by Calculated Risk on 3/26/2010 06:07:00 PM

Friday, March 26, 2010

Bank Failures #38, #39 and #40: Florida and Georgia

Banks versus Bair's big sluggers

First inning triple.

by Soylent Green is People

From the FDIC: CharterBank, West Point, Georgia, Assumes All of the Deposits of McIntosh Commercial Bank, Carrollton, Georgia

McIntosh Commercial Bank, Carrollton, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Key West Bank, Key West, Florida

As of December 31, 2009, McIntosh Commercial Bank had approximately $362.9 million in total assets and $343.3 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $123.3 million. ... McIntosh Commercial Bank is the 38th FDIC-insured institution to fail in the nation this year, and the sixth in Georgia. The last FDIC-insured institution closed in the state was Bank of Hiawassee, Hiawassee, on March 19, 2010.

Key West Bank, Key West, Florida, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Unity National Bank, Cartersville, Georgia

As of December 31, 2009, Key West Bank had approximately $88.0 million in total assets and $67.7 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.1 million. ... Key West Bank is the 39th FDIC-insured institution to fail in the nation this year, and the sixth in Florida. The last FDIC-insured institution closed in the state was Old Southern Bank, Orlando, on March 12, 2010.

Unity National Bank, Cartersville, Georgia, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....It is Friday!

As of December 31, 2009, Unity National Bank had approximately $292.2 million in total assets and $264.3 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $67.2 million. ... Unity National Bank is the 40th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia. The last FDIC-insured institution closed in the state was McIntosh Commercial Bank, Carrollton, earlier today.

More on HAMP "Improvements"

by Calculated Risk on 3/26/2010 02:49:00 PM

There are four elements to the Making Home Affordable Program Enhancements:

1. Temporary Assistance for Unemployed Homeowners While They Search for Re-EmploymentThe focus is on principal writedowns, but possibly the bigger impact will be from the fourth point - the HAFA program (short sales and deed-in-lieu).

2. Requirement to Consider Alternative Principal Write-down Approach and Increased Principal Write-down Incentives

3. Improvements to Reach More Borrowers with HAMP Modifications

4. Helping Homeowners Move to More Affordable Housing

The temporary assistance is just that - temporary. Hopefully the homeowner will find a job otherwise most borrowers will be moved on to #4.

4. Helping Homeowners Move to More Affordable HousingI think this change will impact the most borrowers (I think principal reduction will be a limited tool). Treasury is doubling the incentive for 2nd lien holders (may still not be enough), and increasing the incentive for servicers and borrowers.Increase incentives to provide more homeowners with foreclosure alternatives Increase payoffs to subordinate lien holders who agree to release borrowers from debt to facilitate greater use of foreclosure alternatives including short sales or deeds-in-lieu. The new payoff schedule allows servicers to increase the maximum payoff to subordinate lien holders to 6 percent of the outstanding loan balance and doubles from $1,000 to $2,000 the incentive reimbursement that is available to investors for subordinate lien payoffs, subject to an overall cap of $6,000. Increase servicer incentive payments from $1,000 to $1,500 to increase use of foreclosure alternatives and encourage additional outreach to homeowners unable to complete a modification. Double relocation assistance payment for borrowers successfully completing foreclosure alternative to $3,000 Help homeowners who use a short sale or deed-in-lieu to transition more quickly to housing they can afford.

This is the HAFA program that is scheduled to start in early April. This will probably only apply to around 3 million of the 8 million homeowners who are delinquent on their mortgage (initial guess). And probably only about half of those 3 million will receive a modification or use a short sale.

HAMP Principal Write-downs

by Calculated Risk on 3/26/2010 11:41:00 AM

There are a number of changes to HAMP announced today. This includes help for unemployed homeowners and more outreach. David Streitfeld at the NY Times gives an overview: U.S. Plans Big Expansion in Effort to Aid Homeowners.

Here is a fact sheet from Treasury on these changes.

The key changes are principal reductions and larger payments to 2nd liens (including for HAFA short sales). For short sales, the 2nd lien payment has been doubled from 3% of the outstanding balance to 6% - although this is probably still below the typical recovery rate for 2nd liens.

From Treasury on short sales (and deed-in-lieu):

Increase payoffs to subordinate lien holders who agree to release borrowers from debt to facilitate greater use of foreclosure alternatives including short sales or deeds-in-lieu.For 1st lien principal reduction, the incentive from the Federal Government (taxpayers) is to pay 15 cents on the dollar for reductions in the unpaid principal balance for LTVs (loan-to-values) between 115% and 140%. For LTVs above 140%, the payment is 10 cents on the dollar, and for reductions below 115%, the payment increases to 21 cents on the dollar.The new payoff schedule allows servicers to increase the maximum payoff to subordinate lien holders to 6 percent of the outstanding loan balance and doubles from $1,000 to $2,000 the incentive reimbursement that is available to investors for subordinate lien payoffs, subject to an overall cap of $6,000.

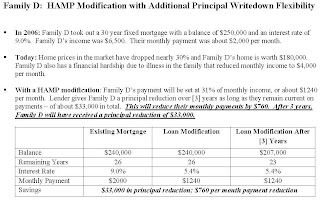

The Treasury has some examples here for the various changes.

An example of principal reduction (optional):

Click on example for larger image in new window.

Click on example for larger image in new window.So this is 133% LTV. So the taxpayers will pay 15 cents on the dollar to the lender to reduce the principal by $33,000. This is a payment of $4,950 (the lender takes a loss of $28,050). This still leave the borrower with a LTV of 115%.

Unemployment Rate Increases in 27 States in February

by Calculated Risk on 3/26/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-seven states recorded over-the-month unemployment rate increases, 7 states and the District of Columbia registered rate decreases, and 16 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in 46 states and the District of Columbia and declined in 4 states.

...

Michigan again recorded the highest unemployment rate among the states, 14.1 percent in February. The states with the next highest rates were Nevada, 13.2 percent; Rhode Island, 12.7 percent; California and South Carolina, 12.5 percent each; and Florida, 12.2 percent. North Dakota continued to register the lowest jobless rate, 4.1 percent in February, followed by Nebraska and South Dakota, 4.8 percent each. The rates in Florida and Nevada set new series highs, as did the rates in two other states: Georgia (10.5 percent) and North Carolina (11.2 percent).

emphasis added

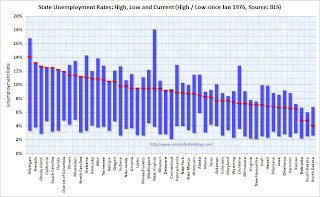

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: Florida, Nevada, Georgia and North Carolina. Three other states tied series record highs: California, Rhode Island and South Carolina.

Correction: Fed MBS Program: $6.075 Billion to go

by Calculated Risk on 3/26/2010 09:10:00 AM

For the MBS countdown I've been using the Atlanta Fed numbers and there was some rounding involved. Instead of $2 billion more to go, the Fed will buy $6.075 billion in MBS over the final week.

The program ends in a few days, and Adam Quinones at Mortgage News Daily was kind of enough to send me his spreadsheet (thanks!). Here is his story: Fed's MBS Purchase Program: One Week To Go

Since the inception of the program in January 2009, the Fed has spent $1.244 trillion in the agency MBS market, or 99.5 percent of the allocated $1.25 trillion, which is scheduled to run out next Wednesday. With one week left in the program, there is now only $6.1 billion in funding remaining.