by Calculated Risk on 5/07/2010 04:00:00 PM

Friday, May 07, 2010

NMHC Quarterly Survey: Apartment Market Conditions Tighten

From the National Multi Housing Council (NMHC): Apartment Industry Shows Widespread Improvement According to NMHC Quarterly Survey of Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years. Fully 64 percent of respondents said markets were tighter (meaning lower vacancies and/or higher rents). Only two percent reported looser markets. This is the sixth straight increase for this measure.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth. ... Even so, a sustained recovery in the apartment market needs a firm economic and demographic foundation ... in the near-term the industry’s prospects still depend upon a stronger rebound in both the job market and household formation.” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year. Right now I expect BLS reported rents to continue to decline through most of 2010.

This data is a survey of large apartment owners. The data released last week from the Census Bureau showed a 10.6% rental vacancy rate for all rental units.

A final note: at some point the apartment market would start to tighten from the very high vacancy rates (record levels according to the Census Bureau and Reis).

The question asked was:

Q: [O]n balance, apartment market conditions in your markets today are:

Of those surveyed, 64% answered: "Tighter than three months ago" and 34% answered "About unchanged from three months ago". So it appears the bottom in vacancy rates was reached in Q4 2009.

The improvement in the labor market is probably leading to more household formation - and combined with a record low number of new apartment units being completed this year - the apartment market is now starting to tighten. It will take some time for the overall vacancy rate to fall to normal levels, but the excess housing units are now being absorbed. (See Housing Stock and Flow for an analysis of the absorption of excess housing units).

European Liquidity Issues

by Calculated Risk on 5/07/2010 01:29:00 PM

There is a rumor circulating that the ECB is prepared to announce a €600 billion loan facility for European banks over the next few days. One key analyst has suggested that the FOMC might re-open the dollar swap lines for Europe. Update: I don't usually post rumors during the day, but this is being widely circulated as a possibility.

Note that the Bank of Japan moved last night, from the Financial Times: Bank of Japan pumps funds into market

The Bank of Japan offered Y2,000bn ($21.6bn) in overnight liquidity on Friday to “increase markets’ sense of security” because of turmoil resulting from the debt crisis in Greece. ... the bank’s action reflects global demand for dollar liquidity as investors move out of the euro.And from the WSJ: European Banks Head Toward New Funding Crunch

excerpt with permission

Europe's sovereign debt crisis is making it harder for European banks to get their hands on dollars and may require their central banks to step in with short-term liquidity ...The Libor rate has increased, but it is still at a very low level. This could be something to watch.

Temporary Help and Diffusion Index

by Calculated Risk on 5/07/2010 12:51:00 PM

Here are a couple more graphs based on data in the employment report ...

Temporary Help

From the BLS report:

Temporary help services continued to add jobs (26,000); employment in this industry has increased by 330,000 since September 2009.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees (hours worked increased slightly in April) and also hire temporary employees. Since the number of temporary workers increased sharply over the last seven months, some people think this might be signaling the beginning of a strong employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Note that the temporary hiring for the Census is excluded from this graph.

Diffusion Index

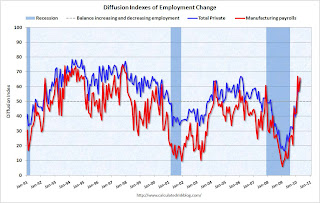

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This fits with the headline payroll report and is a positive.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 5/07/2010 09:59:00 AM

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio increased to 58.8% in April (from 58.6% in March), after plunging since the start of the recession. This is about the same level as in December 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased to 65.2% from 64.9% in March. This is the percentage of the working age population in the labor force. This is still well below the 66% to 67% rate that was normal over the last 20 years. As people return to the labor force, as the employment picture improves, this will put upward pressure on the unemployment rate - even with job growth.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 9.2 million in April. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.152 million in April.

The all time record of 9.24 million was set in October.

These workers are included in the alternate measure of labor underutilization (U-6) that was at 17.1% in April.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.72 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.34% of the civilian workforce. (note: records started in 1948)

Although the headline number of 290,000 payroll jobs was a positive (this is 224,000 after adjusting for the 66,000 Census 2010 temporary hires), the underlying details were mixed. The positives: the employment-population ratio increased (after plunging sharply), and average hours increased.

Negatives include the unemployment rate increasing to 9.9%, a near record number of part time workers (for economic reasons) pushing U-6 to 17.1%, and a record number of workers unemployed for more than 26 weeks.

The number of long term unemployed is one of the key stories of this recession, especially since many of them are now losing their unemployment benefits. Note: In Q1, all of the increase in income - and much of the increase in consumption - came from government transfer payments for unemployment benefits.

I'll have even more later ...

Earlier employment post today:

April Employment Report: 290K Jobs Added, 9.9% Unemployment Rate

by Calculated Risk on 5/07/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 290,000 in April, the unemployment rate edged up to 9.9 percent, and the labor force increased sharply, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 290,000 in April. The economy has lost 1.4 million jobs over the last year, and 7.8 million jobs since the recession started in December 2007.

The unemployment rate increased to 9.9 percent as people returned to the workforce.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 66,000 (NSA) in April.

This was well above expectations, especially given the level of Census 2010 hiring. The increase in the unemployment rate was because of people returning to the work force - the decline in the participation rate during the recession was stunning, and it is no surprise that people are once again looking for work. I'll have much more soon ...