by Calculated Risk on 4/13/2010 08:54:00 AM

Tuesday, April 13, 2010

Trade Deficit increases in February

The Census Bureau reports:

[T]otal February exports of $143.2 billion and imports of $182.9 billion resulted in a goods and services deficit of $39.7 billion, up from $37.0 billion in January, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2010.

On a year-over-year basis, exports are up 14% and imports are up 20%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009. This is the first time since late 2008 that imports are up a greater percentage than imports on a YoY basis as export growth appears to have slowed.

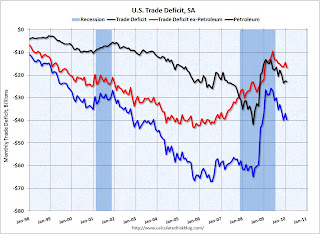

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $72.92 in February - but are up 86% from the low of one year ago in February 2009 (at $39.22). Oil import volumes declined in February.

In general trade has been increasing, although both imports and exports are still below the pre-financial crisis levels. Exports boosted the economy over the last year, however it now appears that export growth has slowed. Imports are still increasing even with the lower oil deficit in February.

Small Business Index Declines in March

by Calculated Risk on 4/13/2010 08:18:00 AM

From the National Federation of Independent Business: Small Business Optimism Declines in March

The National Federation of Independent Business Index of Small Business Optimism lost 1.2 points in March, falling to 86.8. The persistence of index readings below 90 is unprecedented in survey history.

“The March reading is very low and headed in the wrong direction,” said Bill Dunkelberg, NFIB chief economist. “Something isn’t sitting well with small business owners. Poor sales and uncertainty continue to overwhelm any other good news about the economy.”

...

After a devastating period of employment reductions, employment change per firm hit the “zero line” in March. .... While actual job reductions may have halted, plans to create new jobs remain weak. ... Only nine percent (seasonally adjusted) reported unfilled job openings, down two points and historically low, showing little hope for a lower unemployment rate.

Monday, April 12, 2010

Report: Commuting Costs offset Lower House Prices

by Calculated Risk on 4/12/2010 11:15:00 PM

Something a little different ...

From the Boston Globe: Travel swells cost of housing

People who move to an outlying Boston suburb to find affordable housing or to get more house for their money often sacrifice the savings to higher transportation costs, according to a study to be released today by a national planning and land-use organization.Here is the report on Boston:

The report, by the Urban Land Institute, is the first to quantify by community not only commuting costs, but the price of daily transportation around often-sprawling suburbs.

This report analyzes the combined costs of housing and transportation for neighborhoods, cities, and towns throughout a Boston regional study area that extends south to Providence, Rhode Island; west to Worcester, Massachusetts; and northeast to Dover, New Hampshire.When gasoline prices rose to over $4 per gallon in 2008, it really crushed some exurban areas that were already hard hit by the housing bust. The old saying "Drive to you qualify" doesn't really make sense if the transportation costs offset the lower house prices.

Our analysis finds that the typical household in the study area spends upwards of $22,000 annually on housing, which represents roughly 35 percent of the median household income ($68,036). With transportation costs for the typical household reaching nearly $12,000 annually, the combined costs of housing and transportation account for roughly 54 percent of the typical household’s income.

Similar studies conducted for the San Francisco Bay Area and the Washington, D.C., region have found average housing and transportation cost burdens of 59 percent and 47 percent, respectively.

WaMu Hearings Start Tomorrow

by Calculated Risk on 4/12/2010 05:50:00 PM

Jim Puzzanghera at the LA Times has a preview: Washington Mutual created 'mortgage time bomb,' Senate panel finds

Before Washington Mutual collapsed ... its executives knowingly created "a mortgage time bomb" by steering borrowers to subprime mortgages and turning the loans into securities the company knew were likely to go bad, one of the most extensive investigations into the causes of the financial crisis has found.More from the WSJ: Senate Probe Finds Washington Mutual Ignored Warnings

...

"At times, WaMu selected and securitized loans that it had identified as likely to go delinquent" or securitized loans in which the company had discovered fraudulent activity, such as misstated income, without disclosing the information to investors, the committee found. The company's pay practices exacerbated the problem by rewarding loan officers and processors based on how many mortgages they could churn out.

The documents to be disclosed on Tuesday also reflect that employees routinely fabricated lending documents. "One Sales Associate admitted that during that crunch time some of the Associates would 'manufacture' asset statements …and submit them to the" loan processing center, according to one document. "She said the pressure was tremendous ... since the loan had already [been] funded."The Inspectors General's report on WaMu will be issued on Friday - Sewell Chan at the NY Times reported Saturday: U.S. Faults Regulators Over a Bank

Regulators failed for years to properly supervise the giant savings and loan Washington Mutual, even as the company wobbled ... a federal investigation has concluded.A huge bank out of control and regulators ignoring the problem ... this is quite a story. And no surprise at all.

...

The report, prepared by the inspectors general for the Treasury Department and the Federal Deposit Insurance Corporation, is expected to be released Friday. A draft was obtained by The New York Times.

PIMCO's Simon on a Post-Fed MBS Market

by Calculated Risk on 4/12/2010 02:34:00 PM

Scott Simon, Managing Director at PIMCO Discusses a Post-Fed Mortgage-Backed Securities Market. A few excerpts:

We are unlikely to see a significant market disruption in the Agency market stemming from the Fed’s retreat. ... if and when we see mortgages cheapen, we expect to see private institutions stepping in to buy. Even a 15 basis point move could spark a flurry of buying. Therefore, we don’t expect a major widening of mortgage spreads ...And some Q&A:

Q: Could you elaborate more on who will fill the purchasing gap left by the Fed’s exit?And finally on housing:

Simon: Money managers and other institutions have been sitting on the sidelines for quite a while, but cash yields are essentially zero, making it very tempting to move out the risk and duration spectrum. This is exactly what the Fed has meant to do with a fed funds rate near zero – make it so that investors can’t stand to be in cash any more. For banks, it makes the spread between cash and Agency mortgages look more attractive, and for investors, it makes risk-adjusted yields on Agencies look competitive.

...

Q: Do you think it’s at all likely the Federal Reserve will reboot its MBS purchase program later this year or in 2011?

Simon: Probably not. Barring a major double dip in the economy or housing, private balance sheets have plenty of room to add Agency MBS (unlike in late 2008, when the Fed program began).

Q: Finally, let’s discuss housing more directly. When might we see a recovery?My comments: In the low price / high foreclosure bubble areas, I think house prices bottomed over a year ago because of the flood of foreclosure sales (Tom Lawler's "destickification"), however I think there will be further price declines in the mid-to-high end bubbles areas. This is where many of the next wave of distressed sales will be concentrated. My guess is this will push the national price indexes (Case-Shiller, LoanPerformance) to new lows later this year and probably into 2011. And then any recovery in prices will be very slow because distressed sales will remain elevated for some time.

Simon: We continue to believe that lower-priced homes bottomed last year. Higher-priced homes should bottom later this year. If one labels recovery as prices rising dramatically, we do not foresee that anytime soon.

Q: Do you think the government is done tinkering with housing sales and foreclosures?

Simon: The three issues that need addressing are: 1) negative equity, 2) unemployment and 3) second liens hindering loan modifications. Obama’s plan addresses these issues, but the devil is in the details. ...

And 2nd liens remain a huge stumbling block. Dakin Campbell and David Henry at Bloomberg had a story on 2nd liens and banks this morning: Bank Profits Dimmed by Prospect of Home-Equity Losses (ht Brian, Mike in Long Island, Clip)

Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co. may have to set aside an additional $30 billion to cover possible losses on home-equity loans, an amount almost equal to analysts’ estimates of profit at the three banks this year.Although the article is focused on write-downs for the banks, this also has implications for the housing market.

The cost of these reserves was calculated by CreditSights Inc., a New York-based research firm whose prediction almost four years ago proved prescient after banks reported unprecedented mortgage-related writedowns. Recognizing the home- equity loan losses is unfinished business from the housing bubble ...

The four biggest U.S. banks by assets -- Bank of America, JPMorgan, Citigroup Inc. and Wells Fargo -- hold about 42 percent, or $442 billion of the $1.1 trillion in second-lien mortgage loans, according to Amherst Securities Group LP, an Austin, Texas-based firm that analyzes home-loan assets.