by Calculated Risk on 3/12/2010 04:16:00 PM

Friday, March 12, 2010

The Toxic Asset that Planet Money Bought

Earlier I linked to this podcast from Planet Money: We Bought A Toxic Asset! And the story is here: We Bought A Toxic Asset; You Can Watch It Die.

And here is a PDF with the details of the bond (ht daddyo, based on details in story). There are many details in the PDF - a brief excerpt:

At a 1-10 ½ price (bond notation, 1 plus 10.5/32), which is what they apparently paid, and at current 1-month prepayment speeds and severities, this bond will be gone in September. Total cashflows of $957, for an annualized yield of -41%.And here is a tracking graphic from Planet Money.

...

The bond is very sensitive to your assumptions (not all bonds are like this). At 3m, 6m, and 12m historical speeds, the bond has positive yield. So the question is, do you think things are getting better, or worse? Remember, this is an Option ARM pool with recasts ramping in the summer. When will the default wave occur on the troubled borrowers? If you think it doesn’t happen until after the summer, you’ll be a-ok in this bond.

Also, remember in article, prices on this stuff are all over the place. If it was bought at a 1.8 price, it’s a loss in any scenario, and if it’s bought at a sub-dollar price, it’s a win.

HAMP: About One-Third of eligible Trial Mods approved for Permanent

by Calculated Risk on 3/12/2010 02:07:00 PM

From Treasury: Administration Releases February Loan Modification Report

Click on graph for larger image  in new window.

in new window.

Over 168,000 modifications are now permanent. 88,663 trial modificatons have been cancelled (and another 1,499 permanent mods cancelled).

Here is the report. See here for a list of reports.

Lets see: there were 553,051 cumulative HAMP trial modifications in September. There are 168,708 permanent mods - and about 90,000 cancelled. What happened to the 300 thousand or so other trial mods? Sure another 91,800 have been "approved" for a permanent modification, but that still leaves a huge number missing.

There is a note in the report that says "32% of trials started at least three month ago have been approved for converstion to permanent". But what about the over two-thirds?  The second graph shows the cumulative HAMP trial programs started.

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in Septmenber to just over 70,000 in February 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

NPR Planet Money: "We bought a toxic asset!"

by Calculated Risk on 3/12/2010 11:30:00 AM

From Planet Money: Podcast: We Bought A Toxic Asset!

And the story is here: We Bought A Toxic Asset; You Can Watch It Die. An excerpt:

Finally, we find a beautiful, totally toxic asset at what [Wit Solberg, a former Wall Street trader] thinks is a good price: $36,000. Back in the bubble, somebody paid $2.7 million for this thing. We buy a piece from Solberg for $1,000. It's going to be our encyclopedia of the financial crisis.Listen to the podcast - it is pretty funny!

What Our Toxic Asset Looks Like

Our toxic asset has 2,000 mortgages, many of them in hard-hit states like California, Arizona and Florida. A lot of the people in our bond are really struggling. Almost half are behind on their mortgage payments, and 15 percent of the homes are already in foreclosure.

At some point those homes will be taken over and sold for a loss. Every time that happens, the bond shrinks. Eventually, our part of the bond will disappear entirely.

Until then, we get a little money every month from people paying off their mortgages. We just got a check for $141. If it goes to Thanksgiving, we could double our money.

By the way, we bought the asset with our own money. Any proceeds will go to charity. If we lose money, we take the loss.

Manufacturing and Trade Inventory-to-Sales Ratio: Inventory Adjustment Over

by Calculated Risk on 3/12/2010 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed that the inventory-to-sales ratio was mostly back to normal in January.

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,310.2 billion, virtually unchanged (±0.1%)* from December 2009 and down 8.6 percent (±0.3%) from January 2009.

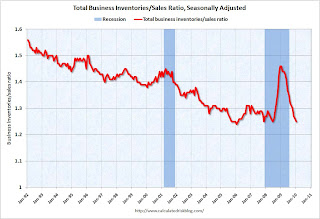

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of January was 1.25. The January 2009 ratio was 1.46.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in the 2007 recession, but it now appears the inventory adjustment is over. Growth in inventories will depend on increases in underlying demand.

The second graph shows the inventory to sales ratio. This has declined sharply to 1.25 (SA) from the peak of 1.46 back in Dec 2008. This could decline further - the trend is definitely down over time - but clearly most of the inventory adjustment is over.

The second graph shows the inventory to sales ratio. This has declined sharply to 1.25 (SA) from the peak of 1.46 back in Dec 2008. This could decline further - the trend is definitely down over time - but clearly most of the inventory adjustment is over.This is important because the change in inventory added significantly to Q4 GDP growth. (See BEA line 13: the contribution to GDP in Q4 from 'Change in private inventories' was 3.88 of the 5.9 percent annualized increase in GDP.)

Any boost to Q1 GDP from inventory changes will be minor in comparison to Q4.

Retail Sales increase in February

by Calculated Risk on 3/12/2010 08:30:00 AM

On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted, after revisions), and sales were up 4.5% from February 2009 (easy comparison).

UPDATE: January was revised down sharply. Jan was originally reported at $355.8 billion, an increase of 0.5% from December.

February was reported at $355.5 billion - a decline without the revision to January.

January has been revised down to $354.3 or an increase of 0.1% from December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

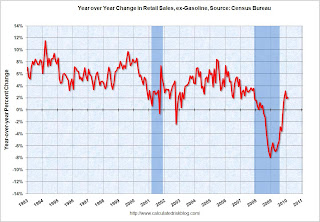

Retail sales are up 6.0% from the bottom, but still off 6.4% from the peak. Retail ex-gasoline are up 3.6% from the bottom and still off 5.4% from the peak. The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 2.1% on a YoY basis (4.5% for all retail sales). The year-over-year comparisons are easy now since retail sales collapsed in late 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $355.5 billion, an increase of 0.3 percent (±0.5%)* from the previous month and 3.9 percent (±0.5%) above February 2009.

...

Gasoline stations sales were up 24.0 percent (±1.5%) from February 2009 and nonstore retailers sales were up 11.8 percent (±1.7%) from last year.