by Calculated Risk on 5/06/2010 08:30:00 AM

Thursday, May 06, 2010

Weekly Initial Unemployment Claims decline slightly

The DOL reports on weekly unemployment insurance claims:

In the week ending May 1, the advance figure for seasonally adjusted initial claims was 444,000, a decrease of 7,000 from the previous week's revised figure of 451,000. The 4-week moving average was 458,500, a decrease of 4,750 from the previous week's revised average of 463,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 24 was 4,594,000, a decrease of 59,000 from the preceding week's revised level of 4,653,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 458,500.

The dashed line on the graph is the current 4-week average. The current level of 444,000 (and 4-week average of 458,500) is still high, and suggests continuing weakness in the labor market.

Although declining over the last few weeks, the 4-week average first declined to this level in December 2009, and has been at this level for about five months.

Wednesday, May 05, 2010

Evening Euro

by Calculated Risk on 5/05/2010 10:13:00 PM

Just a bit of an overview ... the European Central Bank (ECB) is meeting in Lisbon, Portugal, and will announce their interest rate decision at 4:45 AM ET. You can watch the news conference here live at 5:30 AM ET.

Great timing to meet in Lisbon since earlier today Moody's warned that Portugal may face a downgrade.

Ratings agency Moody's Investors Service on Wednesday placed Portugal's government bond ratings on review for possible downgrade, citing the recent deterioration of the country's public finances and "long-term growth challenges" to the economy.Three months?

In the event of a downgrade, the country's Aa2 ratings would fall by one or, at most, two notches, the agency said. Moody's said it expects to complete the review within three months.

At the meeting, it is expected that the ECB will leave rates unchanged at 1%.

Professor Krugman argues Greece may end up leaving the euro: Greek End Game

Many commentators now believe that Greece will end up restructuring its debt — a euphemism for partial repudiation. I agree. But the reasoning seems to stop there, which is wrong. In effect, the consensus that Greece will end up defaulting is probably too optimistic. I’m growing increasingly convinced that Greece will end up leaving the euro, too.And there was sad news from Greece, from Reuters: Europe leaders warn of contagion, 3 die in Greece

Freddie Mac: Q1 Net Loss $6.7 billion, Asks for $10.6 billion

by Calculated Risk on 5/05/2010 05:40:00 PM

"[A]s we have noted for many months now, housing in America remains fragile with historically high delinquency and foreclosure levels, and high unemployment among the key risks."

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Press Release: Freddie Mac Reports First Quarter 2010 Financial Results

First quarter 2010 net loss was $6.7 billion. ...The first quarter loss in 2009 was $9.97 billion and the Q4 2009 loss was $6.5 billion. The losses keep coming, but last quarter Haldeman warned about "a potential large wave of foreclosures", so it appears he is a little more optimistic.

Net worth deficit was $10.5 billion at March 31, 2010, driven primarily by a significant adverse impact due to the change in accounting principles. ...

The Federal Housing Finance Agency (FHFA), as Conservator, will submit a request on the company’s behalf to Treasury for a draw of $10.6 billion under the Senior Preferred Stock Purchase Agreement (Purchase Agreement).

emphasis added

Whitney: Banks Under-reserved for 'Double-dip' in House Prices

by Calculated Risk on 5/05/2010 02:25:00 PM

From Nikolaj Gammeltoft and Peter Eichenbaum at Bloomberg: Whitney Says Banks Face ‘Tough’ Quarter, Housing Dip (ht jb)

Banks continue to suffer from losses on non-performing loans, and U.S. home prices will fall again amid increasing supply and sluggish demand, according to [banking analyst Meredith Whitney].I also think the repeat national house price indexes (Case-Shiller, LoanPerformance) will show further price declines later this year. But, we have to recognize that a majority of the national price declines are behind us, and any 'double-dip' in prices will be much smaller than the previous declines.

“I’m steadfast in my belief there’s going to be a double- dip in housing,” she said. “You will see clearly that the banks are under-reserved when housing dips again.”

My guess is some mid-to-high end bubble areas will see the largest future price declines - so the impact on the banks will depend on their exposure to the those areas.

I think BofA with the Countrywide loans, Wells Fargo with Wachovia / Golden West, and JPMorgan with WaMu are all exposed to the mid-to-high end bubble areas. But all the acquiring banks took large write-downs for these loans earlier, so I'm not sure Whitney is correct about them being under-reserved (it is hard to tell). Of course there are the 2nd lien issues too.

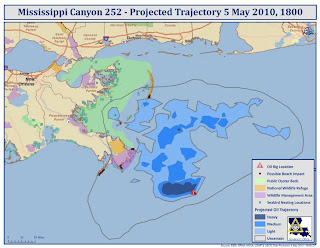

Web Resources for tracking the Oil Spill

by Calculated Risk on 5/05/2010 12:19:00 PM

From NOAA: Deepwater Horizon Incident, Gulf of Mexico

From the Office of the Governor, Louisiana: Gulf Oil Spill 2010 Trajectory

Click on map for larger image in new window.

Update: from Google: Gulf of Mexico Oil Spill (ht Jan)