by Calculated Risk on 10/03/2011 11:19:00 AM

Monday, October 03, 2011

Construction Spending increased in August

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2011 was estimated at a seasonally adjusted annual rate of $799.1 billion, 1.4 percent (±2.1%)* above the revised July estimate of $788.3 billion. The August figure is 0.9 percent (±1.9%)* above the August 2010 estimate of $791.7 billion.Private construction spending increased in August:

Spending on private construction was at a seasonally adjusted annual rate of $511.0 billion, 0.4 percent (±1.3%)* above the revised July estimate of $508.9 billion. Residential construction was at a seasonally adjusted annual rate of $237.8 billion in August, 0.7 percent (±1.3%)* above the revised July estimate of $236.2 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64.8% below the peak in early 2006, and non-residential spending is 34% below the peak in January 2008.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling as the stimulus spending ends. The improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index increases in September

Weekend:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

• A few preliminary comments on the September Employment Report

ISM Manufacturing index increases in September

by Calculated Risk on 10/03/2011 10:00:00 AM

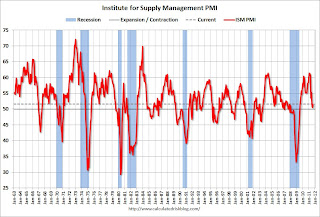

PMI was at 51.6% in September, up from 50.6% in August. The employment index was at 53.8%, up from 51.8%, and new orders index was unchanged at 49.6%.

From the Institute for Supply Management: September 2011 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 51.6 percent, an increase of 1 percentage point from August, indicating expansion in the manufacturing sector for the 26th consecutive month, at a slightly higher rate. The Production Index registered 51.2 percent, indicating a return to growth after contracting in August for the first time since May of 2009. The New Orders Index remained unchanged from August at 49.6 percent, indicating contraction for the third consecutive month. The Backlog of Orders Index decreased 4.5 percentage points to 41.5 percent, contracting for the fourth consecutive month and reaching its lowest level since April 2009, when it registered 40.5 percent. Comments from respondents generally reflect concern over the sluggish economy, political and policy uncertainty in Washington, and forecasts of ongoing high unemployment that will continue to put pressure on demand for manufactured products."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.5% and suggests manufacturing expanded at a slightly higher rate in September than in August. It appears manufacturing employment expanded in September with the employment index increasing to 53.8%, up from 51.8% in August.

Chrysler: U.S. September sales increase 27% year-over-year

by Calculated Risk on 10/03/2011 08:48:00 AM

From MarketWatch: Chrysler's U.S. Sept. sales rise 27%

Chrysler Group LLC's U.S. auto sales climbed 27% as the manufacturer posted its strongest September since 2007 and saw double-digit sales increases among its biggest brands.The key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total September light vehicle sales (SAAR) - usually around 4 PM ET.

...

Chrysler ... also estimated the industry's U.S. sales in September at a seasonally adjusted annualized rate of 13.2 million.

The consensus is for an increase to 12.6 million SAAR, from 12.1 million in August, however I think we will see a stronger increase based on recent manufacturer and dealer reports. This will probably be the strongest month for auto sales since April (13.13 million SAAR) - before the tsunami in Japan.

I'll add the reports from the other major auto companies as updates to this post.

Update: From MarketWatch: GM U.S. vehicle sales total 207,145 in Sept., up 20%

From MarketWatch: Ford Sept. U.S. sales rise 9%

Weekend:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

• A few preliminary comments on the September Employment Report

Sunday Night: Europe and Futures

by Calculated Risk on 10/03/2011 12:50:00 AM

• An overview on Europe from the NY Times: Toil and Trouble Over the Caldron That Is Greece

In the short term, Greece remains the central problem. ... Europe’s strategy, to the extent it can be discerned, is to put off restructuring Greece’s debt as long as possible and build up enough backing for a bailout fund so that banks with large exposure to the sovereign debt of Greece and other troubled euro-zone countries, like Portugal, Ireland, Italy and Spain, can survive an all-but-inevitable Greek default.What a mess.

...

When speaking privately, officials concede that Greece’s debt ... is unsustainable and that lenders will probably have to write some of it off. A “haircut” of 50 percent, followed by a recapitalization of banks if necessary, is the outcome most commonly mentioned.

Germany and France are not prepared to consider doing that yet, though, in part because relieving the pressure on Greece would remove its incentive to overhaul its finances and make its economy more competitive. ... Equally important, Germany and France want to delay any Greek default, orderly or not, until they have bolstered the rescue fund and taken other steps to protect Italy, the biggest economy in southern Europe.

The Asian markets are red tonight with the Nikkei down 2.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 8 points, and Dow futures are down about 65 points.

Oil: WTI futures are down to $78 and Brent is down under $102 per barrel.

Yesterday:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

Sunday, October 02, 2011

Greece to cut 30,000 public sector jobs, miss deficit targets

by Calculated Risk on 10/02/2011 04:46:00 PM

From the Financial Times: Greek cabinet approves budget cuts

[Finance Minister] Venizelos has agreed to eliminate 30,000 public sector jobs by December ... About 23,000 workers nearing retirement will lose their positions. Another 7,000 will be made redundant after mergers and restructurings ... “Given that we’re taking such tough measures ... the sixth tranche is assured.” [said Venizelos]Cutting jobs means putting workers into "reserve" and they are still paid 60% of their salary.

excerpt with permission

And from Deutche Welle: Greece misses EU and IMF deficit targets

Greece announced late Sunday that its budget deficit will reach 8.5 percent of gross domestic product (GDP) this year, below the initial target of 7.6 percent.The troika is still working on pay cuts for higher-paid officials.

According to a statement issued by the Finance Ministry, Greece will manage to bring the budget deficit down to 6.8 per cent of GDP next year, but it will still miss the bailout target of 6.5 per cent of GDP.

"Because three critical months remain for the completion of the financial year 2011, and the final estimate of 8.5 per cent of GDP deficit can be achieved if the state mechanism and citizens respond accordingly," the finance ministry statement said.

Yesterday:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd