by Calculated Risk on 2/24/2010 08:12:00 AM

Wednesday, February 24, 2010

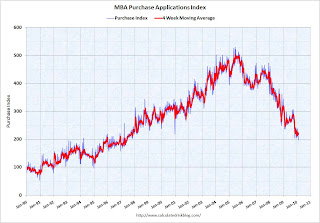

MBA: Mortgage Purchase Applications at Lowest Level Since May 1997

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index ... decreased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

“As many East Coast markets were digging out from the blizzard last week, purchase applications fell, another indication that housing demand remains relatively weak,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “With home prices continuing to drift amid an abundant inventory of homes on the market, potential homebuyers do not see any urgency to lock in purchases.”

The Refinance Index decreased 8.9 percent from the previous week. The seasonally adjusted Purchase Index decreased 7.3 percent from one week earlier, putting the index at its lowest level since May 1997. ...

The refinance share of mortgage activity decreased to 68.1 percent of total applications from 69.3 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.03 percent from 4.94 percent, with points increasing to 1.34 from 1.09 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Once again, the decline in purchase applications since October appears significant.

Also, with mortgage rates back above 5% again, refinance activity declined too.

AIA: Architecture Billings Index Shows Contraction in January

by Calculated Risk on 2/24/2010 01:13:00 AM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 42.5 in January from 43.4 in December. Any reading below 50 indicates contraction.

The index has remained below 50, indicating contraction in demand for design services, since January 2008. Its lowest recent reading was in January 2009, when it reached a revised 33.9 level.The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through this year, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Tuesday, February 23, 2010

Housing: Price-to-Rent Ratio

by Calculated Risk on 2/23/2010 08:27:00 PM

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through December 2009 using the two Case-Shiller Home Price Composite Indices: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined again in January, and with rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Q4 Report: 11.3 Million U.S. Properties with Negative Equity

by Calculated Risk on 2/23/2010 05:27:00 PM

First American CoreLogic released the Q4 negative equity report today.

First American CoreLogic reported today that more than 11.3 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the fourth quarter of 2009, up from 10.7 million and 23 percent at the end of the third quarter of 2009. An additional 2.3 million mortgages were approaching negative equity at the end of last year, meaning they had less than five percent equity. Together, negative equity and near‐negative equity mortgages accounted for nearly 29 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (35 percent). Among the top five states, the average negative equity share was 42 percent, compared to 15 percent for the remaining 45 states. In numerical terms, California (2.4 million) and Florida (2.2 million) had the largest number of negative equity mortgages accounting for 4.6million, or 41 percent, of all negative equity loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentgage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states, and over 20% have negative equity or near negative equity in 23 states. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.The second graph shows homeowners with severe negative equity for five states.

These homeowners are far more likely to default.

The rise in negative equity is closely tied to increases in pre‐foreclosure activity and is a major factor in changing homeowners’ default behavior. Once negative equity exceeds 25 percent, or the mortgage balance is $70,000 higher than the current property values, owners begin to default with the same propensity as investors.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

This graph fits with figure 2 above and suggests a large number of future defaults in Nevada, Arizona, Florida and California.

Most homeowners with negative equity will probably not default, but this does suggest there are many more foreclosures coming - and more losses.The aggregate dollar value of negative equity was $801 billion, up $55 billion from $746 billion in Q3 2009. The average negative equity for an underwater borrower in Q4 was ‐$70,700, up from ‐$69,700 in Q3 2009. The segment of borrowers that are 25 percent or more in negative equity account for over $660 billion in aggregate negative equity.

Case Shiller House Price Graphs for December

by Calculated Risk on 2/23/2010 02:42:00 PM

Finally. The S&P website has been down all morning.

S&P/Case-Shiller released the monthly Home Price Indices for December (actually a 3 month average).

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted monthly data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.3% from the peak, and up about 0.3% in December.

The Composite 20 index is off 29.4% from the peak, and up 0.3% in December.

The impact of the massive government effort to support house prices is obvious on the Composite graph. The question is what happens to prices as these programs end over the next few months?  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 2.4% from December 2008.

The Composite 20 is off 3.1% from December 2008.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

In Las Vegas, house prices have declined 55.9% from the peak. At the other end of the spectrum, prices in Dallas are only off about 3.1% from the peak. Several cities are showing price increases in 2009 - San Diego, San Francisco, Boston, Washington D.C., Denver and Dallas.