by Calculated Risk on 8/31/2011 07:13:00 AM

Wednesday, August 31, 2011

MBA: Mortgage Purchase Activity "near 15-year lows"

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12.2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Refinance application volume declined for a second week from recent highs, despite rates staying near a 10-month low, while purchase volume remained near 15-year lows," said Mike Fratantoni, MBA's Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.32 percent from 4.39 percent, with points increasing to 1.30 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is now at the lowest levels since August 1995!

This doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last three weeks, and this suggests weak home sales in the coming months.

Tuesday, August 30, 2011

LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

by Calculated Risk on 8/30/2011 08:14:00 PM

LPS Applied Analytics released their July Mortgage Monitor Report today. From LPS: LPS' Mortgage Monitor Report Shows Average Loan in Foreclosure Is Delinquent for Record 599 Days; First-Time Foreclosure Starts Near Three-Year Lows

The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.According to LPS, 8.34% of mortgages were delinquent in July, up from 8.15% in June, and down from 9.31% in July 2010.

As of the end of June, 4.1 million loans were either 90 or more days delinquent or in foreclosure, as delinquencies remain two times and foreclosures eight times pre-crisis levels. Foreclosure sales remain constricted, with foreclosure starts outnumbering sales by a factor of almost three to one.

LPS reports that 4.11% of mortgages were in the foreclosure process, down slightly from 4.12% in June, and up from 3.74% in July 2010. This gives a total of 12.45% delinquent or in foreclosure. It breaks down as:

• 2.48 million loans less than 90 days delinquent.

• 1.90 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.54 million loans delinquent or in foreclosure in July.

Click on graph for larger image in graph gallery.

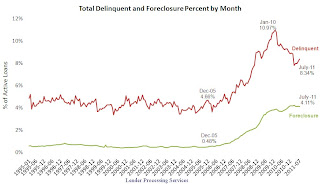

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has increased recently (part of the increase is seasonal), but the rate has fallen to 8.34% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million) - and the average loan in foreclosure has been delinquent for a record 599 days!

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.Looking at this graph, one might expect the number of loans in the foreclosure process to be increasing sharply since there are so many more starts than sales.

And there are very few cures too - what is happening is a large number of loans each month have been moving from "in foreclosure" back to "90+ days delinquent" status - so the number of loans "in foreclosure" hasn't increased recently.

The third graph shows mortgage origination by the original term.

The third graph shows mortgage origination by the original term. This graph is interesting because of the surge in shorter duration loans.

This is probably being driven by two factors: 1) older borrowers are hoping to pay off their loans as part of their retirement planning and are taking out 15 year mortgages, and 2) many jumbo borrowers are probably taking out 5 year loans with a balloon payment since 30 year jumbo rates are much higher.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

Recession Measures

by Calculated Risk on 8/30/2011 05:39:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that most major indicators are still way below the pre-recession peaks.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.5% below the previous pre-recession peak. However Gross Domestic Income (red) is now back to the pre-recession peak. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

And real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision!

Real personal income less transfer payments is still 4.8% below the previous peak.

This graph is for industrial production through July.

This graph is for industrial production through July.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 6.5% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

On the timing of the trough of the recession, GDP and industrial production would suggest the end of Q2 2009 (and June 2009). The other two indicators would suggest later troughs.

And of course the recovery in all indicators has been very sluggish compared to recent recessions.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

FOMC Minutes: Discussed Options for additional monetary accommodation

by Calculated Risk on 8/30/2011 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, August 9, 2011. Excerpts:

Participants discussed the range of policy tools available to promote a stronger economic recovery should the Committee judge that providing additional monetary accommodation was warranted. Reinforcing the Committee's forward guidance about the likely path of monetary policy was seen as a possible way to reduce interest rates and provide greater support to the economic expansion; a few participants emphasized that guidance focusing solely on the state of the economy would be preferable to guidance that named specific spans of time or calendar dates. Some participants noted that additional asset purchases could be used to provide more accommodation by lowering longer-term interest rates. Others suggested that increasing the average maturity of the System's portfolio--perhaps by selling securities with relatively short remaining maturities and purchasing securities with relatively long remaining maturities--could have a similar effect on longer-term interest rates. Such an approach would not boost the size of the Federal Reserve's balance sheet and the quantity of reserve balances. A few participants noted that a reduction in the interest rate paid on excess reserve balances could also be helpful in easing financial conditions. In contrast, some participants judged that none of the tools available to the Committee would likely do much to promote a faster economic recovery, either because the headwinds that the economy faced would unwind only gradually and that process could not be accelerated with monetary policy or because recent events had significantly lowered the path of potential output. Consequently, these participants thought that providing additional stimulus at this time would risk boosting inflation without providing a significant gain in output or employment. Participants noted that devoting additional time to discussion of the possible costs and benefits of various potential tools would be useful, and they agreed that the September meeting should be extended to two days in order to provide more time.The forward guidance was included in the last FOMC statement. The other three options are: Additional asset purchases (QE3), extend maturities, and reduce interest paid on reserves. As Bernanke noted in his Jackson Hole speech, the next meeting has been extended to allow for more discussion of these options.

...

In the discussion of monetary policy for the period ahead, most members agreed that the economic outlook had deteriorated by enough to warrant a Committee response at this meeting. While all felt that monetary policy could not completely address the various strains on the economy, most members thought that it could contribute importantly to better outcomes in terms of the Committee's dual mandate of maximum employment and price stability. In particular, some members expressed the view that additional accommodation was warranted because they expected the unemployment rate to remain well above, and inflation to be at or below, levels consistent with the Committee's mandate. Those viewing a shift toward more accommodative policy as appropriate generally agreed that a strengthening of the Committee's forward guidance regarding the federal funds rate, by being more explicit about the period over which the Committee expected the federal funds rate to remain exceptionally low, would be a measured response to the deterioration in the outlook over the intermeeting period. A few members felt that recent economic developments justified a more substantial move at this meeting, but they were willing to accept the stronger forward guidance as a step in the direction of additional accommodation. Three members dissented because they preferred to retain the forward guidance language employed in the June statement.

Real House Prices and Price-to-Rent

by Calculated Risk on 8/30/2011 11:25:00 AM

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through June) and CoreLogic House Price Indexes (through June) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to May 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to May 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to May 2000.

Earlier:

• Case Shiller: Home Prices increased in June