by Calculated Risk on 3/11/2010 04:26:00 AM

Thursday, March 11, 2010

RealtyTrac: Foreclosure Activity Decreases Slightly

From RealtyTrac: U.S. Foreclosure Activity Decrease 2 Percent in February

[F]oreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 308,524 U.S. properties during the month, a decrease of 2 percent from the previous month but still 6 percent above the level reported in February 2009.Blame it on the snow!

...

Default notices (Notices of Default and Lis Pendens) were reported on a total of 106,208 U.S. properties during the month, an increase of 3 percent from the previous month but down 3 percent from February 2009. ...

Foreclosure auctions (Notices of Trustee’s Sale and Notices of Sheriff’s Sales) were scheduled for the first time on a total of 123,633 U.S. properties, a decrease of 1 percent from the previous month but still 16 percent higher than the level reported in February 2009. ...

Bank repossessions (REOs) were reported on a total of 78,683 U.S. properties during the month, a 10 percent decrease from the previous month but an increase of 6 percent from February 2009. ...

“This leveling of the foreclosure trend is not necessarily evidence that fewer homeowners are in distress and at risk for foreclosure, but rather that foreclosure prevention programs, legislation and other processing delays are in effect capping monthly foreclosure activity — albeit at a historically high level that will likely continue for an extended period." [said James J. Saccacio, chief executive officer of RealtyTrac.]

“In addition, severe winter weather appears to have temporarily slowed the processing of foreclosure records in some Northeastern and Mid-Atlantic states.”

Wednesday, March 10, 2010

Congressional Oversight Panel criticizes handling of GMAC

by Calculated Risk on 3/10/2010 11:59:00 PM

The Congressional Oversight Panel (COP) released a new report: The Unique Treatment of GMAC Under the TARP

[T]he Panel remains unconvinced that bankruptcy was not a viable option in 2008. In connection with the Chrysler and GM bankruptcies, Treasury might have been able to orchestrate a strategic bankruptcy for GMAC. This bankruptcy could have preserved GMAC’s automotive lending functions while winding down its other, less significant operations, dealing with the ongoing liabilities of the mortgage lending operations, and putting the company on sounder economic footing.And a few recommendations from COP:

...

The federal government has so far spent $17.2 billion to bail out GMAC and now owns 56.3 percent of the company. Both GMAC and Treasury insist that the company is solvent and will not require any additional bailout funds, but taxpayers already bear significant exposure to the company, and the Office of Management and Budget (OMB) currently estimates that $6.3 billion or more may never be repaid.

In light of the scale of these potential losses, the Panel is deeply concerned that Treasury has not required GMAC to lay out a clear path to viability or a strategy for fully repaying taxpayers. Moving forward, Treasury should clearly articulate its exit strategy from GMAC. More than a year has elapsed since the government first bailed out GMAC, and it is long past time for taxpayers to have a clear view of the road ahead.

• Treasury should insist that GMAC produce a viable business plan showing a path toward profitability and a resolution of the problems caused by ResCap.This fits with the earlier discussions on the stress tests since GMAC was on the "Stress Test 19". It probably would have cost the taxpayers far less to have GMAC file bankruptcy than the current situation.

• Treasury should formulate, and clearly articulate, a near-term exit strategy with respect to GMAC and articulate how that exit will or should be coordinated with exit from Treasury’s holdings in GM and Chrysler.

• To preserve market discipline and protect taxpayer interests, Treasury should go to greater lengths to explain its approach to the treatment of legacy shareholders, in conjunction with both initial and ongoing government assistance.

"A viable business plan" and an "exit strategy"; Elizabeth Warren is so demanding!

The Next Stress Test Scenarios

by Calculated Risk on 3/10/2010 09:51:00 PM

It is probably time for the U.S. to consider the next set of stress tests for the banks. That is what the Financial Services Authority (FSA) is doing in the U.K.

From the FSA:

We have now embedded our new approach to stress testing into our normal supervisory process. This includes supplementing firms’ own stress testing with supervisory stress testing of major firms. This involves regularly updating the stress test scenarios.So stress tests are now part of the normal oversight process. I think the Treasury should do the same thing, and release two scenarios again: 1) a baseline case matching the consensus view (or the Fed's current forecast), and 2) a more severe case with a double dip recession and further house price declines.

More from the FSA:

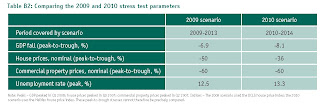

In 2009, the macroeconomic scenario used as an input for this supervisory stress testing took the economic position of the beginning of 2009 as its starting point, and projected forward for five years (until the end of 2013). Given the changes in economic performance and prospects since early 2009, it is now appropriate to define a new scenario for 2010 to 2014. We will continue to keep the appropriateness of the macroeconomic scenario under review.Notice that the FSA stress test scenarios are for five years; the Treasury and Fed stress tests scenarios were for only 2 years. I think many of the problems (like extending CRE loans) were pushed beyond the stress test horizon, and make the banks look healthier than they really are.

More FSA:

This new scenario takes the developments of 2009 as given and applies a severe but plausible stress to the macroeconomic environment that prevails at the start of 2010.

Click on table for larger image.

Click on table for larger image.And here is a table comparing the 2009 stress test scenario and the 2010 scenarios.

From the FSA:

[O]ur new macroeconomic stress scenario models a further decline in GDP of 2.3% from the end of 2009 to the end of 2011, with gradual recovery thereafter. Alongside this fall in GDP, the scenario includes a rise in unemployment to a peak of 13.3% in 2012, and allows for a ‘doubledip’ in property prices, with house prices falling by 23% from current levels and commercial property by more than 34%.And the FSA on the U.S.

Given the UK banks’ overseas exposures, our scenario also includes stressed projections for the US and other economies, which similarly experience further declines in GDP and property prices from current levels.A double dip for the U.S. is included.

Bubbling over in China?

by Calculated Risk on 3/10/2010 07:15:00 PM

From CR: There are so many reports of a housing bubble in China, I asked a friend living in China for his thoughts ... this is his view:

From Michael Kleist in Shanghai:

News of soaring housing prices in China, which are now hovering around late 2007 peaks, naturally invites talk of bubbles and excessive speculation. More so, since the 2007 highs led to a humbling drop in prices for homeowners and investors in 2008. Are things heading that way again in 2010?

Not necessarily.

Let’s start with the news in the papers. See the WSJ today: China Property Prices Surge

It’s clear the housing market in China has been hot, topped by February’s 10.7% YoY increase in prices. In fact, housing prices have been rising for 9 straight months YoY in China, which coincides to some degree with the government’s massive stimulus package that took effect first quarter 2009.

Certainly there is some speculation inside these numbers, as there would be in any hot property market. The government has shown enough concern on this point, and overheating in general, to tell banks last month to curtail lending and increase reserve rations.

But the bigger reason for rising home prices in China may simply be due to an imbalance in supply and demand.

In 2008 the housing market tanked, in large part, because the China government, which was worried about overheating in the property sector, slammed on the brakes in 2007. The government added a hefty tax on homes sold within 5 years of purchase, increased fees, told banks to raise interest rates on home loans and increase minimum down payments, and essentially forced banks to stop lending to developers.

The result was a dried up market, a drastic drop in prices, and an almost complete halt in new home starts.

When in early 2009, in response to the economic crisis, the China government launched its stimulus package it also stoked the property market by once again loosening lending regulations and lowering taxes and fees for both developers and home buyers. Builders began building and people began buying homes again. As a result, prices naturally began to go up.

What we are seeing today is that with fewer homes on the market after a nearly 2 year lull in building, the prices have continued to climb.

This imbalance will likely even out as the homes started in 2009 become available for sale. Most likely, this will result in a stabilization of prices but not a bursting bubble because it’s not even clear there is a housing bubble in China.

Certainly there isn’t a mortgage credit-related bubble. The majority of homes in China are purchased with down payments between 30-40%, which is required by the banks, and nearly 25% of homes are purchased with all cash. Only those qualifying for low-cost housing can purchase a home with a minimum down payment as low as 20%. For this reason foreclosures in China are practically nonexistent.

In addition, the majority of home buyers in China are still either first-time buyers or upgrading their home. Only an estimated around 20% of home buyers in China are pure investors. As with any statistics coming out of China, this figure can be questioned, but regardless, if investors are speculating, they are doing it with large cash down payments.

Still, it is clear that prices in tier 1 cities such as Beijing, Shanghai, and Shenzhen in the south have risen to amazing levels for China. Flats in downtown Shanghai can sell for RMB150,000 (US$ 22,000) per square meter with exclusive homes in prime locations commanding even higher prices. To get a new home for under RMB18,000 (US$2,640) per square meter certainly requires a trip to the suburbs and only a hope of being near a subway line.

With prices at these highs, it is fair to wonder at what point the situation in China can be called a bubble and what risk there is of it bursting.

With regard to the bursting side of this question, two things to keep in mind are the tremendous amount of influence the China government has to manipulate the housing market (both up and down) and its strong desire to keep prices stable or rising comfortably without squashing the market like it did at the end of 2007.

The central government in China has multiple tools at its disposal to directly impact the market. This begins with its control over all of the country’s commercial banks. When the Party tells banks to increase or adjust lending there is an immediate response. That’s one reason why the country was able to recover so quickly from the world credit crunch. The government uses this blunt tool when it feels there is a need for a country-wide impact on lending.

More subtly, it can direct banks to adjust mortgage rates or down payment percentages in specific locations that seem to be heating or cooling, it its mind, at an unreasonably pace.

One of the government’s most effective tools against speculation is to raise the down payment ratio and interest rate for buyers with an existing mortgage trying to purchase a second home. Currently, in Shanghai any buyer of a home with an existing mortgage is required to have a minimum down payment of 40% and must pay a higher interest rate on the loan than a first time buyer or buyer without an existing loan. This is a very effective approach that targets speculators without affecting the rest of the market and can be applied locally. In some locations, banks are forbidden to approve any second home loan until the first loan is paid off.

The point here is that as long as China’s government acts by tapping the brakes when and where necessary, a precipitous drop in home prices is unlikely. This assumes the government has learned from its mistakes in late 2007 when it adjusted too hard.

Given the sentiment and concern out of Beijing about keeping a balanced economy as the world recovers, I think the likelihood of any strong movements to dampen the housing market across China are low. More likely, through 2010 it will continue to use the banks and rules on second mortgages to cool specific locations while letting the overall market grow.

Note: Michael lives in Shanghai and has been in China for 8 years. He is a founder of www.tradesparq.com, a trade advertising platform that combines products and categories with social networking web tools to match international buyers and sellers. Michael hopes to address how local Chinese can afford homes in China in a future post.

From CR: This was Michael's view. It is certainly different than what we read in the U.S. I'm looking forward to his next post - US$ 22,000 per square meter (about $2,000 per foot) sounds very expensive to me - but the large downpayments should cushion in spillover if prices do decline.

Greenspan to Testify before Financial Crisis Inquiry Commission

by Calculated Risk on 3/10/2010 04:03:00 PM

From the WSJ: Financial Crisis Panel to Grill Greenspan

Greenspan is scheduled to testify before the Financial Crisis Inquiry Commission in early April. This might be the one real opportunity to understand why regulators missed the lending problems.

Hopefully the Commission will ask about regulatory oversight (and lack thereof). We already know from various Inspector General reports that Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004. What action did Greenspan take at that time with those reports? Put them in a drawer?

Why wasn't action taken earlier to tighten lending standards? Was Greenspan concerned about the "widespread" innovation in the mortgage industry (automated underwriting, reliance on FICO scores instead of the 3 Cs - creditworthiness, capacity, and collateral, agency issues with the widespread use of independent mortgage brokers, expanded securitization, non-traditional mortgage products, etc.)? When lending booms, methods change, and standards weaken - isn't that when the regulators need to be the most vigilant?

Unfortunately the WSJ article discusses "subprime" and Fannie and Freddie - and misses all the key issues.