by Calculated Risk on 8/08/2011 07:14:00 PM

Monday, August 08, 2011

Q2 REO Inventory Estimate

Important: REO inventories have declined over the last couple of quarters. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post this weekend on Mortgage Delinquencies and REOs.

This is an important change from Freddie Mac: In Q1, Freddie Mac wrote: "We expect the pace of our REO acquisitions to increase in the remainder of 2011". Today Freddie Mac said the pace will remain low all year "The pace of REO acquisitions slowed in Q2 2011 due to delays in the foreclosure process. We expect these delays will likely continue through the remainder of 2011."

Freddie Mac reported today that REO dispositions (sales) were at a near record 29,000 units in Q2 and REO acquisitions were down to 24,799 units.

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 250,982 at the end of Q2 from a record 288,341 units at the end of Q1. The "F's" REO inventory increased 6% compared to Q2 2010 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

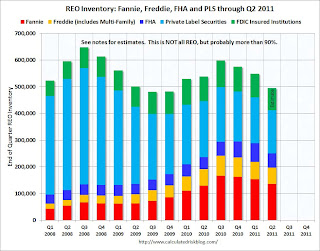

This graph shows the REO inventory for Fannie, Freddie and FHA through Q2 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks.

The second graph shows REO inventory for Fannie, Freddie, FHA, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

As Tom Lawler has noted before, the FDIC does not collect data on the NUMBER of REO properties held, and there are different estimates of the average carrying value of 1-4-family REO properties at FDIC-insured institutions. This graph uses an an average carrying value of about $150,000 (Q2 2011 is estimated since the FDIC hasn't released the quarterly profile yet).

As Tom Lawler noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is around 550,000 in Q2.