by Calculated Risk on 9/21/2011 04:55:00 PM

Wednesday, September 21, 2011

Will there be another Refinance Boom?

First, one of the changes in the FOMC statement was the assessment of "downside risks". The August phrase "downside risks to the economic outlook have increased" was changed to "there are significant downside risks to the economic outlook, including strains in global financial markets." (emphasis added). Now the risks are "significant".

The Ten year Treasury yield declined following the FOMC announcement today to 1.875% - another record low. The Fed will not extend maturities, but the Fed will also "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities", and that will probably push mortgage rates down.

A 3 handle for a conforming 30 year fixed rate mortgage is very possible. As of Sept 15, the 30 year fixed rate was at 4.09% for conforming loans according to the Freddie Mac Weekly Primary Mortgage Market Survey®.

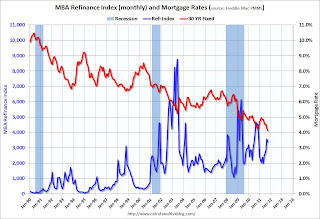

Here are a couple of graphs - the first comparing 30 year conforming mortgage rates to the MBA Refinance index (on a monthly basis), and the 2nd graph is weekly comparing the Refinance index to the Ten Year yield.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years and will probably fall further.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates might not fall that far - but there should be an increase in refinance activity over the next few weeks. Note: 30 year conforming mortgage rates were at 4.23% in October 2010.

The second graph compares refinance activity to the ten year yield.

The second graph compares refinance activity to the ten year yield.

The ten year yield is below the level during the financial crisis.

My guess is we see 30 year mortgage rates under 4% and a significant pickup in mortgage refinance activity - although probably not the level of refinance activity that happened in 2003 or 2009.

Earlier:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

FOMC Statement: Extend Maturities, Reinvest in agency mortgage-backed securities

by Calculated Risk on 9/21/2011 02:22:00 PM

From the Federal Reserve:

Information received since the Federal Open Market Committee met in August indicates that economic growth remains slow. Recent indicators point to continuing weakness in overall labor market conditions, and the unemployment rate remains elevated. Household spending has been increasing at only a modest pace in recent months despite some recovery in sales of motor vehicles as supply-chain disruptions eased. Investment in nonresidential structures is still weak, and the housing sector remains depressed. However, business investment in equipment and software continues to expand. Inflation appears to have moderated since earlier in the year as prices of energy and some commodities have declined from their peaks. Longer-term inflation expectations have remained stable.UPDATE: Statement from NY Fed: Statement Regarding Maturity Extension Program and Agency Security Reinvestments (includes details).

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect some pickup in the pace of recovery over coming quarters but anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, there are significant downside risks to the economic outlook, including strains in global financial markets. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to extend the average maturity of its holdings of securities. The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less. This program should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

To help support conditions in mortgage markets, the Committee will now reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. In addition, the Committee will maintain its existing policy of rolling over maturing Treasury securities at auction.

The Committee also decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action were Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who did not support additional policy accommodation at this time.

Earlier:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Existing Home Sales: Comments and NSA Graph

by Calculated Risk on 9/21/2011 11:59:00 AM

A few comments and a graph (of course):

• The NAR reported that inventory decreased in August from July, and that inventory is off 13.1% from August 2010. Other data sources suggest that the NAR is overstating inventory (inventory will be part of the coming revisions). Also it appears inventory has continued to decline (year-over-year) in September.

This year-over-year decline in inventory is one of the most important stories of the year for the existing home market, and is hardly being mentioned. I suspect many homeowners are "waiting for a better market", but less inventory will put less downward pressure on prices. Of course REO activity is picking up again and distressed sales will put more downward pressure on prices - but this decline in inventory is still important.

• The NAR provided an update on the timing of the "benchmark revisions":

Update on Benchmark Revisions: ... Preliminary data based on the new benchmark is undergoing review by professional economists. This process is expected to take some time before finalized revisions can be published to address any issues that may surface in the review process and to update monthly seasonal adjustment factors; NAR is committed to providing accurate, reliable data. Publication of the revisions is expected in several months, and we will provide a notice several weeks in advance of the publication date.This revision is expected to show significantly fewer homes sold over the last few years (perhaps 10% to 15% fewer homes in 2010 than originally reported), and also fewer homes for sale.

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The red columns are for 2011.

Sales NSA are above last August - of course sales declined sharply last year following the expiration of the tax credit in June 2010 - but sales are also above August 2008 and 2009 (pre-revision).

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 29 percent of transactions in August, unchanged from July; they were 28 percent in August 2010; investors account for the bulk of cash purchases.Earlier:

Investors accounted for 22 percent of purchase activity in August, up from 18 percent in July and 21 percent in August 2010. First-time buyers purchased 32 percent of homes in August, unchanged from July; they were 31 percent in August 2010.

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Existing Home Sales graphs

Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

by Calculated Risk on 9/21/2011 10:00:00 AM

The NAR reports: August Existing-Home Sales Rise Despite Headwinds, Up Strongly from a Year Ago

Total existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 7.7 percent to a seasonally adjusted annual rate of 5.03 million in August from an upwardly revised 4.67 million in July, and are 18.6 percent higher than the 4.24 million unit level in August 2010.

...

Total housing inventory at the end of August fell 3.0 percent to 3.58 million existing homes available for sale, which represents an 8.5-month supply4 at the current sales pace, down from a 9.5-month supply in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2011 (5.03 million SAAR) were 7.7% higher than last month, and were 18.6% above the August 2010 rate (depressed in Aug 2010 following expiration of tax credit).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.58 million in August from 3.69 million in July.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.1% year-over-year in August from August 2010. This is the seventh consecutive month with a YoY decrease in inventory.

Inventory decreased 13.1% year-over-year in August from August 2010. This is the seventh consecutive month with a YoY decrease in inventory.Months of supply decreased to 8.5 months in August, down from 9.5 months in July. This is much higher than normal. These sales numbers were well above the consensus, but just slightly above Lawler's forecast using the NAR method.

I'll have more soon ...

AIA: Architecture Billings Index Turns Positive

by Calculated Risk on 9/21/2011 08:12:00 AM

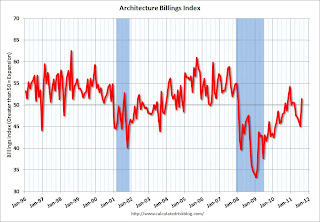

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Turns Positive after Four Straight Monthly Declines

On the heels of a period of weakness in design activity, the Architecture Billings Index (ABI) took a sudden upturn in August. ... The American Institute of Architects (AIA) reported the August ABI score was 51.4, following a very weak score of 45.1 in July. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.9, up sharply from a reading of 53.7 the previous month.

“Based on the poor economic conditions over the last several months, this turnaround in demand for design services is a surprise,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Many firms are still struggling, and continue to report that clients are having difficulty getting financing for viable projects, but it’s possible we’ve reached the bottom of the down cycle.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index increased to 51.4 in August from 45.1 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent contraction suggests further declines in CRE investment in early 2012, but possibly flattening out in 9 to 12 months (just one month's data).