by Calculated Risk on 6/20/2010 08:36:00 AM

Sunday, June 20, 2010

On Fannie and Freddie REO Inventory

Binyamin Appelbaum writes in the New York Times: Cost of Seizing Fannie and Freddie Surges for Taxpayers

Fannie Mae and Freddie Mac took over a foreclosed home roughly every 90 seconds during the first three months of the year. They owned 163,828 houses at the end of March, a virtual city with more houses than Seattle. The mortgage finance companies, created by Congress to help Americans buy homes, have become two of the nation’s largest landlords.The REO inventory of Fannie and Freddie (and the FHA) are increasing rapidly, but this is only a portion of the total REO inventory. The worst loans were made outside of Fannie and Freddie.

This graph shows the increase in Fannie, Freddie and FHA REOs through Q1 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Even with all the delays in foreclosure, the REO inventory has increased sharply over the last three quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, 172,357 at the end of Q4 2009 and now 209,500 at the end of Q4 2010.

These are new records for all three agencies.

However private label securities and banks and thrifts hold an even larger number of REOs. For more, see Tom Lawler's earlier post: REO: Agencies vs. Private Label and from James Hagerty at the WSJ in March writing about a Barclays Capital report: Supply of Foreclosed Homes on the Rise Again.

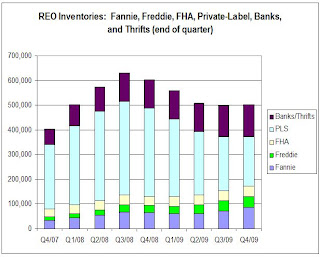

Here is the graph Tom Lawler constructed for REOs at the end of Q4 2009:

Tom wrote:

Tom wrote: Putting the Fannie, Freddie, FHA, and private-label data (with the latter “grossed up” assuming LP covers 85% of the market) together; making a crude assumption of units of REO at banks and thrifts (and grossing the total up to reflect non-FDIC institutions), here is a crude look at the path of REO inventories by quarter from the end of 2007 through the end of 2009. These estimates would NOT be the full market, of course, but the general pattern would probably reflect the overall market.Although this graph is only through Q4 2009, notice that the Fannie, Freddie and FHA REO are just a small part of the total!

The major problem were the loans outside of Fannie and Freddie. From Tanta in 2008:

I think we can give Fannie and Freddie their due share of responsibility for the mess we're in, while acknowledging that they were nowhere near the biggest culprits in the recent credit bubble. They may finance most of the home loans in America, but most of the home loans in America aren't the problem; the problem is that very substantial slice of home loans that went outside the Fannie and Freddie box.Of course now Fannie, Freddie and FHA are almost the entire market, and unfortunately most of the bad loans being made today are insured by the FHA - but that is a different story.

Saturday, June 19, 2010

Housing Starts and the Unemployment Rate

by Calculated Risk on 6/19/2010 09:02:00 PM

An update on a theme ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts and the unemployment rate through May (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Usually housing starts and residential construction employment lead the economy out of a recession, but not this time because of the huge overhang of existing housing units. After rebounding a little in early '09, housing starts (blue) have mostly moved sideways.

This is what I expected when I first posted the above graph last summer. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This lead to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recovery.

Note: RI is mostly new home sales and home improvement.

However this time, with the huge overhang of existing housing units, this key sector isn't participating. So in this recovery there is less job creation, less household formation, and less demand for housing units than a normal recovery. This is sort of a circular trap for both GDP growth and employment.

Eventually the excess housing units will be absorbed - (progress is slowly being made, see Housing Stock and Flow) - but until then, this key sector will remain under pressure and I expect the recovery will be sluggish and the unemployment rate will stay elevated.

Summers cautious about recovery

by Calculated Risk on 6/19/2010 05:02:00 PM

From the Boston Globe: Summers cites recovery, risks

The US economy has probably begun a lasting recovery, but the outlook has become more uncertain in recent weeks ... said Lawrence Summers, President Obama’s top economic adviser.No one has a crystal ball, but Summers sure doesn't seem very confident.

...

Summers ... presented a cautious, measured view of economic conditions. For example, after expressing confidence that European policy makers would contain the government debt crisis and avoid another global financial crisis, he added that the assessment was “my best guess, and I could be wrong.’’

Or, when asked if the nation had achieved a self-sustaining recovery, Summers responded, “I think that’s the right presumption and my expectation. I wouldn’t be foolish enough to be certain.’’

Impact of Decennial Census on June Payroll Report

by Calculated Risk on 6/19/2010 01:05:00 PM

In a post last month I reviewed the impact of the decennial Census hiring on the payroll report. Here is an update ...

We can estimate the Census hiring using weekly payroll data from the Census bureau (ht Bob_in_MA). If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring.

The Census Bureau releases the actual number with the employment report.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

So far the decennial Census payroll has decreased by 156 thousand this month, and will probably subtract 200 to 250 thousand from the payroll report (we will have a good estimate this coming Wednesday when the week ending June 12th is released).

When the employment report is released on July 2nd, a key number will be payroll jobs ex-Census (to understand the underlying trend). The headline number for June - including Census numbers - will probably be negative.

China statement: "To proceed with exchange rate reform"

by Calculated Risk on 6/19/2010 08:48:00 AM

From Bloomberg: China Yuan Pledge Suggests Peg to Dollar May Go

Here are some excerpts from the statement (via WSJ):

In view of the recent economic situation and financial market developments at home and abroad, and the balance of payments (BOP) situation in China, the People´s Bank of China has decided to proceed further with reform of the RMB exchange rate regime and to enhance the RMB exchange rate flexibility.I'll believe it when I see it ...

...

The global economy is gradually recovering. The recovery and upturn of the Chinese economy has become more solid with the enhanced economic stability. It is desirable to proceed further with reform of the RMB exchange rate regime and increase the RMB exchange rate flexibility.