by Calculated Risk on 4/15/2010 09:39:00 AM

Thursday, April 15, 2010

Industrial Production, Capacity Utilization increase in March

From the Fed: Industrial production and Capacity Utilization

Industrial production edged up 0.1 percent in March and increased at an annual rate of 7.8 percent in the first quarter. Manufacturing output rose 0.9 percent in March, led by widespread gains among durable goods industries. Factory production was likely held down in February by the winter storms but nonetheless rose at an annual rate of 6.6 percent for the first quarter as a whole. The output of mines increased 2.3 percent in March. Utilities output dropped 6.4 percent; after a relatively cold February, demand for heating fell in March as temperatures climbed to above-normal levels. At 101.6 percent of its 2002 average, industrial output in March was 4.0 percent above its year-earlier level. Capacity utilization for total industry advanced 0.2 percentage point to 73.2 percent, a rate 7.4 percentage points below its average from 1972 to 2009, but 3.7 percentage points above the rate from a year earlier.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 7.2% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 73.2% is still far below normal - and 9.1% below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

Also - this is the highest level for industrial production since Dec 2008, but production is still 9.6% below the pre-recession levels at the end of 2007.

RealtyTrac: March Foreclosure Activity Highest on Record

by Calculated Risk on 4/15/2010 08:54:00 AM

From RealtyTrac: Foreclosure Activity Increases 7 Percent in First Quarter

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for Q1 2010, which shows that foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 932,234 properties in the first quarter, a 7 percent increase from the previous quarter and a 16 percent increase from the first quarter of 2009. One in every 138 U.S. housing units received a foreclosure filing during the quarter.This is the highest monthly total - and highest quarterly total - since RealtyTrac started tracking foreclosures in 2005 (and that probably means this is the highest ever). Note that the initial stage filings (Notice of Default and Lis Pendens depending on the state) were flat with Q1 2009, but that later stage filings (of Trustee Sale and Notice of Foreclosure Sale and repossessions) surged:

Foreclosure filings were reported on 367,056 properties in March, an increase of nearly 19 percent from the previous month, an increase of nearly 8 percent from March 2009 and the highest monthly total since RealtyTrac began issuing its report in January 2005.

“Foreclosure activity in the first quarter of 2010 followed a very similar pattern to what we saw in the first quarter of 2009: a shallow trough in January and February followed by a substantial spike in March,” said James J. Saccacio, chief executive officer of RealtyTrac. “One difference, however, is that the increases were more tilted toward the final stage of foreclosure, with REOs increasing 9 percent on a quarterly basis in the first quarter of 2010 compared to a 13 percent quarterly decrease in REOs in the first quarter of 2009.

“This subtle shift in the numbers pushed REOs to the highest quarterly total we’ve ever seen in our report and may be further evidence that lenders are starting to make a dent in the backlog of distressed inventory that has built up over the last year as foreclosure prevention programs and processing delays slowed down the normal foreclosure timeline.”

Foreclosure auctions were scheduled for the first time on a total of 369,491 properties during the quarter, the highest quarterly total for scheduled auctions in the history of the report. Scheduled auctions increased 12 percent from the previous quarter and were up 21 percent from the first quarter of 2009.It appears that the banks are starting to clear out the foreclosure backlog.

Bank repossessions (REOs) also hit a record high for the report in the first quarter, with a total of 257,944 properties repossessed by the lender during the quarter — an increase of 9 percent from the previous quarter and an increase of 35 percent from the first quarter of 2009.

Weekly Initial Unemployment Claims Increase to 484,000

by Calculated Risk on 4/15/2010 08:34:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 10, the advance figure for seasonally adjusted initial claims was 484,000, an increase of 24,000 from the previous week's unrevised figure of 460,000. The 4-week moving average was 457,750, an increase of 7,500 from the previous week's unrevised average of 450,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 3 was 4,639,000, an increase of 73,000 from the preceding week's revised level of 4,566,000.

Click on graph for larger image in new window.

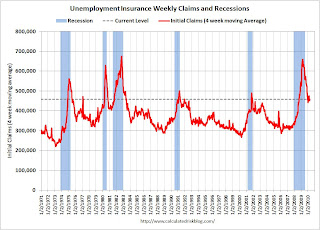

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 7,500 to 457,750.

The dashed line on the graph is the current 4-week average. The current level of 484,000 (and 4-week average of 457,750) is still high, and suggests continuing weakness in the jobs market. This is much worse than expected.

Wednesday, April 14, 2010

Lawler: BoA and Chase on Second Mortgages

by Calculated Risk on 4/14/2010 11:06:00 PM

The following report is from housing economist Tom Lawler:

In a House Financial Services Committee meeting today on “Second Liens and Other Barriers to Principal Reduction as an Effective Foreclosure Mitigation Program, spokespersons from BoA, Citi, JPMorgan Chase, and Wells Fargo explained the potential dangers of broad principal reductions, as well as tried to dismiss the silly claim that many second mortgages have “virtually no value” because so many borrowers with seconds have total mortgage balances at or exceeding the value of the home collateralizing those mortgages. Below are some observations on BoA’s and Chase’s testimony.

BoA provided a few interesting stats: of the 10.4 million first lien mortgages that it services, 15% of second mortgages owned by BoA, while 16% have second mortgages with other lenders. (Thus, 31% have second liens!).

BoA also said that about 90% of BoA’s owned second-lien mortgage portfolio is made up of “standalone originations used to finance a specific customer need, such as education expenses or home improvements, with “(t)he remainder consists of piggy back (combo) loans originated with the home purchase.” BoA made this point to highlight that the vast bulk of its second mortgage lending was collateralized consumer credit lending, where the borrower’s ability to pay was a major factor behind extending the credit.

Here is what BoA said about their second mortgage portfolio:

“Most of our second loans continue to have collateral value, and of those where the second loan is underwater, a significant number are still performing. Indeed, out of 2.2 million second liens in Bank of America’s held for investment portfolio – only 91,000 seconds – about four percent – are (i) delinquent, (ii) behind a delinquent first mortgage and (iii) not supported by any equity.”

BoA’s spokesperson vexed a number of investors in first-lien mortgages (or securities backed by such mortgages) by saying that in cases where the first and second are held by different investors, the “logic of 2MP” (the administrations second mortgage program) where “the holder of the second lien is required to forebear a similar percentage as the first lien holder” seems “equitable” to BoA – despite the subordinate nature of the second, and despite the fact that the 2MP program does not require second mortgage holders to forgive principal, even when the first mortgage holder does!

Here is what Chase said about its Home Equity (second) mortgage portfolio:

Chase owns about $131 billion in Home Equity loans and lines as of February 28, 2010.

• Approximately $25 billion are home equity loans and $106 billion are home equity lines of credit.And on the issue of broad-based principal reduction programs, as well as the “subordinate” nature of second mortgages, here is what Chase had to say:

• Approximately $33 billion are in first lien position and $98 billion in second lien position.

• 5% of Chase’s home equity portfolio is 30 days or more delinquent. Total home equity line, home equity loan, first lien and second lien delinquency rates are within two percentage points of the overall total.

• About 50% of the total Chase second lien portfolio is underwater, and 95% of this portfolio is performing (less than 60 days past due). 30% of second lien mortgages have combined loan-to-value ratios over 125% and 94% of this portfolio is performing.

• For $40 billion of Chase-owned second lien mortgages, Chase also services a first lien mortgage:• 92% of these first lien mortgages are performing.• About 10% of Chase’s total serviced portfolio of first lien mortgage loans has a Chase-owned second lien.

• 28% of these first lien mortgages are by themselves underwater (loan- to-value ratio of over 100%).

• 45% of first lien mortgages have a combined loan- to-value ratio of over 100%.

• Our best estimate is that about 20% of Chase serviced first lien mortgages may have a second lien from another lender and about 70% do not have a second lien.

“We do think that large scale, broad–based principal reduction programs raise serious policy concerns, for both first and second lien mortgage loans, and particularly for current borrowers with an ability to repay their obligations. In Chase’s view, such programs could be potentially very harmful to consumers, investors and future mortgage market conditions – and should not be undertaken without first attempting other solutions, including more targeted modification efforts.

“Like all loans, mortgage contracts are based on a promise to repay money borrowed. Importantly, there is no provision in the mortgage contract, express or implied, that the lender will restore equity or reduce the repayment amount if the value of the collateral – be it a home, a car or a stock market investment – depreciates. If we re-write the mortgage contract retroactively to restore equity to any mortgage borrower because the value of his or her home declined, what responsible lender will take the equity risk of financing mortgages in the future? What responsible regulator would want lenders to take such risk?

“We are also concerned that broad-based principal reduction could result in reduced access to credit and higher costs for consumers if market risk to lenders and investors materially increases. Borrowers likely will be required to increase their down payments, credit criteria will be further tightened and risk premiums for mortgage credit will increase and get passed on to consumers. Less affluent borrowers would likely be harmed disproportionately.

“The benefits of a broad-based principal reduction program are to a large degree unknown and in Chase’s view, outweighed by the risks and the facts that we do know.”

And here is Chase on why many second loan portfolios are performing better than firsts, as well as the risks involved in broad-based principal reduction plans:

“Many borrowers remain current on their home equity loans because they want to honor their obligations and protect their credit. Our data show that 97% of borrowers in Chase’s $98 billion second lien portfolio are performing on their loans (less than 60 days past due). For second liens that have a cumulative loan-to-value ratio greater than 100%, 95% of borrowers are performing. Regardless of loan-to-value, as long as borrowers continue to do the right thing and fulfill their contractual obligations, second liens that are current and producing cash flow to investors have value."

“Additionally, a broad-based second-lien principal reduction plan would be forgiving past consumption by borrowers rather than housing investment. According to both internal Chase and Federal Reserve data, over 50% of borrowers used home equity loan proceeds for repayment of debt or personal consumption. No more than 15-20% used home equity proceeds to purchase a home. A broad-based program of principal reduction would be very expensive. To bring underwater borrowers “even” to a loan to value ratio of 100%, we estimate:

• It would have an industry-wide cost of $700 billion to $900 billion.And on the issue of LIEN priority, here is what Chase had to say:

• The cost to Fannie Mae, Freddie Mac and FHA alone would be in the neighborhood of $150 billion.

• The Federal Reserve and Department of Treasury would have additional exposure through their ownership interests and risk guarantees of AIG, GMAC, and other institutions.

• Mortgage lenders would incur a significant reduction in capital now, potentially impairing their ability to extend future credit – mortgage or otherwise.

• And if house prices decline further, the costs would be even higher, representing the implicit “put” at 100% CLTV. “

“It is important not to confuse payment priority with lien priority. In almost all scenarios, second lien holders have rights equal to a first lien holder with respect to a borrower’s cash flow. The same is true with respect to other secured or unsecured debt, such as credit cards or car loans. Generally, consumers can decide how they want to manage their monthly payments. In fact, almost 64% of borrowers who are 30-59 days delinquent on a first lien serviced by Chase are current on their second lien. It is only at liquidation or property disposition that first lien investors have priority.”

The banks’ testimony, of course, was in response to a letter from Barney Frank, who has been heavily lobbied (and influenced) by the Mortgage Investors Coalition to get second mortgage holders to write down their loans. In that letter Congressman Frank incorrectly argued that because many borrowers with second mortgages have total mortgage indebtedness that exceeds the value of their homes, these second mortgages “have no real economic value,” and he urged banks “in the strongest possible terms to take immediate steps to write down these second mortgages.”

Here, by the way, are some residential mortgage servicing statistics as of the end of last year for the top four mortgage servicers:

| 12/31/2009 | Delinquency Stats: Q4/09 | |||||

|---|---|---|---|---|---|---|

| Company Name | Number of Loans Serviced1 | 30-day | 60-day | 90+-day | In Foreclosure | Total Past Due |

| Bank of America | 14,011,029 | 3.4% | 1.7% | 6.5% | 3.3% | 14.8% |

| Wells Fargo | 12,168,836 | 2.4% | 1.2% | 3.5% | 1.9% | 9.0% |

| Chase | 9,689,312 | 3.0% | 1.4% | 4.6% | 3.2% | 12.2% |

| CitiMortgage, Inc. | 5,118,563 | 2.3% | 1.4% | 4.9% | 1.7% | 10.4% |

1 includes first liens and subordinate liens

These “mega” servicers were, through the economies of scale in processing payments, able to charge a pretty small fee to service loans and still make what appeared to be a decent amount of money. However, as problem loans mounted it became clear that the companies were woefully understaffed to deal with these problem loans effectively, leading to extremely poor loss mitigation efforts, poorly designed foreclosure prevention/modification programs.

All of these companies finally began materially increasing the size of their staffs devoted to troubled loan management, and the administration’s HAMP effort helped prompt them to do so by providing hefty premiums to servicers. However, it took companies quite a while to get staff and board and train them, as was clearly evidence in last year’s overall servicing performance.

NOTE: This was from housing economist Tom Lawler.

Iceland Bank "Black Report"

by Calculated Risk on 4/14/2010 08:16:00 PM

The English version of the Black Report on the Iceland bank failures was released today. It has it all - regulatory capture, oblivious politicians, shadow banking, loans to shareholders to buy shares and more. (ht Steinn)

Here is the website with the English version.

The following graph is from Chapter 21: Causes of the Collapse of the Icelandic Banks - Responsibility, Mistakes and Negligence

Here is an excerpt from the long report:

[This figure] shows the lending of the three big banks’ parent companies, classified by type of borrowers. The lending by the parent companies amounted usually to 50-60% of all lending by the banking groups from mid-2004. ... the largest and steadiest increase in lending was to holding companies on the one hand and to foreign parties on the other. The increase in lending to foreign parties was notably larger. The increase was especially big during the latter part of 2007. During the first part of 2007 the Icelandic banks increased their lending to foreign parties by 800 million EUR, to 8.3 billion EUR. During the latter part of that year, i.e. after the beginning of the international liquidity crisis in mid-summer 2007, the lending to foreign parties increased however by 11.4 billion EUR, to 20.7 billion EUR. Thereby, lending by the banks’ parent companies to foreign parties increased by more than 120% in just six months. As stated in Chapter 8, this increase was seen in all three banks, an increase of 5 billion in Kaupthing and 3 billion each in Landsbanki and Glitnir. The [Special Investigation Commission] (SIC) notes that this increased lending started at about the same time as the liquidity crisis in the international financial markets began. The increase was so substantial that it can be assumed that many of the new customers had turned to the Icelandic banks after other banks had made arrangements to reduce their lending and that these customers had therefore been refused service by other banks.It sounds like the Icelandic banks were making bad loans right at the wrong time.

One of the key problems identified in the report is "weak equity". Although some of these arrangment were complicated, basically the bank would loan money to an owner who would buy shares in the bank - and use those shares as collateral for the loan. This boosted the apparent capital, and allowed the bank to lend more money. Amazing.

The largest owners of all the big banks had abnormally easy access to credit at the banks they owned, apparently in their capacity as owners.Geesh - that reminds me of Enron.

...

The banks had invested their funds in their own shares. Share capital, financed by the company itself, is not the protection against loss it is intended to be. Here this is referred to as “weak equity”. Weak equity in the three banks amounted to about ISK 300 billion by mid year 2008. At the same time, the capital base of the banks was about ISK 1,186 billion in total. Weak equity, therefore, represented more than 25% of the banks’ capital base. If only the core component of the capital base is examined, i.e. shareholders’ equity, according to the annual accounts, less intangible assets, the weak equity of the three banks amounted to more than 50% of the core component in mid year 2008.

Here is the executive summary for a quick read.