by Calculated Risk on 3/17/2010 08:03:00 AM

Wednesday, March 17, 2010

MBA: Mortgage Applications Decrease, Mortgage Rates Fall

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.7 percent from the previous week and the seasonally adjusted Purchase Index decreased 2.3 percent from one week earlier. ...

The refinance share of mortgage activity increased to 67.3 percent of total applications from 67.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.91 percent from 5.01 percent, with points increasing to 1.30 from 0.82 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed-rate observed in the survey since mid-December of 2009, yet the effective rate was unchanged from last week due to the significant increase in points.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with mortgage rates below 5%, the 4 week average of the purchase index is still at the levels of 1997.

Geithner, Orzag, Romer: "We do not expect substantial further declines in unemployment this year"

by Calculated Risk on 3/17/2010 12:43:00 AM

From Treasury Secretary Timothy Geithner, White House budget director Peter Orszag and Christina Romer, chairman of the Council of Economic Advisers: Joint Statement. A few excerpts:

Because of normal growth in the population and the fact that some workers are likely to reenter the labor force as the economy improves, it typically takes employment growth of somewhat over 100,000 per month to bring the unemployment rate down. Because we do not expect job growth substantially over 100,000 per month over the remainder of the year, we do not expect substantial further declines in unemployment this year. Indeed, the rate may rise slightly over the next few months as some workers return to the labor force, before beginning a steady downward trend. ...

As the pace of job creation picks up in 2011 and 2012, there is likely to be greater progress in reducing unemployment. Nonetheless, because of the severe toll the recession has taken on the labor market, the unemployment rate is likely to remain elevated for an extended period. The forecast projects that in the fourth quarter of 2011, the unemployment rate will be 8.9 percent, and that by the fourth quarter of 2012, it will be 7.9 percent.

The unemployment rate at 8.9% in Q4 2011? And 7.9% in Q4 2012? Ouch ...

Tuesday, March 16, 2010

Some previous FOMC forecasts

by Calculated Risk on 3/16/2010 09:32:00 PM

This is just a reminder to take FOMC forecasts with a grain of salt.

First, the NBER determined that the great recession started in December 2007, and the FOMC met that same month - so we can see what they were thinking. The participant were aware that the incoming data was weakening, but their outlook was still for growth in 2008 and beyond ...

From the December 2007 FOMC Minutes:

In their discussion of the economic situation and outlook, participants generally noted that incoming information pointed to a somewhat weaker outlook for spending than at the time of the October meeting. The decline in housing had steepened, and consumer outlays appeared to be softening more than anticipated, perhaps indicating some spillover from the housing correction to other components of spending. These developments, together with renewed strains in financial markets, suggested that growth in late 2007 and during 2008 was likely to be somewhat more sluggish than participants had indicated in their October projections. Still, looking further ahead, participants continued to expect that, aided by an easing in the stance of monetary policy, economic growth would gradually recover as weakness in the housing sector abated and financial conditions improved, allowing the economy to expand at about its trend rate in 2009.And here are the October projections mentioned in the December minutes:

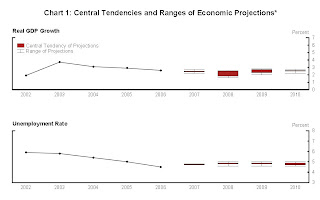

Click on graph for larger image in new window.

Click on graph for larger image in new window.In October 2007, FOMC participants were forecasting GDP in the 2% range in 2008 with a return to trend growth in 2009, and the unemployment rate rising to perhaps 5%. How did that work out?

Of course this is nothing new. Here are a few quotes from Fed Chairman Alan Greenspan back in 1990 (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990Of course I started marking my graphs with recession blue bars in January 2008 (I had luckily predicted the December start to the recession). Although my current view is for sluggish and choppy growth in 2010, there are still some downside risks - especially in the 2nd half of the year. Right now I think Q1 GDP growth will be sluggish, and the impact from the stimulus will fade over the year.

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990

Distressed Sales: Sacramento as an Example, February Update

by Calculated Risk on 3/16/2010 06:49:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area. It will be especially interesting to track this after the Home Affordable Foreclosure Alternatives (HAFA) starts on April 5th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the February data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 68% of all resales (single family homes and condos) were distressed sales in February.

Note: This data is not seasonally adjusted, and the decline in sales from the end of last year is about normal. The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

Now that many HAMP trial modifications have been cancelled, I expect REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in February were off 24.3% compared to February 2009; the ninth month in a row with declining YoY sales.

On financing, over 60 percent were either all cash (30.7%) or FHA loans (30.2%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

DataQuick: SoCal Home Sales up slightly in February

by Calculated Risk on 3/16/2010 03:58:00 PM

From DataQuick: Southern California median price and sales volume up

Note: Ignore the median price. The repeat sales indexes from Case-Shiller and LoanPerformance are better measures. The median is impacted by the mix.

Southern California home sales in February were above year-ago levels for the 20th month in a row as buyers continued to snap up bargain properties with government-backed mortgages and tax incentives. ....DataQuick doesn't list the percentage of short sales, but the total distressed sales is probably over 50%. Also the 38.5% of buyers using FHA insured loans is way above normal levels.

A total of 15,359 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was virtually unchanged from 15,361 in January, and up 0.8 percent from 15,231 in February 2009, according to MDA DataQuick of San Diego.

[CR Note: this is the second month in a row the YoY increase was razor thin.]

The February sales average is 17,983 going back to 1988, when DataQuick’s statistics begin. The sales distribution remains tilted toward lower-cost distressed homes, although not as steeply as most of last year.

...

Foreclosure resales accounted for 42.3 percent of the resale market last month, up from 42.1 percent in January, and down from 56.7 percent a year ago, which was the all-time high.

Government-insured FHA loans, a popular choice among first-time buyers, accounted for 38.5 percent of all home purchase loans in February.

Absentee buyers – mostly investors and some second-home purchasers – bought 18.9 percent of the homes sold in February. Buyers who appeared to have paid all cash – meaning there was no indication that a corresponding purchase loan was recorded – accounted for 29.3 percent of February sales. In January it was a revised 29.7 percent – an all-time high. The 22-year monthly average for Southland homes purchased with cash is 13.8 percent.

When the first time homebuyer tax credit ends, I expect the percent of FHA insured loans to decline sharply - and probably for total sales to decline. The tax credit associated buying will end in April, but the sales are counted when escrow closes - and that could be in May or June.