economist Ryan Severino said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The vacancy rate for regional malls is the highest on record, and the vacancy rate for strip malls is just below the record set in 1990. It is still very ugly for malls ...

• On the employment report tomorrow: Employment Situation Preview: Another Weak Report

Earlier:

• CoreLogic: Home Price Index declined 0.4% in August

• Weekly Initial Unemployment Claims increase to 401,000

• Reis: Apartment Vacancy Rate falls to 5.6% in Q3

Thursday, October 06, 2011

Survey: Small Business Owners report reduction in employment, hiring plans slightly positive

by Calculated Risk on 10/06/2011 07:18:00 PM

Note: NFIB’s monthly small business survey for September will be released on Tuesday, October 11, 2011.

From the National Federation of Independent Business (NFIB): NFIB Jobs Statement: No News is Bad News; More Jobs Lost

“There is no good news to report. Until sales improve, until it becomes cost-effective to hire new workers, we cannot expect small-business owners to take advantage of new hiring tax credits and increase their employee rolls. ... For the fourth month in a row, small-business owners reported an overall reduction in employment, posting an average reduction of 0.3 workers per firm." [said William C. Dunkelberg, Chief economist for (NFIB)]Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

And looking ahead, 11 percent plan to increase employment (unchanged) over the next three months, while 12 percent plan to reduce their workforce (also unchanged), yielding a seasonally adjusted net 4 percent of owners planning to create new jobs, one point lower than August and far below the double digit readings that are typical during an expansion.

Here is a graph of the net hiring plans for the next three months since 1986.

Here is a graph of the net hiring plans for the next three months since 1986.Hiring plans were still low in September, but still positive and the trend is up.

It is no surprise that small businesses are struggling due to the high concentration of real estate related companies in the survey. But as Dunkelberg noted, until sales improve (lack of demand) small business hiring will remain weak.

• On the employment report tomorrow: Employment Situation Preview: Another Weak Report

Earlier:

• CoreLogic: Home Price Index declined 0.4% in August

• Weekly Initial Unemployment Claims increase to 401,000

• Reis: Apartment Vacancy Rate falls to 5.6% in Q3

Misc: Solid Retail Sales, Rail Traffic increases, ECB, Protests

by Calculated Risk on 10/06/2011 03:40:00 PM

The first three stories are more evidence for sluggish growth in the U.S. economy. Also the ECB is offering more liquidity, and protests spread in the U.S.

• From MasterCard: SpendingPulse September 2011 U.S. Retail Sector Report: Momentum Continues With Strong Results in Most Sectors

... Most sectors reported positive year-over-year sales results, with particularly strong results in the Apparel, Hardware, and Department Store sectors.• From the WSJ: September Retail Sales Are Solid Ahead of Holiday Push

According to Michael McNamara, VP of Research and Analysis for MasterCard Advisors SpendingPulse, the results showed the continuing resilience of the U.S. consumer, even in the face of a lackluster labor environment and volatile financial markets. “The US consumer continues to spend across multiple sectors outside of the sectors tied to the housing market. This resilience in retail sales growth has been impressive in spite of disruptive weather, high gasoline prices and generally negative economic news,” he observed.

McNamara suggested that some of the boost in year-over-year results may be due to the aftermath of Hurricane Irene back in August, particularly in stores with a strong presence on the East Coast. The strong performance in Hardware may reflect some repair work, and September’s Apparel sales may have been boosted by delayed back-to-school shopping. Meanwhile, the poor housing market continues to be reflected in declines in Furniture, Furnishings, and Electronics and Appliances.

The 23 retailers tracked by Thomson Reuters reported a 5.1% rise in stores open more than a year, or same-store sales. The figure beat expectations for 4.6% and compares with 2.7% growth last year.• From the Association of American Railroads: AAR Reports Gains for September Rail Traffic

The Association of American Railroads (AAR) today reported ... U.S. railroads originating 1,195,671 carloads, up 1.1 percent [from September 2010], and 949,606 trailers and containers, up 2.3 percent.• From Reuters: ECB gears up crisis measures, tussles over rates

...

“Carloads have been closely tracking last year’s levels for six months, and intermodal continues to grow, though more moderately than earlier this year,” said AAR Senior Vice President John T. Gray. “Rail traffic is consistent with an economy that is probably still growing, but far more slowly than any of us would want.”

The European Central Bank reinstated some of its ... crisis-fighting tools on Thursday ... but opted to keep interest rates at 1.5 percent despite some of the bank's policymakers calling for cuts.• From Reuters: Wall St protests spread

...

[Jean-Claude Trichet] said [the ECB] will offer struggling banks two new injections of ultra-cheap 1-year funding and buy another 40 billion euros ($54 billion) of 'covered bonds' -- assets backed by mortgage loans or public sector lending and perceived as safe to own.

"The economic outlook remains subject to particularly high uncertainty and intensified downside risks," Trichet told a news conference, offering a more gloomy prognosis than last month when he merely talked of downside risks.

Protests that began in New York against U.S. economic inequality spread around America on Thursday ...The anger and frustration is understandable, and I'm definitely sympathetic. The economy needs to benefit everyone.

Dallas Fed President Richard Fisher told a group of business people in Fort Worth, Texas: "I am somewhat sympathetic - that will shock you."

• And on the employment report tomorrow: Employment Situation Preview: Another Weak Report