by Calculated Risk on 8/24/2011 01:20:00 PM

Wednesday, August 24, 2011

FHFA Introduces Expanded House Price Index

A common criticism of the FHFA house price index (HPI) is that the index only includes GSE properties. Today the FHFA announced (PDF) an expanded series:

To further enhance public understanding of house price changes, FHFA is introducing in this release a new set of house price indexes that make use of additional sales price information from external data sources. The new indexes, denoted as the “expanded-data” HPI, use a data sample that has been augmented with sales price information for homes with mortgages endorsed by the Federal Housing Administration (FHA) and real property county recorder information licensed from DataQuick Information Systems. In the past, price trends sometimes have been different for homes with Fannie Mae or Freddie Mac financing than for properties with alternate financing. To the extent those differences exist, the new data sources will allow the expanded-data HPI to reflect price trends for a larger set of homes.These expanded-data indexes are quarterly for states, census divisions, and the United States. The FHFA is considering introducing MSA indexes too. Here is the Q2 expanded series data.

Using the standard FHFA HPI:

U.S. house prices were 0.6 percent lower in the second quarter than in the first quarter of 2011 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). ... While the national, purchase-only house price index fell 5.9 percent from the second quarter of 2010 to the second quarter of 2011, prices of other goods and services rose 4.5 percent over the same period. Accordingly, the inflation-adjusted price of homes fell approximately 10.0 percent over the last year.The expanded FHFA national series was down 1.1 percent in Q2 (Seasonally adjusted), and down 6.1% from Q2 2010 - and down 24.2% from the peak.

For comparison, the Case-Shiller national quarterly index was off 32.7% from the peak in Q1 2011.

In 2005, most reporting focused on NAR median house prices - however median prices can be distorted by the mix of homes sold. The most followed repeat sales price index in 2005 was the OFHEO HPI (now FHFA). The Case-Shiller index gained popularity in early 2007 since it seemed to better reflect observed changes in house prices. (as an example, the first mention of the Case-Shiller index in the LA Times appears to be on June 27, 2007)

Now the most followed house price indexes are Case-Shiller and CoreLogic; both repeat sales indexes. There are several other house price indexes that I track: RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

With the addition of the expanded quarterly HPI, I will probably mention the FHFA indexes more often in the future. Also the NAR is rumored to be considering introducing a repeat sales index. The "most followed" indexes might change again ...

Europe Update: Greek Bond Yields Surge

by Calculated Risk on 8/24/2011 10:31:00 AM

The Greek bailout deal is under pressure ... and the Greek 2 year yield increased to 44% and the 10 year yield increased to 18% this morning.

From the WSJ: German Adviser: We Must Help Greece

The euro zone must continue to stand by Greece while it carries out a decade of reforms ... Wolfgang Franz, chairman of the independent council of economic advisers to the federal government ... said in a telephone interviewFrom the Telegraph: Finland threatens to withdraw Greek bailout support

Mr. Franz struck ... said he was "horrified" by the Finnish government's request for collateral against its next tranche of aid, saying that this could cause the whole deal to unravel.

"This is a discussion that should be ended as soon as possible," he said. "This is the exact opposite of solidarity."

Jyrki Katainen, the Finnish prime minister ... said that if Finland's bilateral agreement with Greece over collateral payments was overruled, the Nordic country could back out of the rescue programme.The Portuguese 2 year yield is up some to 13.3%, otherwise there is no panic in the European bond markets. Right now this is just an issue for Greece.

He told reporters that the private collateral agreement, in which Greece agreed to give Finland €1bn (£875m) in cash in return for its support, was "our parliament's decision that we demand it as a condition for us joining in".

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 282, down from 389 on Aug 4th, and the Spanish spread is at 279, down from 398 on Aug 4th.

Also the Irish 2 year yield is at 8.9%. And the French 10 year is at 2.87%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

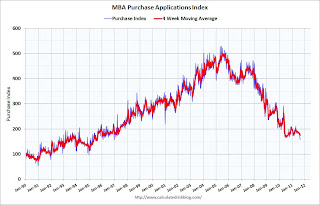

MBA: Mortgage Purchase Activity at Lowest Level Since 1996

by Calculated Risk on 8/24/2011 07:28:00 AM

The MBA reports: Mortgage Applications Decrease with Purchase Index at Lowest Level Since 1996

The Refinance Index decreased 1.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier and is at the lowest level in the survey since December 1996.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Another week of volatile markets and rampant uncertainty regarding the economy kept prospective homebuyers on the sidelines, with purchase applications falling to a 15-year low," said Mike Fratantoni, MBA's Vice President of Research and Economics. "This decline impacted borrowers across the board, with purchase applications for jumbo loans falling by more than 15 percent, and purchase applications for the government housing programs (FHA, VA, and USDA) falling by 8.2 percent. Although mortgage rates remain quite low, they increased over the week, bringing refinance application volumes down slightly."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.39 percent from 4.32 percent, with points increasing to 0.88 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index has been moving down recently and is at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last two weeks.

Tuesday, August 23, 2011

DOT: Vehicle Miles Driven decreased -1.4% in June compared to June 2010

by Calculated Risk on 8/23/2011 11:15:00 PM

The Department of Transportation (DOT) reported:

Based on preliminary reports from the State Highway Agencies, travel during June 2011 on all roads and streets in the nation changed by -1.4 percent (-3.8 billion vehicle miles) resulting in estimated travel for the month at 259.1** billion vehicle-miles.This was before the recent slowdown.

Cumulative Travel changed by -1.1 percent (-15.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 43 months - so this is a new record for longest period below the previous peak - and still counting!

Note: some people have asked about miles driven on a per capita basis (or per registered driver), and I'm still looking at the data.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the slowdown at the end of July and in August, miles driven might decline further.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

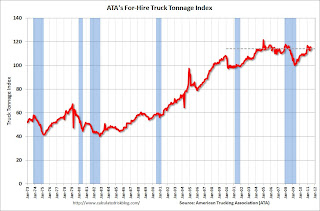

ATA Trucking index decreased 1.3% in July

by Calculated Risk on 8/23/2011 06:20:00 PM

From ATA: ATA Truck Tonnage Index Fell 1.3% in July

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.3% in July after rising a revised 2.6% in June 2011. ... The latest pullback put the SA index at 114 (2000=100) in July, down from the June level of 115.5.

...

Compared with July 2010, SA tonnage was up 3.9%. In June, the tonnage index was 6.5% above a year earlier.

...

“We had heard that freight weakened from a robust June, that that was true,” ATA Chief Economist Bob Costello said. Tonnage has fallen in three of the last four months on a sequential basis.

“Despite a solid June, our truck tonnage index fits with an economy that is growing very slowly,” Costello noted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.When the June index was released it was already obvious that July would be weak based on comments from UPS and others. August will probably show a decline too.