by Calculated Risk on 8/09/2011 10:59:00 AM

Tuesday, August 09, 2011

Freddie Mac Seriously Delinquent Loans and REO by Selected States

Yesterday I posted a graph for REO inventory through Q2. (REO: Real Estate Owned by lenders)

And on Sunday, I noted that REO is only a part of the problem. A bigger part of the problem is the large number of seriously delinquent and in-foreclosure loans. See: Mortgage Delinquencies and REOs

Although delinquencies and foreclosure activity is higher than normal in all states, a few states stand out. The following data is from the Q2 Freddie Mac SEC filing:

| Freddie Mac Single Family Portfolio, Serious Delinquencies and REO | ||||||

|---|---|---|---|---|---|---|

| California | Florida | Illinois | Arizona | Nevada | All States | |

| Portfolio UPB (billions)1 | $285 | $109 | $91 | $45 | $20 | $1,805 |

| Seriously Delinquent (billions) | $13.388 | $15.099 | $5.071 | $2.673 | $2.770 | $77.840 |

| Serious Delinquency Rate | 3.8% | 10.6% | 4.5% | 4.6% | 10.6% | 3.5% |

| REO Inventory (billions)2 | $2.163 | $0.751 | $0.772 | $0.610 | $0.338 | $10.830 |

| REO compared to Portfolio | 0.8% | 0.7% | 0.8% | 1.4% | 1.7% | 0.6% |

| Negative Equity3 | 30.9% | 46.1% | 21.7% | 49.6% | 62.6% | 22.7% |

| Foreclosure | Non-Judicial | Judicial | Judicial | Non-Judicial | Non-Judicial | |

2 Based on UPB at time of REO acquisition.

3 Negative Equity source: CoreLogic.

I marked a few numbers in red. Although Freddie Mac has the most REO in California, the percent of REO in California is only slightly above the national average compared to the portfolio size. Nevada and Arizona have the most Freddie Mac REOs compared to the portfolio (Nevada is almost triple the national rate).

Look at the serious delinquency rate. Now Florida and Nevada stand out. In general judicial foreclosure states have more loans in process, but Nevada is a non-judicial state!

I've also added negative equity data from CoreLogic (percent of properties with a mortgage that owe more than their home is worth). Nevada, Arizona and Florida really stand out.

Although Florida doesn't have an especially high number of Freddie Mac REO, there are many more coming. Nevada has both a high number of REO and a high delinquency rate. The timing of the eventual recovery in housing depends on clearing out this backlog of REO and seriously delinquent loans - so I think California will recover long before areas like Florida and Nevada.

Also: I noted this yesterday, but this is important. Freddie Mac had been expecting REO acquisitions to increase in the 2nd half of 2011, now they are expecting the delays to continue all year. From their SEC filing: "The pace of REO acquisitions slowed in Q2 2011 due to delays in the foreclosure process. We expect these delays will likely continue through the remainder of 2011."

NFIB: Small Business Optimism Index declines in July

by Calculated Risk on 8/09/2011 07:30:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward Trajectory

For the fifth consecutive month, NFIB’s monthly Small-Business Optimism Index fell, dropping 0.9 points in July—a larger decline than in each of the previous three months—and bringing the Index down to a disappointing 89.9. This is below the average Index reading of 90.2 for the last two-year recovery period.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

The percent of owners citing poor sales as their top problem—the long-time primary complaint of firms—has faded a few points, and reports of sales trends are much better than a few months ago. However, the July survey anticipates slow growth for the remainder of the year, high unemployment rates, inflation rates that are too high and little progress on job creation.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 89.9 in July from 90.8 in June.

Optimism has declined for five consecutive months now.

The second graph shows the net hiring plans for the next three months.

Hiring plans were slightly positive in July.

Hiring plans were slightly positive in July. According to NFIB: “While the national unemployment rate dipped marginally, for the nation’s small businesses, the employment story is not a positive one. Twelve percent (seasonally adjusted) reported unfilled job openings, down 3 points. Over the next three months, 10 percent plan to increase employment (down 1 point), and 11 percent plan to reduce their workforce (up 4 points), yielding a seasonally adjusted 2 percent of owners planning to create new jobs, 1 point lower than June, leaving the prospect for job creation bleak."

Weak sales is still the top business problem with 23 percent of the owners reporting that weak sales continued to be their top business problem in July.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.From NFIB: "The percent of owners citing poor sales as their top problem—the long-time primary complaint of firms—has faded a few points, and reports of sales trends are much better than a few months ago."

The index continues to struggle, probably a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.

Monday, August 08, 2011

Monday Night Futures

by Calculated Risk on 8/08/2011 11:06:00 PM

The Asian markets are red tonight with the Nikkei down 4%. The Shanghai is down almost 7%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 27 points, and Dow futures are down about 250 points.

Oil: WTI futures are down to $76 and Brent is under $100.

Earlier:

• Dow Down 600+, S&P 500 down 6.66%

• Q2 REO Inventory Estimate

• FOMC Preview

Q2 REO Inventory Estimate

by Calculated Risk on 8/08/2011 07:14:00 PM

Important: REO inventories have declined over the last couple of quarters. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post this weekend on Mortgage Delinquencies and REOs.

This is an important change from Freddie Mac: In Q1, Freddie Mac wrote: "We expect the pace of our REO acquisitions to increase in the remainder of 2011". Today Freddie Mac said the pace will remain low all year "The pace of REO acquisitions slowed in Q2 2011 due to delays in the foreclosure process. We expect these delays will likely continue through the remainder of 2011."

Freddie Mac reported today that REO dispositions (sales) were at a near record 29,000 units in Q2 and REO acquisitions were down to 24,799 units.

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 250,982 at the end of Q2 from a record 288,341 units at the end of Q1. The "F's" REO inventory increased 6% compared to Q2 2010 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

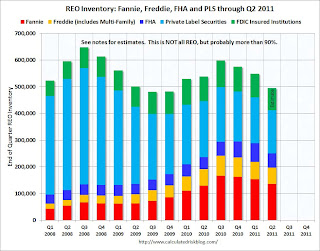

This graph shows the REO inventory for Fannie, Freddie and FHA through Q2 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks.

The second graph shows REO inventory for Fannie, Freddie, FHA, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

As Tom Lawler has noted before, the FDIC does not collect data on the NUMBER of REO properties held, and there are different estimates of the average carrying value of 1-4-family REO properties at FDIC-insured institutions. This graph uses an an average carrying value of about $150,000 (Q2 2011 is estimated since the FDIC hasn't released the quarterly profile yet).

As Tom Lawler noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is around 550,000 in Q2.

Dow Down 600+, S&P 500 down 6.66%

by Calculated Risk on 8/08/2011 04:03:00 PM

From CNBC: Dow Skids 600, Worst Day Since Credit Crisis

The S&P 500 and the tech-heavy Nasdaq were down 6 percent. August is already on track to be the worst month for both indexes since Oct. 2008.

The CBOE Volatility Index, widely considered the best gauge of fear in the market, spiked above 40 to touch its highest level since Mar. 2009.

All 10 S&P sectors were lower, led by banks, energy and materials. Financials have plunged more than 20 percent this year.

Click on graph for larger image.

Here is a table of the largest one day declines (in percentage terms) for the S&P 500 since January 1950. There were quite a few large down days in 2008 and early 2009 ... and now two in the last week (both in red).

| Largest S&P 500 One Day Percentage Declines since 1950 | ||||||

|---|---|---|---|---|---|---|

| Date | Percent Decline | Close | Previous Close | Six Months Later | ||

| 1 | 10/19/1987 | -20.5% | 224.84 | 282.70 | 15.3% | |

| 2 | 10/15/2008 | -9.0% | 907.84 | 998.01 | -4.7% | |

| 3 | 12/1/2008 | -8.9% | 816.21 | 896.24 | 15.7% | |

| 4 | 9/29/2008 | -8.8% | 1106.42 | 1213.27 | -28.8% | |

| 5 | 10/26/1987 | -8.3% | 227.67 | 248.22 | 15.3% | |

| 6 | 10/9/2008 | -7.6% | 909.92 | 984.94 | -5.9% | |

| 7 | 10/27/1997 | -6.9% | 876.99 | 941.64 | 23.7% | |

| 8 | 8/31/1998 | -6.8% | 957.28 | 1027.14 | 28.0% | |

| 9 | 1/8/1988 | -6.8% | 243.40 | 261.07 | 11.7% | |

| 10 | 11/20/2008 | -6.7% | 752.44 | 806.58 | 17.9% | |

| 11 | 5/28/1962 | -6.7% | 55.50 | 59.47 | 10.6% | |

| 12 | 8/8/2011 | -6.7% | 1,119.47 | 1199.38 | --- | |

| 13 | 9/26/1955 | -6.6% | 42.61 | 45.63 | 14.1% | |

| 14 | 10/13/1989 | -6.1% | 333.65 | 355.39 | 3.2% | |

| 15 | 11/19/2008 | -6.1% | 806.58 | 859.12 | 10.1% | |

| 16 | 10/22/2008 | -6.1% | 896.78 | 955.05 | -5.0% | |

| 17 | 4/14/2000 | -5.8% | 1356.56 | 1440.51 | -2.0% | |

| 18 | 10/7/2008 | -5.7% | 996.23 | 1056.89 | -18.1% | |

| 19 | 6/26/1950 | -5.4% | 18.11 | 19.14 | 10.0% | |

| 20 | 1/20/2009 | -5.3% | 805.22 | 850.12 | 18.1% | |

| 21 | 11/5/2008 | -5.3% | 952.77 | 1005.75 | -4.8% | |

| 22 | 11/12/2008 | -5.2% | 852.30 | 898.95 | 4.8% | |

| 23 | 10/16/1987 | -5.2% | 282.70 | 298.08 | -8.1% | |

| 24 | 11/6/2008 | -5.0% | 904.88 | 952.77 | 2.7% | |

| 25 | 9/17/2001 | -4.9% | 1038.77 | 1092.54 | 12.2% | |

| 26 | 2/10/2009 | -4.9% | 827.16 | 869.89 | 21.8% | |

| 27 | 9/11/1986 | -4.8% | 235.18 | 247.06 | 23.4% | |

| 28 | 8/4/2011 | -4.8% | 1200.07 | 1260.34 | --- | |

| 29 | 9/17/2008 | -4.7% | 1156.39 | 1213.60 | -31.3% | |

| 30 | 9/15/2008 | -4.7% | 1192.70 | 1251.70 | -36.8% | |

| 31 | 3/2/2009 | -4.7% | 700.82 | 735.09 | 47.1% | |

| 32 | 2/17/2009 | -4.6% | 789.17 | 826.84 | 27.2% | |

| 33 | 4/14/1988 | -4.4% | 259.75 | 271.58 | 7.0% | |

| 34 | 3/12/2001 | -4.3% | 1180.16 | 1233.42 | -8.0% | |

| 35 | 4/20/2009 | -4.3% | 832.39 | 869.60 | 31.7% | |

| 36 | 3/5/2009 | -4.3% | 682.55 | 712.87 | 46.2% | |

| 37 | 11/30/1987 | -4.2% | 230.30 | 240.34 | 10.0% | |

| 38 | 11/14/2008 | -4.2% | 873.29 | 911.29 | 4.2% | |

| 39 | 9/3/2002 | -4.2% | 878.02 | 916.07 | -6.4% | |

| 40 | 10/2/2008 | -4.0% | 1114.28 | 1161.06 | -25.1% | |

| 41 | 10/25/1982 | -4.0% | 133.32 | 138.83 | 20.3% | |

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |