by Calculated Risk on 3/15/2010 11:20:00 PM

Monday, March 15, 2010

2010: REOs or Short Sales?

Paul Jackson has a great post at HousingWire: Housing Recovery is Spelled R-E-O

[U]sing LPS data, for all loans more than 90 days in arrears, the average days delinquent is now at 272 days—up from 204 days in early 2008. For loans in foreclosure, the aging numbers are even more staggering: loans in this bucket average 410 days delinquent, up from 260 days delinquent in early 2008.Ahhh ... the "Squatter Stimulus Plan" - live mortgage free (but not worry free).

Ponder those numbers for just a second. On average, severely delinquent borrowers have gone more than 9 months without making a mortgage payment—and yet foreclosure has not yet started for them. For those borrowers who are in the foreclosure process, it’s been an average of 13.6 months—more than one full year—since they last made any payment on their mortgage.

But Paul thinks foreclosures (REOs) will be the answer, not short sales:

For some, short sales will be an important solution—but don’t kid yourself: the hype currently surrounding short sales and the HAFA program will prove to be short-lived ...He gives two main reasons for foreclosures over short sales: 1) 2nd liens, and 2) that HAFA has the same qualifications as HAMP. I agree that 2nd liens pose a serious problem, but on the qualifications, Paul writes:

The HAFA program, going into effect on April 5, is getting plenty of attention—and the program’s heart is in the right place. But most are forgetting that it’s an extension of HAMP, the government’s loan modification program that has seen tepid success at best thus far. A loan must first be HAMP-eligible in order for anyone (borrower, servicer, or investor) to qualify for the program’s various incentive payments for short sale or deed-in-lieu.But lets review the qualifications for HAFA:

Which means any of the guidelines applicable to the HAMP program—loan in default or default imminent, within UPB [CR: unpaid principal balance] guidelines, owner-occupied, and originated prior to 2009—still apply.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) for permanent mods was 45%, and the back end DTI was an astounding 76.4%! And these are the borrowers who made it to permanent status!The property is the borrower’s principal residence; The mortgage loan is a first lien mortgage originated on or before January 1, 2009; The mortgage is delinquent or default is reasonably foreseeable; The current unpaid principal balance is equal to or less than $729,7501; and The borrower’s total monthly mortgage payment (as defined in Supplemental Directive

09-01) exceeds 31 percent of the borrower’s gross income.

Many borrowers who meet the HAMP qualifications never even get a trial program because their DTI ratios are so high there is just no way they will make it to a permanent mod. The servicers turn them down on the spot. These are the borrowers eligible for the HAFA program right away - and looking at the HAMP DTI stats I suspect this is a much larger group of borrowers than will ever get a permanent mod. So, although I think REOs will play a key role, I think short sales will also be very important.

More on Short Sales at HousingWire:

As 2010 gears up to be the ‘Year of the Short Sale,’ Lenders Processing Service (LPS), the integrated technology provider, is jumping on opportunities such a situation offers by launching its own short sale service to clients.

In a report that may be considered numerical ammunition to the argument that short sales are heating up faster than modifications, Equator announced that it ushered along more than 125,000 short sale transactions, from November to February, since launching an automated short sale platform.Note: Yes, I predicted that 2010 would be the year of the short sale, although I think economist Tom Lawler was first.

Financial Regulatory Reform Update

by Calculated Risk on 3/15/2010 08:15:00 PM

For those interested, here is the text of the proposed bill.

It is only 1,336 pages long ...

Some overviews:

From Sewell Chan at the NY Times:

Mr. Dodd said he believed there was substantial bipartisan agreement on 9 of the bill’s 11 provisions, the exceptions being consumer protection and corporate governance.From the WSJ: Finance Overhaul Sets Up Winners, Losers

...

The major flashpoints will include, among other things, the scope of authority for a new Consumer Financial Protection bureau to be established within the Fed; the scope of exemptions under new rules governing the trade of derivatives; and the mechanism by which the government could seize and dismantle a large company on the verge of failure.

The bill includes a provision intended to curb Wall Street’s influence over the Federal Reserve Bank of New York. Its president would be appointed by the president of the United States, not by a board that includes representatives of member banks.

Among the winners, community banks and small credit unions would be financially able to compete, for perhaps the first time, against large competitors reined in by new restrictions on capital, complexity and size. The Federal Reserve and the Federal Deposit Insurance Corp. would see their powers redefined, and in many ways expanded.From Elizabeth Warren, via Firedoglake:

On the other side of the ledger, large financial companies overseen by the Fed would have to pay into a $50 billion fund to pay for the collapse of failed financial firms.

“Since bringing our economy to the brink of collapse, Wall Street has spent more than a year and hundreds of millions of dollars in an all-out effort to block financial reform. Despite the banks’ ferocious lobbying for business as usual, Chairman Dodd took an important step today by advancing new laws to prevent the next crisis. We’re now heading toward a series of votes in which the choice will be clear: families or banks.”

Afternoon Reading: Taxes on Short Sales, More Delinquencies, TARP Fraud

by Calculated Risk on 3/15/2010 05:02:00 PM

California legislators last week passed a bill that ... mirrors a federal law that excludes "forgiven debt" on a principal residence from being considered taxable income. It covers short sales, foreclosures, deeds in lieu of foreclosure and loan modifications that reduce the principal due.It is important to remember the Federal exemption only applies to "money used to purchase, build or fix up a home". That exemption makes sense - and California will probably fix the current tax law.

However, Gov. Arnold Schwarzenegger, who has until March 23 to sign the bill, indicated that he is likely to veto it based on an unrelated provision regarding tax fraud.

...

When the foreclosure crisis started, Congress passed the Mortgage Forgiveness Debt Relief Act of 2007 so foreclosed homeowners would not be liable for their canceled debt. It is in force through 2012. California had a similar law, but it expired at the end of 2008, leaving Californians who lost their homes in 2009 potentially liable for big state tax bills.

...

Tax experts advise people who lost their homes in 2009 to file for an extension in hopes that California will rectify matters.

However the exemption doesn't apply to those who used the Home ATM for toys or trips ... that debt forgiveness is taxable by both the federal government and the state.

Lender Processing Services put out its Mortgage Monitor report today, and the numbers are really staggering.

Loans delinquent/in foreclosure process: 7.5 million

REO/Post-sale foreclosure: 1 million

Loans that were current 1/1/09 and 60+ days delinquent 1/1/10: 2.5 million

That last one is interesting, because it shows how much faster loans are going bad than are being modified.

...

Tomorrow on CNBC we're going to devote a full day to the current state of the housing market, from what has failed to what is promising on the horizon.

The former president of New York's privately held Park Avenue Bank was arrested and charged on Monday ... A 10-count criminal complaint accused Charles Antonucci of devising "an elaborate round-trip loan transaction" that he told others was his own $6.5 million investment in the bank, misleading state bank regulators and the U.S. Federal Deposit Insurance Corporation (FDIC).

...

"Antonucci is the first person ever to be charged with attempting to defraud the TARP and we expect he will not be the last," Manhattan U.S. Attorney Preet Bharara said at a news conference.

Home Builders $2.3 Billion "Gift" from Taxpayers

by Calculated Risk on 3/15/2010 03:16:00 PM

Last year, included in the "Worker, Homeownership and Business Assistance Act of 2009" that extended the popular unemployment benefits were two unpopular and ineffective tax credits: the home buyer tax credit, and a net operating loss carryback extension to allow businesses to write off current losses against profits up to 5 years ago - the profitable years for home builders.

Zach Fox at SNL Financial has an update on the carryback: Builders record $2.30B in tax benefits

In all, homebuilders recorded $2.30 billion in income tax benefits during their most recent quarters, according to SNL Financial. ... The tax benefit was so large that it might have been the only reason two builders did not go under, Vicki Bryan, a senior high-yield analyst at Gimme Credit, told SNL.Zach has much more on the home builders, and here are some comments from Chris Thornberg on the effectiveness of the tax credit:

"This is so important that it might have saved the weakest ones, Hovnanian [Enterprises Inc.], Beazer [Homes USA Inc.] They looked like they were headed to bankruptcy," she said.

excerpts with permission

[Christopher Thornberg] said the net operating loss carryback extension and expansion will do nothing to mend the housing market.As Thornberg notes, the only reason for a tax provision like this is to spur construction - something we don't need right now. It would be better if there was less capacity in the home building sector.

"Of course not. They're not building any homes; there's still too many of them kicking around," Christopher Thornberg, a principal at Beacon Economics in Los Angeles, told SNL. "Permits, starts are still flat; they're still at a bottom. It's a bailout. It's a bailout for builders. It's a bailout for Robert Toll. They're bailing out Robert Toll. Repeat after me, they are bailing out Robert Toll. What's wrong with this picture?"

When asked whether there were any positives to come out of the net operating loss carryback extension and expansion, Thornberg said, "No, no, no, no, no, no, no. No. Nothing. There's nothing to build; there's an oversupply. If anything, they're making it worse because they're encouraging construction when we need to burn off our existing supply first."

One thing is certain, the Return on Lobbying (ROL) for the home builders was awesome, as Gretchen Morgenson noted in the NY Times last year: Home Builders (You Heard That Right) Get a Gift

The Center for Responsive Politics reports that through Oct. 26 of this year, home builders paid $6 million to their lobbyists. ... Much of this year’s lobbying expenditures were focused on arguing for the tax loss carry-forward, documents show.

Among individual companies, Lennar spent $240,000 lobbying while companies affiliated with Hovnanian Enterprises spent $222,000. Pulte Homes spent $210,000 this year.

That’s some return on investment. After spending its $210,000, Pulte will receive $450 million in refunds. And Hovnanian, after spending its $222,000, will get as much as $275 million.

NAHB Builder Confidence declines in March

by Calculated Risk on 3/15/2010 01:00:00 PM

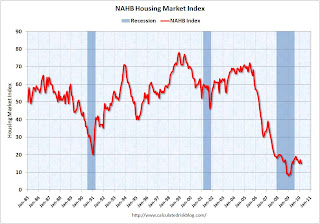

Note: any number under 50 indicates that more builders view sales conditions as poor than good. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in March. This is a decrease from 17 in February.

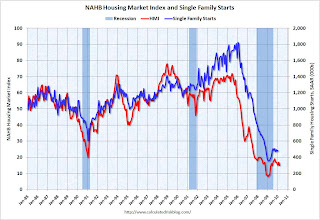

The record low was 8 set in January 2009. This is very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May 2009. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February starts will be released tomorrow, Tuesday March 16th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February starts will be released tomorrow, Tuesday March 16th).

This shows that the HMI and single family starts mostly move generally in the same direction - although there is plenty of noise month-to-month.

And right now they are moving sideways - at best.

I was looking back through some old posts - and it seems like yesterday - but it was last summer that I wrote about how starts would probably move sideways for some time because of the large overhang of existing housing units (both owner occupied homes and rental units). I added some emphasis later in the year:

"To be blunt: Those expecting a sharp rebound in starts from the bottom are wrong. And remember - residential investment is usually the best leading indicator for the economy."That still seems correct today.

Press release from the NAHB: (added) Foreclosures Weigh on Builder Confidence in March

Builder confidence in the market for newly built, single-family homes fell back two points to 15 in March as poor weather conditions and distressed property sales posed increasing challenges to both builders and buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.Not much snow in March ...

“Unusually poor weather conditions certainly had a negative effect on builders’ business in February,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich. “At the same time, the continual flow of distressed properties priced below the cost of production is having an adverse effect on new-home appraisals and also making it tough for builders’ customers to sell their existing homes.”