by Calculated Risk on 4/08/2010 08:35:00 AM

Thursday, April 08, 2010

Weekly Initial Unemployment Claims increase 18,000

The DOL reports on weekly unemployment insurance claims:

In the week ending April 3, the advance figure for seasonally adjusted initial claims was 460,000, an increase of 18,000 from the previous week's revised figure of 442,000. The 4-week moving average was 450,250, an increase of 2,250 from the previous week's revised average of 448,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 27 was 4,550,000, a decrease of 131,000 from the preceding week's revised level of 4,681,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 2,250 to 450,250.

The dashed line on the graph is the current 4-week average. The current level of 460,000 (and 4-week average of 450,250) is still high, and suggests continuing weakness in the jobs market. Note: There is no way to compare directly between weekly claims, and net payrolls jobs.

Wednesday, April 07, 2010

Report: BofA to increase Foreclosures significantly in 2010

by Calculated Risk on 4/07/2010 09:42:00 PM

Irvine Renter at the Irvine Housing Blog writes: Bank of America to Increase Foreclosure Rate by 600% in 2010

[Irvine Renter] attended a local Building Industry Association conference on Friday 26 March 2010. The west coast manager of real estate owned, Senior Vice President Ken Gaitan, stated that Bank of America, which currently forecloses on 7,500 homes a month nationally, will increase that number to 45,000 homes per month by December of 2010.CR Note: I tried to verify these numbers with BofA without success. Irvine Renter clarified this for me today. Apparently Gaitan said that Bank of America anticipates the peak of foreclosure activity will occur in December 2010 and will top out at 45,000 units that month. Apparently BofA believes foreclosure activity will trend down in 2011. According to Irvine Renter, Gaitan said BofA expects about 300,000 total foreclosures in 2010. That is a significant increase from the current 7,500 per month pace.

After his surprising statement, two questioners from the audience asked questions to verify the numbers.

Bank of America is projecting a 600% increase in its already large number of monthly foreclosures.

This isn't unsubstantiated rumor; this comes straight from one of the most powerful men in Bank of America's OREO department (yes, that really is what they call it). It appears they have too many properties already.

Once again, BofA's media department told me they'd get back to me - but no word so far - so there numbers have not been verified.

CR note: OREO stands for "Other Real Estate Owned"

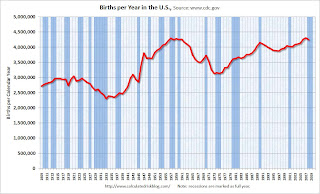

U.S. Births per Year

by Calculated Risk on 4/07/2010 07:02:00 PM

There is a new report1 from researchers at the CDC, released yesterday, showing that U.S. births declined about 2% in 2008 from 2007.

The preliminary number of 2008 US births was 4,251,095, down nearly 2 percent from the 2007 peak; the 2008 general fertility rate (68.7 per 1,000) also declined.Apparently some people are blaming the decline in births on the recession.

From Professor Krugman: Birds And Bees Blogging

There have been many stories about the decline of the birth rate in 2008, with almost all attributing it to the recession. But James Trussell [2] raises an interesting point: doesn’t it take nine months from conception to birth?That calls for a graph ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.First, I think the decline in 2008 was relatively small from the record year in 2007.

Second, I wouldn't be surprised if certain segments of the population were under stress before the recession started (like construction workers).

Third, notice that the number of births started declining sharply a number of years before the Great Depression started. Many families in the 1920s were under severe stress long before the economy collapsed.

So my guess is the decline in births is related to the recession (the segment of the population that was hit first), and I'd expect further declines in 2009 and probably in 2010. But I don't think the declines in births will be anything like what happened during the 1920s.

1 Hamilton BE, Martin JA, Ventura SJ. Births: Preliminary data for 2008. National vital statistics reports web release; vol 58 no 16. Hyattsville, Maryland: National Center for Health Statistics. Released April, 2010.

2 James Trussell, Professor of Economics and Public Affairs and Director of the Office of Population Research at Princeton University

Consumer Credit Declines in February

by Calculated Risk on 4/07/2010 03:08:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 5-1/2 percent in February 2010. Revolving credit decreased at an annual rate of

13 percent, and nonrevolving credit decreased at an annual rate of 1-1/2 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 4.0% over the last 12 months.

Consumer credit has declined for 12 of the last 13 months - and declined for 13 of the last 14 months and is now 5.2% below the peak in July 2008.

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Kansas City Fed's Hoenig Urges Raising Fed Funds Rate "soon"

by Calculated Risk on 4/07/2010 02:10:00 PM

From Kansas City Fed President Thomas Hoenig: What about Zero?

Under [an alternative] policy course, the FOMC would initiate sometime soon the process of raising the federal funds rate target toward 1 percent. I would view a move to 1 percent as simply a continuation of our strategy to remove measure that were originally implemented in response to the intensification of the financial crisis that erupted in the fall of 2008. In addition, a federal funds rate of 1 percent would still represent highly accommodative policy. From this point, further adjustments of the federal funds rate would depend on how economic and financial conditions develop.Hoenig has dissented at the last two FOMC meetings urging the removal of the "extended period" language from the FOMC statement. For some reason, market participants keep thinking the Fed will raise rates soon (last summer it was by the end of 2009, this year it was by summer). Based on history, it is unlikely the FOMC will raise rates this year.