by Calculated Risk on 8/22/2011 10:05:00 PM

Monday, August 22, 2011

Moody's: Commercial Real Estate Prices increased in June

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says

U.S. commercial property prices rose 0.9 percent in June, the second straight monthly gain ... The index, which measures broad price trends, is down 6.6 percent from a year earlier and 45 percent below the peak of October 2007.The article mentions some of the events that have impacted commercial real estate since June, so July and August might be weaker:

Europe’s debt crisis, signs the U.S. will remain mired in sluggish growth through next year and the Standard & Poor’s downgrade of the nation’s credit rating roiled financial markets and triggered a selloff in securities linked to debt on commercial real estate. ...Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 6.6% from a year ago and down about 45% from the peak in 2007. Some of this is probably seasonal, although Moody's mentioned a price pickup "beyond trophy properties and major U.S. coastal cities". Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

• Mortgage Delinquencies by State: Range and Current

Mortgage Delinquencies by State: Range and Current

by Calculated Risk on 8/22/2011 06:25:00 PM

Earlier I posted a graph on mortgage delinquencies by state. This raised a question of how the current delinquency rate compares to before the crisis - and also a comparison to the peak of the delinquency crisis in each state.

The following graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line). The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some states have made progress: Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey, New York, Illinois and Florida are all judicial states.

Note: This data is for 42 states only and D.C.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

Even though there has been some progress in a few states, there is a long way to go to get back to the Q1 2007 rates.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

Research: Aging Population will probably lower Stock Market P/E Ratio

by Calculated Risk on 8/22/2011 03:37:00 PM

From the San Francisco Fed: Boomer Retirement: Headwinds for U.S. Equity Markets?

This Economic Letter examines the extent to which the aging of the U.S. population creates headwinds for the stock market. We review statistical evidence concerning the historical relationship between U.S. demographics and equity values, and examine the implications of these demographic trends for the future path of equity values.There are two diagrams in the economic letter. This is probably another reason many boomers will never retire ...

...

[E]vidence suggests that U.S. equity values are closely related to the age distribution of the population. Since demographic trends are largely predictable, we can forecast the path that the P/E ratio is likely to follow in the next few decades based on the predicted M/O ratio.

...

What does the model say about the future trajectory of the P/E ratio? ... To obtain this future P/E* path, we calculate the projected M/O ratio from 2011 to 2030 by feeding Census Bureau projected population data into the estimated model. Figure 2 shows that P/E* should decline persistently from about 15 in 2010 to about 8.4 in 2025, before recovering to 9.14 in 2030.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

MBA Delinquency Survey: Comments and State Data

by Calculated Risk on 8/22/2011 12:25:00 PM

A couple of comments from MBA chief economist Jay Brinkmann on the conference call:

• The bad news is short term delinquencies increased in Q2. The not-so-bad news is long serious delinquencies declined slightly.

• Because of the high level of delinquencies, there are some questions about the accuracy of the seasonal adjustment.

• Florida has almost 25% of all loans in the U.S. in the foreclosure process. California is 2nd with 10.6%, but the percent of loans in-foreclosure in California (3.62%) is actually below the national average (4.43%).

• Judicial foreclosure states usually have the highest percentage of loans in the foreclosure process.

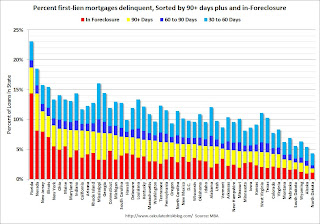

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

Florida, Nevada, New Jersey and Illinois are the top four states with percent of loans in the foreclosure process.

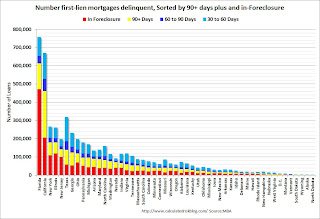

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Ohio and Maine.

I'll post some more graphs later to show which states are seeing improvement.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.9 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

The third graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as Indiana and Rhode Island (previous graph).

The third graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as Indiana and Rhode Island (previous graph).

Florida has 7.6% of all loans, but almost 25% of all loans in-foreclosure and 18% of all seriously delinquent loans. In most ways, dividing this by states is arbitrary - except the foreclosure process matters.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

MBA: Mortgage Delinquencies increased slightly in Q2

by Calculated Risk on 8/22/2011 10:30:00 AM

The MBA reported that 12.87 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2011 (seasonally adjusted). This is up slightly from 12.84 percent in Q1 2011.

From the MBA: Delinquencies Rise, Foreclosures Fall in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.44 percent of all loans outstanding as of the end of the second quarter of 2011, an increase of 12 basis points from the first quarter of 2011, and a decrease of 141 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey. ...Note: 8.44% (SA) and 4.43% equals 12.87%.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.43 percent, down 9 basis points from the first quarter and 14 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.85 percent, a decrease of 25 basis points from last quarter, and a decrease of 126 basis points from the second quarter of last year.

"While overall mortgage delinquencies increased only slightly between the first and second quarters of this year, it is clear that the downward trend we saw through most of 2010 has stopped. Mortgage delinquencies are no longer improving and are now showing some signs of worsening," said Jay Brinkmann, MBA's Chief Economist. "The good news is the continued decline in long-term delinquencies, those mortgages that are three payments or more past due. The bad news is that drop is offset by an increase in newly delinquent loans one payment past due."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.46% from 3.35% in Q1. This is probably related to the increase in the unemployment rate.

Delinquent loans in the 60 day bucket increased slightly to 1.37% from 1.35%.

There was a slight decrease in the 90+ day delinquent bucket. This decreased to 3.61% from 3.65% in Q1 2011.

The percent of loans in the foreclosure process decreased to 4.43%.

So short term delinquencies ticked up, and the 90+ day and in-foreclosure rates declined. I'll have more later after the conference call this morning.