by Calculated Risk on 8/20/2011 09:17:00 PM

Saturday, August 20, 2011

The New Retirement Plan: No Retirement

From Rachel Ensign at the WSJ: For Many Seniors, There May Be No Retirement

Already battered nest eggs took another beating this month with the market's wild swings. With interest rates essentially at zero since 2008, income from Treasurys and certificates of deposit is pretty paltry. ... On top of that, housing prices [leave] homeowners with much less equity to tap.Here is the survey mentioned in the article: The New Retirement: Working

• The survey found that for many Americans, the foundation of their retirement strategy is simply not to retire, to work considerably longer than the traditional retirement age, or work in retirement:Earlier:

–39 percent of workers plan to work past age 70 or do not plan to retire

–54 percent of workers expect to plan to continue working when they retire

–40 percent now expect to work longer and retire at an older age since the recession

• Workers’ greatest fears about retirement include “outliving my savings and investments” and “not being able to meet the financial needs of my family.”

• Most workers will continue working out of financial necessity:

–Workers estimate their retirement savings needs at $600,000 (median), but in comparison, fewer than one-third (30 percent) have currently saved more than $100,000 in all household retirement accounts

–Most workers, regardless of age or household income, agree that they could work until age 65 and still not have enough money saved to meet their retirement needs

–Of those who plan on working past the traditional retirement age of 65, the most commonly cited reasons are of need versus choice

–Many workers (31 percent) anticipate that they will need to provide financial support to family members

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

Unofficial Problem Bank list declines to 984 Institutions

by Calculated Risk on 8/20/2011 07:06:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 20, 2011.

Changes and comments from surferdude808:

The Unofficial Problem Bank List dropped by four institutions this week to 984 while aggregate assets increased by $1.2 billion to $412.5 billion. In all, there were seven removals and three additions.CR Note: The FDIC will release the Q2 Quarterly Banking Profile soon - and also the official number of problems banks.

The removals include two cures, four failures, and an unassisted merger. The OCC terminated actions against Minnstar Bank National Association, Lake Crystal, MN ($101 million) and United Bank, National Association, Absarokee, MT ($71 million). The failures were Lydian Private Bank, Palm Beach, FL ($1.7 billion); First Southern National Bank, Statesboro, GA ($175 million); First Choice Bank, Geneva, IL ($150 million); and Public Savings Bank, Huntingdon Valley, PA ($49 million), which was closed unusually on a Thursday as the bank observed Shommer Shabat. The sole unassisted merger was First National Bank of The North, Sandstone, MN ($72 million) into Northview Bank, Finlayson, MN.

The additions include GreenBank, Greeneville, TN ($2.4 billion Ticker: GRNB); The First National Bank of Shelby, Shelby, NC ($971 million Ticker: FNSE); and Heartland Bank, Leawood, KS ($131 million), which was inadvertently removed as the FDIC modified its enforcement action instead of terminating it.

As expected, the OCC did release its enforcement actions through mid-July, the first since the merger with the OTS was completed, but there were no actions taken against any thrifts. Next week, we anticipate the FDIC will release its actions through July 2011.

Earlier:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

Schedule for Week of Aug 21st

by Calculated Risk on 8/20/2011 02:31:00 PM

Earlier:

• Summary for Week ending August 19th (with plenty of graphs)

The most anticipated event this coming week is Fed Chairman Bernanke's speech at Jackson Hole on Friday.

The key economic releases this week are July New Home Sales on Tuesday and the second estimate of Q2 GDP on Friday. Several high frequency releases will be closely watched: weekly initial unemployment claims, consumer sentiment (final) and two more regional Fed manufacturing surveys. On Monday, the MBA will release the Q2 National Delinquency Survey.

8:30 AM ET: Chicago Fed National Activity Index (July). This is a composite index of other data.

10:00 AM: Mortgage Bankers Association (MBA) 2nd Quarter 2011 National Delinquency Survey (NDS)

10:00 AM: Mortgage Bankers Association (MBA) 2nd Quarter 2011 National Delinquency Survey (NDS)Click on graph for larger image in graph gallery.

This graph shows the percent of loans delinquent by days past due.

The MBA reported 8.32% of mortgage loans were delinquent at the end of Q1, seasonally adjusted, and another 4.52% were in the foreclosure process (total of 12.84%). The deliquency rate probably decreased in Q2, but the in-foreclosure rate probably increased.

Expected: The Moody's/REAL Commercial Property Price Indices (commercial real estate price index) for June.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the June sales rate of 312 thousand (SAAR).

The consensus is for a slight increase to 313 thousand SAAR in July.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August. The consensus is for the index to be at minus 7, down from minus 1 in July. (below zero is contraction).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months, although refinance activity probably increased sharply last week.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders after decreasing 2.1% in June.

10:00 AM: FHFA House Price Index for June 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 415,000 from 408,000 last week.

11:00 AM: Kansas City Fed regional Manufacturing Survey for August. The index was at 3 in July.

8:30 AM: Q2 GDP (second estimate). This is the second estimate for Q2 GDP from the BEA.

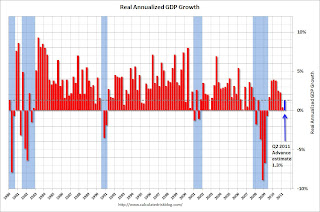

8:30 AM: Q2 GDP (second estimate). This is the second estimate for Q2 GDP from the BEA.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The first estimate was for 1.3% annualized growth in Q2. The consensus is for a downward revision to 1.1% annualized real GDP growth.

9:55 AM: Reuters/University of Mich Consumer Sentiment final for August. The consensus is for a slight increase to 56.0 from the preliminary August reading of 54.9.

10:00 AM: Fed Chairman Ben Bernanke speaks at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, "Near- and Long-Term Prospects for the U.S. Economy"

Summary for Week ending August 19th

by Calculated Risk on 8/20/2011 08:15:00 AM

Once again the two key concerns last week were the weaker economic outlook and the European financial crisis. As I noted last night, a number of analysts have revised down their GDP forecasts for the next few quarters and the debate of a “double dip” recession has really picked up.

In the U.S., some of the high frequency data have been exceptionally weak, especially the NY and Philadelphia Fed manufacturing surveys and consumer sentiment (previous week). That fits with a number of anecdotal reports of the economy freezing for almost two weeks during the debt ceiling debate. There is a growing concern that that debate induced freeze is leading to a "self-reinforcing downward spiral" for the economy. Of the major high frequency data, only weekly initial unemployment claims was relatively benign last week.

The monthly data was mixed. July industrial production and capacity utilization was fairly strong, housing starts are still moving sideways and existing home sales were down.

Here is a summary in graphs:

• Housing Starts declined slightly in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Total housing starts were at 604 thousand (SAAR) in July, down 1.5% from the revised June rate of 613 thousand.

Single-family starts declined 4.9% to 425 thousand in July. This was slightly above expectations of 600 thousand starts in July. Multi-family starts are increasing in 2011 - although from a very low level.

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

The NAR reports: Existing-Home Sales Down in July but Up Strongly From a Year Ago

The NAR reports: Existing-Home Sales Down in July but Up Strongly From a Year Ago

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2011 (4.67 million SAAR) were 3.5% lower than last month, and were 21% above the July 2010 rate.

According to the NAR, inventory decreased to 3.65 million in July from 3.72 million in June.

According to the NAR, inventory decreased to 3.65 million in July from 3.72 million in June.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 8.9% year-over-year in July from July 2010. This is the sixth consecutive month with a YoY decrease in inventory.

Months of supply increased to 9.4 months in July, up from 9.2 months in June. This is much higher than normal.

This graph shows existing home sales Not Seasonally Adjusted (NSA). The red columns are for 2011.

This graph shows existing home sales Not Seasonally Adjusted (NSA). The red columns are for 2011.

Sales NSA are above last July - of course sales declined sharply last year following the expiration of the tax credit in June 2010.

These sales numbers were below the consensus, but right at Lawler's forecast of 4.69 million using the NAR method

• Industrial Production increased 0.9% in July, Capacity Utilization increases

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production advanced 0.9 percent in July and the capacity utilization rate for total industry climbed to 77.5 percent.

Both industrial production and capacity utilization had been moving sideways for a few months. This was a fairly strong increase, although partially related to the extreme heat (and an increase in utilities). This was above the consensus forecast of a 0.5% increase in Industrial Production, and an increase to 77.0% for Capacity Utilization.

• Empire State and Philly Fed Manufacturing Surveys show contraction

From the NY Fed: Empire State Survey indicates contraction

From the NY Fed: Empire State Survey indicates contraction

From the Philly Fed: Regional manufacturing activity has dipped significantly

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The averaged Empire State and Philly Fed surveys are well below zero suggesting a further decline in the ISM index.

• AIA: Architecture Billings Index Drops for Fifth Straight Month

This graph shows the Architecture Billings Index since 1996. The index decreased in in July to 45.1 from 46.3 in June. Anything below 50 indicates a contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index decreased in in July to 45.1 from 46.3 in June. Anything below 50 indicates a contraction in demand for architects' services.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. Some of the recent decline is because the American Recovery and Reinvestment Act of 2009 is winding down, and state and local governments are still cutting back.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in 2012.

• Key Measures of Inflation in July

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.3% annualized rate) during the month."

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.3% annualized rate) during the month."

On a year-over-year basis, these measures of inflation are increasing, and near the Fed's target. "Over the last 12 months, the median CPI rose 1.8%, the trimmed-mean CPI rose 2.1%, the CPI rose 3.6%, and the CPI less food and energy rose 1.8%."

With the slack in the system - and falling gasoline prices, the year-over-year measures will probably stay near or be below 2% by the end of this year.

• Weekly Initial Unemployment Claims increased to 408,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 402,500.

This is the lowest level for the 4-week average since early April. The 4-week average is still elevated, but has been moving down since mid-May.

• Other Economic Stories ...

• NAHB Builder Confidence index unchanged in August, Still Depressed

• NY Fed Q2 Report on Household Debt and Credit

• Residential Remodeling Index at new high in June

• State Unemployment Rates "little changed" in July

Have a great weekend!

Friday, August 19, 2011

More downward revisions to economic forecasts

by Calculated Risk on 8/19/2011 09:20:00 PM

Below are some downward forecast revisions released last night and today. If these forecasts are close, then the unemployment rate will probably increase over the next few quarters too ...

• From Wells Fargo today:

Based on the evidence we have reviewed ... we have concluded there are now significant downside risks to economic growth over the near term. Our forecast now calls for real GDP to rise 1.6 percent in 2011 and 1.1 percent in 2012 ... it is entirely possible the current downward spiral in the economy and financial markets will become self-reinforcing. We will be monitoring high frequency data for further signs of economic deterioration and revise our outlook as needed.• From Goldman Sachs today:

In light of the downshift in the data this week, we are cutting our second-half growth forecasts further. We now expect GDP growth of 1.0% in Q3 and 1.5% in Q4, both down from 2.0% previously.• From JPMorgan via MarketWatch: J.P. Morgan further cuts U.S. growth forecast (ht jb)

Economists at J.P. Morgan on Friday further cut estimates for U.S. economic growth and warned that recession risks are "clearly elevated." While the outlook for third-quarter growth looks only "moderately softer" than previously projected, the economists, in a research note, said they have slashed the outlook for fourth-quarter growth to 1% from a previous projection of 2.5%. They also lowered their first-quarter 2012 growth forecast to 0.5% from 1.5%.• From Citigroup last night via Bloomberg: U.S. Economic Growth Estimates Cut at Citigroup

[Citigroup analysts] cut its 2011 gross domestic product growth forecast to 1.6 percent from 1.7 percent and lowered its 2012 GDP growth estimate to 2.1 percent from 2.7 percent.