by Calculated Risk on 3/14/2010 09:45:00 AM

Sunday, March 14, 2010

Senator Dodd's Financial Overhaul Bill to be introduced Monday

From Sewell Chan at the NY Times: Dodd to Unveil a Broad Financial Overhaul Bill

Here are the key points:

The derivative regulation is a positive step forward. I'm not sure about the systemic risk council, but this could be helpful. The consumer financial protection agency as part of the Fed is really no change.

Chinese Premier: Currency not undervalued, warns of "Double Dip" Recession

by Calculated Risk on 3/14/2010 01:15:00 AM

From Bloomberg: China’s Wen Rebuffs Yuan Calls, Is ‘Still Worried’ About Dollar

"I don’t think the yuan is undervalued,” Wen said at a press conference in Beijing marking the end of China’s annual parliamentary meetings. Dollar volatility is a “big” concern and “I’m still worried” about China’s U.S. currency holdings, he said.And from the WSJ: Chinese Premier Warns of 'Double Dip' Recession

Saturday, March 13, 2010

Saturday Night Greece

by Calculated Risk on 3/13/2010 10:13:00 PM

It has been a month since Jean-Claude Juncker, Luxembourg's prime minister and chairman of the 16 euro-zone finance ministers, said that Greece had until March 16th to show progress on their budget. The euro-zone finance ministers meet this week, and apparently Greece has meet the short term goals.

From Reuters: Euro finance ministers to agree on Greek aid: source

Euro zone finance ministers are likely to agree on Monday on a mechanism for aiding Greece financially, if it is required, but will leave out any sums until Athens asks for them, an EU source said on Saturday. ...And from the WSJ: No Need for Greek Bailout Now, France's Lagarde Says

"I think we should be able to agree on principles of a euro area facility for coordinated assistance. The European Commission and the Eurogroup task force would have the mandate to finalize the work," [a] source said. ... "You would have a framework mechanism and you would have blank spaces for the numbers because there has been no request (from Greece) yet."

Credible efforts by Greece's government to clean up its finances have so far negated the need for any bailout from the European Union, French Finance Minister Christine Lagarde said Friday.

Unofficial Problem Bank List at 640

by Calculated Risk on 3/13/2010 06:00:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

There were several additions and removals during the week that left the Unofficial Problem Bank List totals almost unchanged. This week there are 640 institutions with assets of $325.6 billion compared to 641 institutions and $325.5 billion of assets last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Removals include the four failures -- The Park Avenue Bank ($520 million), Old Southern Bank ($336 million), Statewide Bank ($243 million), and LibertyPointe Bank ($217 million), and one action termination -- Union Federal Savings Bank ($192 million).

Additions include Heritage Oaks Bank, Paso Robles, CA ($942 million); Idaho Banking Company, Boise, ID ($228 million); Albina Community Bank, Portland, OR ($199 million); and Ravalli County Bank, Hamilton, MT ($191 million).

Other changes include for institutions already on the list are Prompt Corrective Action Orders issued against Maritime Savings Bank ($379 million), Horizon Bank ($199 million), and Ideal Federal Savings Bank ($6 million). We anticipate for the OCC to issue their enforcement actions for February 2010 next week.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Nearing Retirement and Unemployed or Underemployed

by Calculated Risk on 3/13/2010 02:05:00 PM

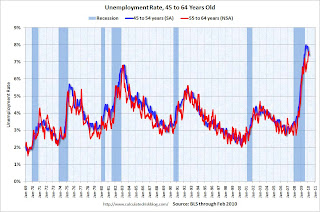

One of the groups seriously impacted by the great recession is the "pre retirement" generation - currently the "Baby Boomers" - the workers between the ages of 45 and 64. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rates for two groups: 45 to 54 (seasonally adjusted), and 55 to 64 (only NSA data is available).

The unemployment rate for these age groups hit an all time high during the great recession (highest since WWII).

Michael Winerip at the NY Times has a story about the plight of several "Boomers" who he has tracked for the last year: Time, It Turns Out, Isn’t on Their Side (ht Ann)

A YEAR ago, I wrote about a job fair at the Sheraton in Midtown Manhattan, where over 5,000 mainly white collar, middle-aged jobless men and women waited in the cold for more than two hours, hoping to find work. ...Kind of hard to sing "Yeah, time time time is on my side ..." when you are 60 and unemployed or underemployed.

For that column, I interviewed two dozen boomers. Given recent reports from the federal government and Manpower, the employment agency, that the hiring outlook is beginning to improve, I thought it would be worthwhile to go back to those highly motivated people. ...

The short answer is, of the 16 I interviewed again, 9 describe themselves as still struggling. Eight continue to be unemployed or are working part-time jobs that pay near minimum wage. Several were so concerned about bias, they did not want to give their ages. ...

Of the 16, only one, Mr. Kramer, who was unemployed eight months before being hired in July as a closing manager at a Best Yet supermarket, has found a job that pays more than his old position. More typical of the seven who’ve found full-time work is Ben Brief, 60, a printing supervisor, who’d been jobless two months when I interviewed him on Sixth Avenue in the 20-degree weather. Mr. Brief was out of work nine more months, before finding a printing job that paid 20 percent less than his previous position. “I’m glad to be working, but people know they can pay you a lot less in this economy,” he said.