by Calculated Risk on 7/06/2011 01:07:00 PM

Wednesday, July 06, 2011

Conforming Loan Limit Data

Just a data post ...

Last night I posted on the new GSE conforming limits and I combined two FHFA spreadsheets to show the change by city. Here is the spreadsheet with the current loan limits and the new loan limits (sorted by largest change in limit).

As Tom Lawler noted back in April, effective Oct 1st "the conforming loan limit will revert back to those established under the Housing and Economic Recovery Act (HERA) of 2008. That act upped the conforming loan limit in many parts of the country, but the HERA hike was trumped by the Economic Stimulus Act (ESA) of 2008 and the Continuing Appropriations Act of 2011."

Here is the source data from the FHFA:

1) Spreadsheet: Maximum Loan Limits for Loans Originated between 10/1/2010 and 9/30/2011 (Same as Limits for 1/1/10-9/30/10 Originations)

2) Spreadsheet: Maximum Loan Limits that Apply to Loans Acquired in Calendar Year 2011 and Originated after 9/30/2011 or Prior to 7/1/2007

ISM Non-Manufacturing Index indicates slower expansion in June

by Calculated Risk on 7/06/2011 10:00:00 AM

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 19th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 53.3 percent in June, 1.3 percentage points lower than the 54.6 percent registered in May, and indicating continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 0.2 percentage point to 53.4 percent, reflecting growth for the 23rd consecutive month, but at a slightly slower rate than in May. The New Orders Index decreased by 3.2 percentage points to 53.6 percent. The Employment Index increased 0.1 percentage point to 54.1 percent, indicating growth in employment for the 10th consecutive month and at a slightly faster rate than in May. The Prices Index decreased 8.7 percentage points to 60.9 percent, indicating that prices increased at a slower rate in June when compared to May. According to the NMI, 15 non-manufacturing industries reported growth in June. Respondents' comments are mixed about the business climate and vary by industry and company. The most prominent concern remains about the volatility of prices."emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0%.

MBA: Mortgage Purchase Application activity increases

by Calculated Risk on 7/06/2011 07:52:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 9.2 percent from the previous week. The Refinance Index has decreased for 3 consecutive weeks, reaching its lowest level since May 6, 2011. The seasonally adjusted Purchase Index increased 4.8 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.69 percent from 4.46 percent, with points decreasing to 0.90 from 1.19 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year rate recorded in the survey since the middle of May 2011.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of purchase activity is at about 1997 levels - and mostly moving sideways. Of course there is a very high percentage of cash buyers right now, but this suggests weak existing home sales through the next month or two.

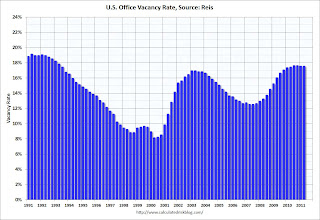

Reis: Office Vacancy Rate flat in Q2 at 17.5 Percent

by Calculated Risk on 7/06/2011 01:32:00 AM

From Reuters: Sluggish economy slows US office market rebound

The U.S. office vacancy rate stood at 17.5 percent at the end of the second quarter, according to Reis. The rate was the same as the first quarter, when vacancies posted the first decline in nearly four years.

...

The average asking rent rose 0.2 percent to $27.72 per square foot, according to Reis. Factoring in months of free rent and other concessions landlords offer to attract tenants, the so-called effective rent also rose 0.2 percent in the second quarter, to $22.25 per square feet.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate was at 17.5% in Q2 2011, the same rate as in Q1, and up from 17.4% in Q2 2010. It appears the office vacancy rate might have peaked - and is now moving sideways. It will be a good sign when the vacancy rate starts falling.

Reis should release the Mall and Apartment vacancy rates over the next few days.

Tuesday, July 05, 2011

Changes to Conforming Loan Limit

by Calculated Risk on 7/05/2011 11:14:00 PM

Back in April, economist Tom Lawler previewed the coming changes to the GSE conforming loan limits on October 1st: FHFA: Where the Conforming Loan Limit Might Fall on October 1

The FHFA has now released the new limits.

Here is a Spreadsheet with the current loan limits and the new loan limits (sorted by largest change in limit).

The largest changes were for Monterey, CA (decrease of $246,750), Monroe, FL (-$200,750) and Puerto Rico (-$189,250). Maui, HI will see a decrease of $163,250 and San Diego, CA a decrease of $151,250.

From Nick Timiraos and Alan Zibel at the WSJ: Sellers Brace for New Mortgage Caps

As an emergency measure three years ago, Congress raised to as high as $729,750 the maximum loan amount that Fannie Mae, Freddie Mac and federal agencies could guarantee. ... Now those limits are set to decline modestly in hundreds of counties across the U.S. as the government attempts to reduce its outsized footprint in the mortgage market and create room for private investors to compete.This will not have a significant impact on the housing market. Remember there are about 5 million home sales per year - so even if all these homes fell through, the impact would be very small.

Had the lower limits been in place last year, Fannie and Freddie would have backed 50,000 fewer loans, according to the Federal Housing Finance Agency. The bulk of the affected loans —about 60%— are in California, with another 20% in Massachusetts, New York and New Jersey.

As Tom Lawler wrote in April:

Letting the conforming loan limits go down on October 1st is not a big deal from the standpoint of the housing market, and the new limits would still leave the VAST bulk of home sales transactions eligible for GSE acquisition. However, it is a “big deal” in terms of it being the first (though very small) step to reduce the government’s/GSE’s “footprint” in the US mortgage market.