by Calculated Risk on 5/12/2010 01:00:00 PM

Wednesday, May 12, 2010

Ceridian-UCLA: Diesel fuel consumption index declines in April

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Ceridian-UCLA Pulse of Commerce Index™ Drops 0.3 Percent in April

With the release of April’s figures, the Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management is showing flat, overall performance during the first four months of 2010. The PCI in April fell 0.3 percent, suggesting the economic recovery may have stalled, although an uptick in consumer spending could continue to drive a slow but steady recovery.

...

While the economy continues to climb year-over-year, the PCI indicates that expectations in the market for a robust recovery may be too optimistic. ...

“The latest PCI numbers are disappointing and cast considerable doubt on the strength of the recovery and the strength of GDP numbers for 2010,” said Ed Leamer, the PCI’s chief economist.

...

The PCI is based on an analysis of real-time diesel fuel consumption data ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999.

Note: This index appears to lead Industrial Production (IP), but there is a significant amount of monthly noise. This is a new index and might be interesting to follow along with the Trucking and Railroad data.

Here is a video of Leamer's comments on the report.

Rail Traffic "Recovering at moderate pace"

by Calculated Risk on 5/12/2010 10:54:00 AM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in April 2010 was up 15.8% compared to April 2009 - although traffic was still 11.5% lower than in April 2008.

This graph shows U.S. average weekly rail carloads. Traffic increased in all 19 major commodity categories YoY.

From AAR:

• U.S. freight railroads originated 1,179,029 carloads in April 2010, up 15.8% from April 2009 on a nonseasonally adjusted basis. That could very well be the highest year-over-year percentage increase for any month ever. It’s definitely the highest since at least January 1989, which is the first month for which we have comparable data.The graph above shows that rail traffic collapsed in November 2008, and now ten months into the recovery, traffic has only recovered half way. This is clearly not a "V-shaped" recovery - there is still a long way to go.

• Part of the big percentage gain in April 2010 reflects real traffic growth, but some of it also reflects the fact that April 2009 was a lousy month for U.S. freight railroads (see chart). May 2009 was even worse, so we can probably expect a very large year-over-year percentage increase in May 2010 too.

• Is this good news? Absolutely. But some caution is in order. Total U.S. rail carloads in April 2010 were still down 11.5% from April 2008, including in 17 of the 19 commodity categories. Generally speaking, recent U.S. rail traffic gains are consistent with an economy that is recovering at a moderate but not breathtaking pace.

excerpts with permission

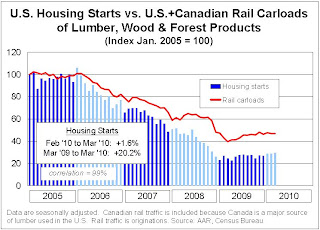

The second graph from the AAR report shows lumber rail traffic compared to U.S. housing starts.

The second graph from the AAR report shows lumber rail traffic compared to U.S. housing starts.From the AAR:

Happy days are not yet here again for homebuilders.That says it all!

Trade Deficit increases in March

by Calculated Risk on 5/12/2010 08:30:00 AM

The Census Bureau reports:

[T]otal March exports of $147.9 billion and imports of $188.3 billion resulted in a goods and services deficit of $40.4 billion, up from $39.4 billion in February, revised. March exports were $4.6 billion more than February exports of $143.3 billion. March imports were $5.6 billion more than February imports of $182.7 billion.

Click on graph for larger image.

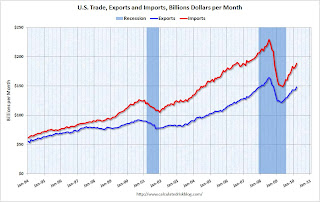

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through March 2010.

On a year-over-year basis, exports are up 20% and imports are up 24%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

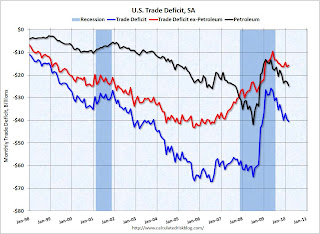

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased slightly to $73.89 in March - and are up 89% from the low of February 2009 (at $39.22). Oil import volumes increased sharply in March pushing up the value of imports.

Both imports and exports have been increasing sharply, but are still below the pre-financial crisis levels. Once again China and oil are the major contributors to the trade deficit.

MBA: Mortgage Purchase Applications Decrease

by Calculated Risk on 5/12/2010 07:21:00 AM

The MBA reports: Refinance Applications Surge, Purchase Applications Drop in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 3.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 14.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 9.5 percent from one week earlier. ...

“The recent plunge in rates on US Treasury securities, due to a flight to quality as investors worldwide sought shelter from the Greek debt crisis, benefitted US mortgage borrowers last week. Rates on 30-year mortgages dropped to their lowest level since mid-March. As a result, refinance applications for conventional loans jumped, hitting their highest level in six weeks,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “In contrast, purchase applications fell almost 10 percent in the first week following the expiration of the homebuyer tax credit, as the tax credit likely pulled some sales into April that would otherwise have occurred in May or later.”

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.96 percent from 5.02 percent, with points decreasing to 0.91 from 0.92 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

We expected the Purchase Index to increase in April - and then turn down in May since the tax credit expired at the end of April (buyers need to close by June 30th). The tax credit related peak in purchase activity is probably behind us.

As Fratantoni noted, the decline in mortgage rates (below 5% again on a 30 year fixed) resulted in a surge in refinance applications last week.

Tuesday, May 11, 2010

Shanghai Composite index Off 1%

by Calculated Risk on 5/11/2010 11:59:00 PM

A follow up to a post two weeks ago ... keep an eye on the Shanghai index (in red). It appears China's economy is slowing.

A follow up to a post two weeks ago ... keep an eye on the Shanghai index (in red). It appears China's economy is slowing.

Click on graph for larger image in new window.

This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite Index is at 2,622.67 mid-day - down about 300 points from 2 weeks ago.