by Calculated Risk on 8/19/2011 09:01:00 AM

Friday, August 19, 2011

Europe Update: More Bank Funding Concerns

From the Financial Times: Funding fears hit European bank stocks

Worries that the eurozone debt crisis could infect the financial system hit the short-term funding markets ... Switzerland’s two largest banks, Credit Suisse and UBS, both denied they had made use of the Federal Reserve’s swap facility ...There is no panic in the bond markets. Some of the spreads have widened, but that is mostly because of lower German yields.

excerpt with permission

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 283, down from 389 on Aug 4th, and the Spanish spread is at 286, down from 398 on Aug 4th. The yield on the Spanish Ten and Italian 10 year bonds are under 5%.

Also the Irish 2 year yield is at 8.9%. And the French 10 year is at 2.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Thursday, August 18, 2011

Key Measures of Inflation in July

by Calculated Risk on 8/18/2011 09:55:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in July on a seasonally adjusted basis ... The gasoline index rebounded from previous declines and rose sharply in July, accounting for about half of the seasonally adjusted increase in the all items index. ... The index for all items less food and energy increased as well, though the 0.2 percent increase was slightly smaller than the two previous months.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for July here.

Over the last 12 months, the median CPI rose 1.8%, the trimmed-mean CPI rose 2.1%, the CPI rose 3.6%, and the CPI less food and energy rose 1.8%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, and near the Fed's target.

On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 3.3% annualized in July, and core CPI increased 2.7% annualized.

With the slack in the system - and falling gasoline prices, the year-over-year measures will probably stay near or be below 2% by the end of this year.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Bank Failure #65: On a Thursday?

by Calculated Risk on 8/18/2011 07:01:00 PM

From the FDIC: Capital Bank, National Association, Rockville, Maryland, Assumes All of the Deposits of Public Savings Bank, Huntingdon Valley, Pennsylvania

As of June 30, 2011, Public Savings Bank had approximately $46.8 million in total assets and $45.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.0 million. ... Public Savings Bank is the 65th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.Thursday failures are pretty unusual.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Early Read: 2012 Social Security Cost-Of-Living Adjustment on track for 3%+ increase

by Calculated Risk on 8/18/2011 03:47:00 PM

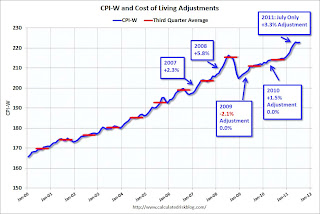

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.1 percent over the last 12 months to an index level of 222.686 (1982-84=100)."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

• CPI-W in July 2011 was 222.686. This is above the Q3 2008 average, although we still have to wait for the August and September CPI-W. CPI-W could be very volatile over the next couple of months, but if the current level holds, COLA would be around 3.3% for next year (the current 222.686 divided by the Q3 2008 level of 215.495).

This is still early - and gasoline prices are falling - but it appears that COLA will increase this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't increase much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 to $110,000 from the current $106,800.

Remember - this is an early look and is only for one month in Q3. What matters is average CPI-W during Q3 (July, August and September).

NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Existing Home Sales: Comments and NSA Graph

by Calculated Risk on 8/18/2011 01:14:00 PM

A few comments and a graph (of course):

• First, from Freddie Mac: Mortgage Rates Lowest in Over 50 Years

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, reaching all-time record lows ... The 30-year fixed averaged 4.15 percent, breaking the previous record low of 4.17 percent set November 11, 2010.• The NAR reported that inventory decreased in July from June, and that inventory is off 8.9% from July 2010. Other data sources suggest that the NAR is overstating inventory (inventory will be part of the coming revisions). Inventory is probably down more year-over-year (YoY) than the NAR reported.

• The NAR provided an update on the timing of the "benchmark revisions":

Update on Benchmark Revisions: ... Preliminary data based on the new benchmark is expected to be available for review by professional economists in coming weeks. This process is expected to take some time before finalized revisions can be published to address any issues that may surface in the review process and to update monthly seasonal adjustment factors; NAR is committed to providing accurate, reliable data. Publication of the revisions is not likely before this fall, but we expect to provide a notice one month in advance of the publication date.This revision is expected to show significantly fewer homes sold over the last few years (perhaps 10% to 15% fewer homes in 2010 than originally reported), and also fewer homes for sale.

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The red columns are for 2011.

Sales NSA are above last July - of course sales declined sharply last year following the expiration of the tax credit in June 2010.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 29 percent of transactions in July, unchanged from June; they were 30 percent in June 2010; investors account for the bulk of cash purchases.

First-time buyers purchased 32 percent of homes in July, up from 31 percent in June; they were 38 percent in July 2010. Investors accounted for 18 percent of purchase activity in July compared with 19 percent in June and 19 percent in July 2010.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales graphs