by Calculated Risk on 3/30/2011 07:46:00 PM

Wednesday, March 30, 2011

Fannie Mae and Freddie Mac Delinquency Rates decline slightly

Fannie Mae reported that the serious delinquency rate decreased to 4.45% in January from 4.48% in December. This is down from 5.52% a year ago.

Freddie Mac reported that the serious delinquency rate decreased to 3.78% in February from 3.82% in January. (Note: Fannie reports a month behind Freddie). This is down from a record high 4.20% in February 2010.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The slowdown in the rate of decline in the 2nd half of last year was probably related to the new foreclosure moratoriums.

Earlier:

• CoreLogic: Shadow Inventory Declines Slightly

• Lawler: The “Shrill Cry” from Lobbyists on QRM

Lawler: The “Shrill Cry” from Lobbyists on QRM

by Calculated Risk on 3/30/2011 04:11:00 PM

Earlier on Shadow Inventory:

• CoreLogic: Shadow Inventory Declines Slightly

In the following long post, housing economist Tom Lawler clears up some misunderstandings and misinformation regarding the new proposed mortgage rules: The “Shrill Cry” from Lobbyists on QRM

Yesterday the Office of the Comptroller of the Currency, Treasury (OCC); Board of Governors of the Federal Reserve System (Board); Federal Deposit Insurance Corporation (FDIC); U.S. Securities and Exchange Commission (Commission); Federal Housing Finance Agency (FHFA); and Department of Housing and Urban Development (HUD) jointly issued their proposed rule on “credit risk retention” for assets collateralizing asset-backed securities pursuant to the Dodd-Frank Act, and the proposed rule included a proposed definition of a “qualified residential mortgage (QRM)” For ABS backed by QRMs, the DFA provides for an exemption of the risk-retention rule. For folks who don’t remember, the “inclusion” of an exemption for QRMs was in the act because of heavy lobbying by financial institutions and housing-related trade groups, and it put regulators in the uncomfortable position of trying to decide what types of mortgages were so inherently “low risk” that they should/could be excluded from the rule designed to ensure that ABS issuers had “skin in the game.”

Regulators yesterday proposed defining “QRM” much more restrictively than the lobbyists who had successfully gotten the concept of a “QRM” into the legislation, including a LTV restriction of 80% (and no piggybacks), front/back end DTIs of 28% and 36%, respectively, and other “borrower credit history” restrictions. Industry lobbyists quickly commented negatively.

A comment on Regional Fed Talk

by Calculated Risk on 3/30/2011 02:18:00 PM

Much has been made about recent comments by St Louis Fed President James Bullard and Philly Fed President Charles Plosser. Kansas City Fed president Thomas Hoenig added his voice today: Fed should head for the exit, Hoenig says

A few comments:

• When Plosser gave his EXIT speech last week, he started by saying: "As always, and perhaps particularly so today, the views I express are my own and do not necessarily represent those of the Federal Reserve System or my colleagues on the Federal Open Market Committee." Notice that he emphasized these are his views.

• Tim Duy wrote today: Fed Watch: Running the Fed Like an Economics Department

It seems to me that the Fed lacks a coherent communication strategy – there is no willingness on the part of the leadership to enforce talking points. As a consequence, there is enormous pointless chatter from Fed officials that might be interesting in some sense, but provide misleading guidance about policy direction. Recent talk about scaling back the size of the large scale asset program, for instance. Almost certainly not going to happen – so why talk about it? Sadly, it appears to be an almost deliberate effort to create uncertainty among market participants at a time when the opposite is so important.A key European analyst wrote to his clients today:

Professor Bernanke likes to allow his students to roam the campus and say what they think. This collegiate approach leads to vibrant debate, but debate that may have previously only occurred behind the closed doors of the FOMC.And that is the point: these comments are the opinions of a few regional presidents - some non-voting - and do not represent the views of the majority on the FOMC.

• The "big three", Fed Chairman Bernanke, Vice Chair Janet Yellen, and NY Fed President William Dudley will all speak over the next two weeks, starting with Dudley this Friday, Bernanke on April 4th, and Yellen on April 11th. I expect they will speak with one voice and stand behind the current QE2 policy stance and the "exceptionally low levels for the federal funds rate for an extended period" guidance. I also expect they will also argue that the increase in inflation is transitory.

Although I read all the regional Fed speeches, I'm not sure why some market participants have been paying closer attention to certain speeches. Perhaps they are unaware of Professor Bernanke's "collegiate approach"!

I believe the current policy will continue as planned.

CoreLogic: Shadow Inventory Declines Slightly

by Calculated Risk on 3/30/2011 10:25:00 AM

From CoreLogic: CoreLogic Reports Shadow Inventory Declines Slightly, However, Nine Months’ Worth of Supply Remains

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

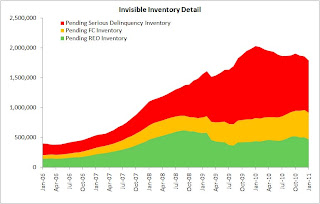

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadow inventory" (by this method) at about 1.8 million units.

CoreLogic ... reported today that the current residential shadow inventory as of January 2011 declined to 1.8 million units, representing a nine months’ supply. This is down slightly from 2.0 million units, also a nine

months’ supply, from a year ago.

CoreLogic estimates current shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLS) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

...

Of the 1.8-million unit current shadow inventory supply, 870,000 units are seriously delinquent (4.2 months’ supply), 445,000 are in some stage of foreclosure (2.1 months’ supply) and 470,000 are already in REO (2.2 months’ supply).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).CoreLogic also notes:

In addition to the current shadow inventory supply, there are nearly 2 million current negative equity loans that are more than 50 percent “upside down” that will likely become shadow supply in the near future.This report provides a couple of key numbers: 1) there are 1.8 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale, and 2) there are about 2 million current negative equity loans that are more than 50 percent “upside down”.

ADP: Private Employment increased by 201,000 in March

by Calculated Risk on 3/30/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 201,000 from February to March on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from January 2011 to February 2011 was revised down to 208,000 from the previously reported increase of 217,000.Note: ADP is private nonfarm employment only (no government jobs).

...

The average monthly increase in employment over the last four months – December through March – has been 211,000, consistent with a gradual if uneven decline in the unemployment rate. This is almost three times the average monthly gain of 74,000 over the preceding four months of August through November.

This was about at the consensus forecast of an increase of about 205,000 private sector jobs in March.

The BLS reports on Friday, and the consensus is for an increase of 195,000 payroll jobs in March, on a seasonally adjusted (SA) basis, and for the unemployment rate to hold steady at 8.9%.