by Calculated Risk on 7/07/2011 08:15:00 AM

Thursday, July 07, 2011

ADP: Private Employment increased by 157,000 in June

ADP reports:

Employment in the U.S. nonfarm private business sector rose 157,000 from May to June on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from April to May was revised down, but only slightly, to 36,000 from the initially reported 38,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Today’s ADP National Employment Report estimates employment in the service-providing sector rose by 130,000 in June, nearly three times faster than in May, marking 18 consecutive months of employment gains. Employment in the goods-producing sector rose 27,000 in June, more than reversing the decline of 10,000 in May. Manufacturing employment rose 24,000 in June, which has seen growth in seven of the past eight months.

This was well above the consensus forecast of an increase of 70,000 private sector jobs in June. The BLS reports on Friday, and the consensus is for an increase of 110,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

As I mentioned last night, the ISM employment indexes suggest that the consensus for June is a little low - and this ADP report also suggests that the BLS report might be above consensus on Friday.

Last night ...

• Reis: Apartment Vacancy Rate falls to 6% in Q2

Reis: Apartment Vacancy Rate falls to 6% in Q2

by Calculated Risk on 7/07/2011 12:32:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

Vacancies ... fell in 72 of the 82 markets during the second-quarter vacancy rate to 6%, the lowest since 2008 and compared with 7.8% a year earlier, according to Reis.

...

The average effective rent, the amount paid after discounting, was $997 in the second quarter of the year, up from $974 a year earlier ...

Landlords filled a net 33,000 units in the second quarter, a slowdown from the 45,000 units they filled in the first quarter.

...

Meanwhile, supply remains constrained. Roughly 8,700 new apartment units opened during the second quarter, the second-lowest quarterly tally for new completions since Reis began collecting data in 1999.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we've been discussing:

• Vacancy rates are falling fast (the excess supply is being absorbed). Note: The excess housing supply includes both apartments and single family homes.

• A record low number of multi-family units will be completed this year (2011). Only 8,700 apartments came on the market in Q1 (in the Reis survey area). This is the second lowest quarter since Reis has been tracking completions - the lowest was 6,000 last quarter.

• The falling vacancy rate is pushing push up effective rents. This also pulls down the price-to-rent ratio for house prices.

• Multi-family starts are increasing, and that will help both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably decline all year.

Wednesday, July 06, 2011

Goldman's Hatzius forecasts 125,000 payroll jobs added in June

by Calculated Risk on 7/06/2011 09:05:00 PM

From CNBC: June Jobs Data to Show 125,000 Added: Hatzius

"Clearly the economy weakened over the last few months so some deceleration makes sense," [Goldman Sachs chief U.S. economist Jan Hatzius] said, but the May figure [54,000 jobs added] was "below what other indicators of labor market activity would suggest."The consensus forecast, according to Bloomberg, is for an increase of 110,000 payroll jobs in June.

The June report, he said, will "provide a correction to that picture," although he said adding 125,000 jobs is "still not particularly strong."

CR Note: The labor indicators are mixed. Initial weekly unemployment claims have been fairly weak (above 400,000 per week all month), and the small business survey suggested June was a "bust". However the ISM employment indexes showed faster expansion in June.

The ISM manufacturing employment index increased to 59.9%, up from 58.2% in May, and the ISM non-manufacturing index increased slightly to 54.1%. Based on a historical correlation between the ISM indexes and the BLS employment report, these readings would suggest close to 200,000 payroll jobs added for private services and manufacturing in June (that seems high, but it is probably one of the indicators that Hatzius is looking at).

Report: $60 Billion Mortgage Servicer Settlement being Discussed

by Calculated Risk on 7/06/2011 05:13:00 PM

In February, the settlement was rumored to be $20 billion.

Then in May the settlement was rumored to be $5 Billion.

Now the NY Post is reporting $60 billion!

From the NY Post: AGs, banks near $60B deal on foreclosures

America's biggest mortgage servicers are closing in on a deal with federal and state officials to settle some of the thorniest foreclosure fiasco problems -- including the robo-signing issue, The Post has learned.But what does "$60 billion" really mean? If the final number is in the $60 billion range, it will probably include already completed principal reductions and modifications. If so, the headline number would be meaningless.

The proposed settlement with the Department of Justice and 50 state attorneys general, once thought to be in the neighborhood of $20 billion, could range as high as $60 billion and include a provision for principal reduction, sources close to the discussions said.

Update: From Barclays Capital analysts via the WSJ: Here’s How a $60B Foreclosuregate Settlement Might Get Divided (ht sum luk)

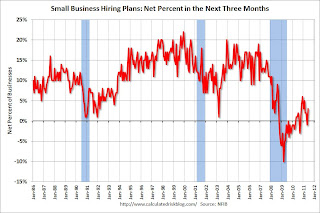

Survey: Small Business Hiring in June a "Bust", but hiring plans turn positive

by Calculated Risk on 7/06/2011 01:58:00 PM

From National Federation of Independent Business (NFIB): NFIB Jobs Statement: June is a Bust, but July Looks Hopeful (link fixed)

“New jobs are not to be found on Main Street. For small firms, reported job losses per firm declined sharply in June as did the net percent of firms that increased employment over the last 3 months." [said NFIB Chief economist William C. Dunkelberg]

...

"Over the next three months, 11 percent plan to increase employment (down 2 points), and 7 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 3 percent of owners planning to create new jobs, a 4 point gain from May. So, going forward, the job picture is a bit brighter than June’s actual dismal performance."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to remain sluggish for some time.