by Calculated Risk on 3/30/2011 10:25:00 AM

Wednesday, March 30, 2011

CoreLogic: Shadow Inventory Declines Slightly

From CoreLogic: CoreLogic Reports Shadow Inventory Declines Slightly, However, Nine Months’ Worth of Supply Remains

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

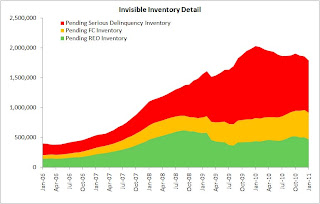

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadow inventory" (by this method) at about 1.8 million units.

CoreLogic ... reported today that the current residential shadow inventory as of January 2011 declined to 1.8 million units, representing a nine months’ supply. This is down slightly from 2.0 million units, also a nine

months’ supply, from a year ago.

CoreLogic estimates current shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLS) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

...

Of the 1.8-million unit current shadow inventory supply, 870,000 units are seriously delinquent (4.2 months’ supply), 445,000 are in some stage of foreclosure (2.1 months’ supply) and 470,000 are already in REO (2.2 months’ supply).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).CoreLogic also notes:

In addition to the current shadow inventory supply, there are nearly 2 million current negative equity loans that are more than 50 percent “upside down” that will likely become shadow supply in the near future.This report provides a couple of key numbers: 1) there are 1.8 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale, and 2) there are about 2 million current negative equity loans that are more than 50 percent “upside down”.

ADP: Private Employment increased by 201,000 in March

by Calculated Risk on 3/30/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 201,000 from February to March on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from January 2011 to February 2011 was revised down to 208,000 from the previously reported increase of 217,000.Note: ADP is private nonfarm employment only (no government jobs).

...

The average monthly increase in employment over the last four months – December through March – has been 211,000, consistent with a gradual if uneven decline in the unemployment rate. This is almost three times the average monthly gain of 74,000 over the preceding four months of August through November.

This was about at the consensus forecast of an increase of about 205,000 private sector jobs in March.

The BLS reports on Friday, and the consensus is for an increase of 195,000 payroll jobs in March, on a seasonally adjusted (SA) basis, and for the unemployment rate to hold steady at 8.9%.

MBA: Mortgage Purchase Application activity decreases slightly

by Calculated Risk on 3/30/2011 07:19:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 10.1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.7 percent from one week earlier.

...

"Treasury and mortgage rates increased towards the end of last week, as global markets calmed following the recent crises in Japan and the Middle East. Refinance volume predictably fell in response to these rate increases. As rates climb back to 5 percent, fewer homeowners have both the incentive and the ability to refinance," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase volume remained roughly flat as we enter what is typically the peak homebuying season."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.92 percent from 4.80 percent, with points decreasing to 0.83 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

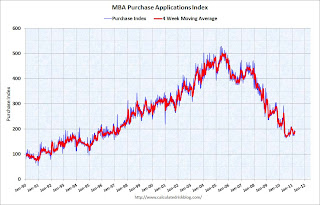

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still moving sideways suggesting fairly weak home sales "as we enter what is typically the peak homebuying season". Note: There is a large percentage of cash buyers too.

Here come the downgrades for Q1 GDP Growth: Part II

by Calculated Risk on 3/30/2011 12:06:00 AM

Based on the February Personal Income and Outlays report, it is pretty clear that GDP growth in Q1 is going to be sluggish. We are going to see a number of downgrades, this once via David Leonhardt at the NY Times: As Economy Sputters, a Timid Fed (pay)

"a prominent research firm ... Macroeconomic Advisers, has downgraded its estimate of economic growth in the current quarter to a paltry 2.3 percent, from 4 percent."Leonhardt mostly discusses the Fed, QE2 and whether the Fed is properly balancing unemployment and inflation.

Earlier posts on Case-Shiller house prices:

• Case Shiller: Home Prices Off to a Dismal Start in 2011

• Real House Prices and Price-to-Rent

• House Price Graph Gallery

Tuesday, March 29, 2011

State and Local tax revenue increases in 2010

by Calculated Risk on 3/29/2011 08:34:00 PM

The Census Bureau released the State and Local tax revenue data for Q4 2010 today. Here is the page.

From Conor Dougherty at the WSJ: Tax Revenue Snaps Back

State and local tax revenue has nearly snapped back to the peak hit several years ago—a gain attributed to a reviving economy and tax increases implemented during the recession.Local governments are mostly funded by property taxes, and it usually takes some time for falling prices to show up in property taxes. Local property tax revenue is just starting to decline in the Census data.

But the improvement masks deeper problems for state and local governments that are likely to linger for years. To weather the recession, state governments relied on now-depleted federal stimulus funds ...

Total tax receipts for state and local governments hit $1.29 trillion in 2010, just 2.3% shy of the $1.32 trillion taken in during 2008, not adjusted for inflation, according to Census Bureau data.

State revenue is mostly from individual income taxes and sales taxes (see tables at the Census Bureau) and this revenue is still well below the pre-recession levels.

Even with improving revenue, there will be more state and local fiscal tightening this year - and that will remain a drag on economic growth.