by Calculated Risk on 5/21/2010 04:13:00 PM

Friday, May 21, 2010

Las Vegas land prices: 80% off peak

From Buck Wargo at the Las Vegas Sun: Foreclosures on land pushing prices back to 2003 levels

Since the peak of the market in 2007’s fourth quarter of $939,400 per acre for land not on the Strip, prices have fallen 80.6 percent, [Applied Analysis Principal Brian] Gordon said.And how about this ...

“I think we will continue to see downward pressure on prices for a while,” Gordon said. “The demand for raw land is somewhat weak. There is excess inventory of office, industrial and residential; and development activity has come to a near standstill in many of those sectors, so that they don’t need raw land.”

During the past year, many landowners have simply turned properties back to banks. ... “The reality is the landowners are finding themselves underwater and servicing their debt, and it has become a challenge,” Gordon said. “Many have opted to let the properties go back to the bank, not unlike what we have seen in the housing market.”More strategic defaults.

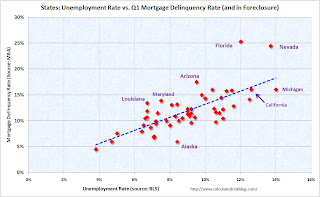

States: Mortgage Delinquency Rate vs. Unemployment Rate

by Calculated Risk on 5/21/2010 01:07:00 PM

Here is a scatter graph comparing the Q1 2010 delinquency rate for mortgage loans (including all loans in foreclosure) vs. the April unemployment rate for all states. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There definitely is a relationship between delinquency rates and the unemployment rate, although a couple of states really stand out; Florida and Nevada. Florida has a high number of delinquencies because of state specific foreclosure laws - it takes forever to foreclose.

The delinquency rate in Nevada is also very high, probably because of the large percentage of homeowners with negative equity. Both states might also have higher than expected delinquency rates because of significant investor activity during the housing bubble.

This does suggest that a large part of the delinquency problem is related to unemployment.

Note: Sorry I couldn't label all the states. Here are graphs by state for unemployment rates and mortgage delinquency rates.

April State Unemployment Rates: California and Nevada at series highs

by Calculated Risk on 5/21/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly lower in April. Thirty-four states and the District of Columbia recorded unemployment rate decreases, 6 states had increases, and 10 states had no change. ...

Michigan again recorded the highest unemployment rate among the states, 14.0 percent in April. The states with the next highest rates were Nevada, 13.7 percent; California, 12.6 percent; and Rhode Island, 12.5 percent. North Dakota continued to register the lowest jobless rate, 3.8 percent, followed by South Dakota and Nebraska, 4.7 and 5.0 percent, respectively. The rate in Nevada set a new series high.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. New Jersey is close.

Nevada set a new series high; California tied the previous record (since 1976).

Bundestag Approves Bailout, possible Strike in Spain

by Calculated Risk on 5/21/2010 08:41:00 AM

From the Financial Times: Bundestag backs eurozone rescue

Germany’s lower house of parliament on Friday narrowly approved Berlin’s contribution to the European Union’s €750bn package of loan guarantees ...The upper house, the Bundesrat, is expected to vote today and passage is expected.

From Reuters: Spain to 'probably' call general strike-report

Spain's largest workers union Comisiones Obreras could call a general strike to protest the government's austerity measures, its head Ignacio Fernandez Toxo said on Friday ...Sounds like just a one day strike.

The futures are off this morning ... but bouncing around.

Thursday, May 20, 2010

Krugman: Lost Decade Looming?

by Calculated Risk on 5/20/2010 11:58:00 PM

From Paul Krugman in the NY Times: Lost Decade Looming?

... Recent data don’t suggest that America is heading for a Greece-style collapse of investor confidence. Instead, they suggest that we may be heading for a Japan-style lost decade, trapped in a prolonged era of high unemployment and slow growth.The two key numbers: the unemployment rate is at 9.9% and inflation, by all key measures, is low and declining (CPI, core CPI, PCE deflator trimmed mean CPI, etc). Of the two problems, unemployment is real and now - and inflation is a possible future threat. The focus needs to stay on the real and now.

... As of Thursday, the 10-year [Treasury] rate was below 3.3 percent. I wish I could say that falling interest rates reflect a surge of optimism about U.S. federal finances. What they actually reflect, however, is a surge of pessimism about the prospects for economic recovery, pessimism that has sent investors fleeing out of anything that looks risky ...

Low inflation, or worse yet deflation, tends to perpetuate an economic slump ... just ask the Japanese, who entered a deflationary trap in the 1990s and, despite occasional episodes of growth, still can’t get out. And it could happen here.

So what we should really be asking right now isn’t whether we’re about to turn into Greece. We should, instead, be asking what we’re doing to avoid turning Japanese.

...

Will the worst happen? Not necessarily. Maybe the economic measures already taken will end up doing the trick, jump-starting a self-sustaining recovery. Certainly, that’s what we’re all hoping.