by Calculated Risk on 8/24/2011 07:28:00 AM

Wednesday, August 24, 2011

MBA: Mortgage Purchase Activity at Lowest Level Since 1996

The MBA reports: Mortgage Applications Decrease with Purchase Index at Lowest Level Since 1996

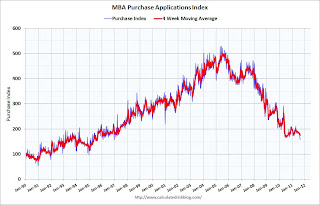

The Refinance Index decreased 1.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier and is at the lowest level in the survey since December 1996.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Another week of volatile markets and rampant uncertainty regarding the economy kept prospective homebuyers on the sidelines, with purchase applications falling to a 15-year low," said Mike Fratantoni, MBA's Vice President of Research and Economics. "This decline impacted borrowers across the board, with purchase applications for jumbo loans falling by more than 15 percent, and purchase applications for the government housing programs (FHA, VA, and USDA) falling by 8.2 percent. Although mortgage rates remain quite low, they increased over the week, bringing refinance application volumes down slightly."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.39 percent from 4.32 percent, with points increasing to 0.88 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index has been moving down recently and is at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last two weeks.

Tuesday, August 23, 2011

DOT: Vehicle Miles Driven decreased -1.4% in June compared to June 2010

by Calculated Risk on 8/23/2011 11:15:00 PM

The Department of Transportation (DOT) reported:

Based on preliminary reports from the State Highway Agencies, travel during June 2011 on all roads and streets in the nation changed by -1.4 percent (-3.8 billion vehicle miles) resulting in estimated travel for the month at 259.1** billion vehicle-miles.This was before the recent slowdown.

Cumulative Travel changed by -1.1 percent (-15.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 43 months - so this is a new record for longest period below the previous peak - and still counting!

Note: some people have asked about miles driven on a per capita basis (or per registered driver), and I'm still looking at the data.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the slowdown at the end of July and in August, miles driven might decline further.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

ATA Trucking index decreased 1.3% in July

by Calculated Risk on 8/23/2011 06:20:00 PM

From ATA: ATA Truck Tonnage Index Fell 1.3% in July

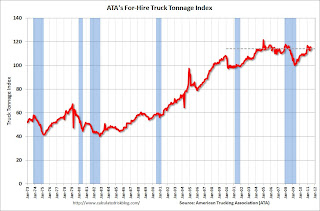

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.3% in July after rising a revised 2.6% in June 2011. ... The latest pullback put the SA index at 114 (2000=100) in July, down from the June level of 115.5.

...

Compared with July 2010, SA tonnage was up 3.9%. In June, the tonnage index was 6.5% above a year earlier.

...

“We had heard that freight weakened from a robust June, that that was true,” ATA Chief Economist Bob Costello said. Tonnage has fallen in three of the last four months on a sequential basis.

“Despite a solid June, our truck tonnage index fits with an economy that is growing very slowly,” Costello noted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.When the June index was released it was already obvious that July would be weak based on comments from UPS and others. August will probably show a decline too.

Philly Fed State Coincident Indexes for July

by Calculated Risk on 8/23/2011 03:05:00 PM

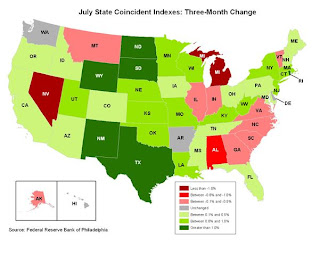

I haven't post this in some time, but the map is turning red again ...

Click on map for larger image.

Above is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago. Here is the Philadelphia Fed state coincident index release (pdf) for July 2011.

In the past month, the indexes increased in 29 states, decreased in 13, and remained unchanged in eight for a one-month diffusion index of 32. Over the past three months, the indexes increased in 34 states, decreased in 12, and remained unchanged in four (Arkansas, Delaware, Hawaii, and Washington) for a three-month diffusion index of 44.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 29 states, decreased in 13, and remained unchanged in 8. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Misc: Richmond Fed, FDIC Problem Banks, Home Sales Distressing Gap

by Calculated Risk on 8/23/2011 12:15:00 PM

• Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined

In August, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — declined nine points to −10 from July's reading of −1.Another weak regional manufacturing survey.

...

Hiring activity at District plants slowed in August. The manufacturing employment index subtracted three points to 1 and the average workweek index moved down five points to −5. Moreover, wage growth eased, losing eight points to finish at 2.

• From the FDIC: Quarterly Banking Profile

The number of institutions on the FDIC's "Problem List" fell for the first time in 15 quarters. The number of "problem" institutions declined from 888 to 865. This is the first time since the third quarter of 2006 that the number of "problem" banks fell. Total assets of "problem" institutions declined from $397 billion to $372 billion. Twenty-two insured institutions failed during the second quarter, four fewer than in the previous quarter, and the fewest since the first quarter of 2009. This is the fourth quarter in a row that the number of failures has declined. Through the first six months of 2011, there have been 48 insured institution failures, compared to 86 failures in the same period of 2010.• Distressing Gap: The following graph shows existing home sales (left axis) and new home sales (right axis) through July. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales