by Calculated Risk on 4/18/2011 11:50:00 AM

Monday, April 18, 2011

A Comment on the Deficit

As everyone knows, S&P issued a "negative outlook" on U.S. debt this morning. Although S&P has made plenty of recent rating mistakes, this is a reminder that there is work to do in the U.S.

Here is the approach an effective manager would take to analyzing the deficit.

The first step would be to divide up the deficit into several components and calculate the NPV (net present value) of each component. I'd divide the deficit into 1) cyclical portion, 2) General Fund ex-healthcare, 3) healthcare (Medicare and Medicaid), and 4) Social Security Insurance. This is nothing new - I've been pointing this out since I started the blog in 2005!

The cyclical deficit is due to the severe recession (and was predictable in 2005). As a result of the recession tax revenues declined, and there was more spending (both stimulus and automatic safety net expenditures). The good news is the cyclical deficit will decline as the economy slowly recovers. The bad news is recoveries following housing/credit bubbles and a financial crisis are usually sluggish and choppy. This is the portion of the deficit that gets the most attention, but from a long run perspective it is the least significant.

The General Fund ex-healthcare deficit is the most immediate problem. I've been writing about this for years. Back in 2006, Professor Samwick (who served as Chief Economist on the Staff of President Bush's Council of Economic Advisers) wrote: First Things First

CR writes:In five years, nothing has changed. This structural deficit is still the most pressing problem.

Everyone should agree that the most immediate fiscal problem is the structural General Fund deficit. Excluding future health care costs, the structural deficit is around 4% to 4.5% of GDP. This serious problem has been caused almost exclusively by Bush's policies. And imagine if the economy slows next year, as many people expect, adding a cyclical deficit on top of the huge Bush structural deficit.CR is correct in his diagnosis of the immediacy and the size of the problems of the General Fund deficit. As I have discussed in earlier posts ... the appropriate target for the General Fund deficit is for it to average to zero over a business cycle. A corollary to that is that the General Fund should be in surplus during the non-recessionary parts of that business cycle. (A slightly weaker target that I would also accept is that the Debt/GDP ratio not trend upward over time.)

So isn't it reasonable to suggest that Mr. Bush and the GOP fix the structural deficit first, before addressing other long-term issues? Of course.

Some politicians refuse to even address this issue, apparently because of a "no tax" pledge. This is silly and juvenile. Besides many of these politicians supported the policies that created the structural deficit, because they thought we were going to have surpluses forever. Since the forecasts for "surpluses forever" were inaccurate, reversing those policies should be a priority. There is no way to balance the General Fund ex-healthcare without gutting defense spending or reversing those earlier policies.

After this is resolved, the next step would be to address the long run healthcare issues. And the last step should be to address any Social Security shortfall.

As an experienced manager, I know that people will avoid the difficult choices and try to fix the wrong problems first. But an important role of management is to focus people on the more immediate and serious problem. And that is:

1) General Fund ex-healthcare, and

2) Healthcare.

So if we are serious about the deficit, we need to start by finally addressing the General Fund ex-healthcare structural deficit issue.

NAHB Builder Confidence index declines slightly in April

by Calculated Risk on 4/18/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined slightly to 16 in April from 17 in March. This was below expectations for a reading of 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Press release from the NAHB: Builder Confidence Slips Back a Notch in April

Builder confidence in the market for newly built, single-family homes slipped back one notch to 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for April, released today. The index has now held at 16 for five of the last six monthsBuilders are still depressed, and the HMI has been below 25 for forty-six consecutive months - almost 4 years.

...

“The spring home buying season is getting off to a slow start due to persistent concerns about home values as more foreclosures seem to be hitting the market, increasingly restrictive lending requirements for home buyers and builders, and the slow pace of economic recovery,” acknowledged NAHB Chief Economist David Crowe. “While pockets of improving activity are appearing in some markets, the best sales activity appears to be happening in the lower price ranges, where first-time buyers have greater flexibility than repeat buyers who must sell their current home"

...

Two out of three of the HMI’s component indexes posted declines in April. While the component gauging current sales conditions fell one point to 16, the component gauging sales expectations for the next six months declined three points to 23, its lowest mark since October of 2010. However, the index gauging traffic of prospective buyers rose a single point to 13 in April, marking its highest level since last June.

Greece Bond Yields at Record High following Default Comments

by Calculated Risk on 4/18/2011 08:29:00 AM

The yield on Greece ten year bonds jumped to 14.4% today and the two year yield is up to 19.6%.

From Reuters: Greece asked EU/IMF at Ecofin to restructure debt-paper

Greece told the IMF and the European Union earlier this month that it wants to restructure its debt and discussions on the issue are expected to start in June, Greek daily Eleftherotypia said on Monday.This report has been "dismissed" by Greek, EU and IMF officials, but it is widely expected that Greece will default (aka restructure). Many analysts expect the restructuring to include extending the duration.

...

The paper said U.S. Treasury Secretary Timothy Geithner is also in favour of stretching out repayments of Greece's debt.

"You have to do it, he told Papaconstantinou," the paper said

Here are the ten year yields for Ireland up to 9.8%, Portugal up to a record 9.1%, and Spain at 5.6%.

Sunday, April 17, 2011

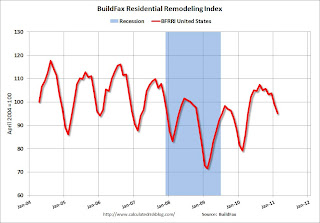

Residential Remodeling Index shows strong increase year-over-year in February

by Calculated Risk on 4/17/2011 10:19:00 PM

The BuildFax Residential Remodeling Index was at 95.1 in February. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 20% year-over-year—and for the sixteenth straight month—in February to 95.1, the highest February number in the index since 2006. Residential remodels in February were down month-over-month 3.9 points (4%) from the January value of 99.0 ...

All regions posted year-over-year gains, although the West posted a much higher year-over-year gain than the other regions, reaching well above index values for the West in February 2010, 2009, 2008, and 2007.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, “February 2011 was a strong month for the industry, despite the fact that remodeling activity traditionally dips during the winter months. February 2011 was better than or equal to February 2010 in every region of the country.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Although down month-to-month (off 4% from January) this is the highest level for a February since 2006 - and above the level of 2005 (during the home equity and remodel boom).

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 20% from February 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index). This fits with other reports too.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Quote of the Day: 15 years of house price appreciation "It's gone"

by Calculated Risk on 4/17/2011 06:17:00 PM

"I bought my first house in 1996, a four-bedroom for $124,000, and I could probably buy that same house for $124,000. All the appreciation we've gained in the last 15 years, it's gone."

Chuck Whitehead, general manager for Coldwell Banker's Southwest Riverside operations, via Eric Wolff at the NC Times.

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th