by Calculated Risk on 3/10/2010 09:51:00 PM

Wednesday, March 10, 2010

The Next Stress Test Scenarios

It is probably time for the U.S. to consider the next set of stress tests for the banks. That is what the Financial Services Authority (FSA) is doing in the U.K.

From the FSA:

We have now embedded our new approach to stress testing into our normal supervisory process. This includes supplementing firms’ own stress testing with supervisory stress testing of major firms. This involves regularly updating the stress test scenarios.So stress tests are now part of the normal oversight process. I think the Treasury should do the same thing, and release two scenarios again: 1) a baseline case matching the consensus view (or the Fed's current forecast), and 2) a more severe case with a double dip recession and further house price declines.

More from the FSA:

In 2009, the macroeconomic scenario used as an input for this supervisory stress testing took the economic position of the beginning of 2009 as its starting point, and projected forward for five years (until the end of 2013). Given the changes in economic performance and prospects since early 2009, it is now appropriate to define a new scenario for 2010 to 2014. We will continue to keep the appropriateness of the macroeconomic scenario under review.Notice that the FSA stress test scenarios are for five years; the Treasury and Fed stress tests scenarios were for only 2 years. I think many of the problems (like extending CRE loans) were pushed beyond the stress test horizon, and make the banks look healthier than they really are.

More FSA:

This new scenario takes the developments of 2009 as given and applies a severe but plausible stress to the macroeconomic environment that prevails at the start of 2010.

Click on table for larger image.

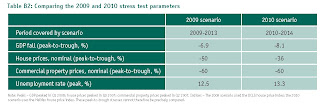

Click on table for larger image.And here is a table comparing the 2009 stress test scenario and the 2010 scenarios.

From the FSA:

[O]ur new macroeconomic stress scenario models a further decline in GDP of 2.3% from the end of 2009 to the end of 2011, with gradual recovery thereafter. Alongside this fall in GDP, the scenario includes a rise in unemployment to a peak of 13.3% in 2012, and allows for a ‘doubledip’ in property prices, with house prices falling by 23% from current levels and commercial property by more than 34%.And the FSA on the U.S.

Given the UK banks’ overseas exposures, our scenario also includes stressed projections for the US and other economies, which similarly experience further declines in GDP and property prices from current levels.A double dip for the U.S. is included.