by Calculated Risk on 1/24/2010 09:24:00 AM

Sunday, January 24, 2010

CRE in SoCal: Vacancy Rates Up, Rents Fall

The headline is on the hopeful side, but the story has some details ...

From Roger Vincent at the LA Times: Bottom is near for building owners; recovery is another matter (ht Bill)

Overall office vacancy in the fourth quarter in Los Angeles, Orange, San Bernardino and Riverside counties was 18.5%, a substantial jump from 14.4% a year earlier, according to commercial real estate brokerage Cushman & Wakefield.And a different kind of "shadow inventory":

"Vacancies are up, and I believe they will continue to go up this year as we have continued job losses," said Joe Vargas, leader of the company's Southern California offices.

Right now, many firms have shrunk but are still renting the same amount of space they had in fatter days. Before they can grow enough to expand into bigger offices, they need to do enough hiring to fill up what they already have.Even if job losses stop, the vacancy rate will probably continue to rise as leases expire and companies downsize. And the current level of vacancies will continue to push down rents as landlords fight for tenants. And of course there will be little investment in new office buildings for some time.

"All the vacant space out there still doesn't reflect all the jobs that were lost," said Whitley Collins, regional managing director of real estate brokerage Jones Lang LaSalle.

Shadow space, as leased but unused space is often called, is impossible to measure accurately, but there is surely enough of it to slow the commercial real estate comeback. Office leasing growth usually lags behind economic recovery by six to nine months, Collins said. A local office market recovery might be as much as 18 months behind the economy now because of shadow space.

Saturday, January 23, 2010

Jon Stewart on Cramer's Tuesday Market Prediction

by Calculated Risk on 1/23/2010 10:40:00 PM

The Cramer bit starts at 7:50 ... another great Cramer prediction last Tuesday afternoon.

Here is the link to the video.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Indecision 2010 - The Re-Changening | ||||

| www.thedailyshow.com | ||||

| ||||

Senators "confident" Bernanke will be confirmed

by Calculated Risk on 1/23/2010 07:03:00 PM

From the Jackie Calmes and Sewell Chan at the NY Times: 2 Senators Predict Bernanke to Be Confirmed

And from David Wessel at the WSJ: Dodd, Gregg Predict Bernanke Will Win Confirmation Vote

Here is the statement:

Today, Senate Banking Committee Chairman Chris Dodd (D-CT) and Banking Committee Member Judd Gregg (R-NH) issued a joint statement on their confidence that Federal Reserve Chairman Ben Bernanke will be confirmed by the Senate for a second term.

“In the last few days there have been a flurry of media reports on Chairman Bernanke’s confirmation prospects, highlighting a very vocal opposition. Chairman Bernanke has done an excellent job responding to one of the most significant financial crises our country has ever encountered. We support his nomination because he is the right leader to guide the Federal Reserve in this recovering economy. Based on our discussions with our colleagues, we are very confident that Chairman Bernanke will win confirmation by the Senate for a second term."

Update on Residential Investment

by Calculated Risk on 1/23/2010 04:46:00 PM

This is an update of some graphs in a post last month: Residential Investment: Moving Sideways.

Housing Starts Click on graph for larger image in new window.

Click on graph for larger image in new window.

Housing starts are still moving sideways ...

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

Builder Confidence This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November.

More moving sideways ... (or down!)

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

MBA Purchase Index This graph shows the MBA Purchase Index and four week moving average since 1990.

This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is slightly above the 12 year low set last week.

Although there are more cash buyers now (all the investor buying), this suggests further weakness in home purchases.

House Prices

LoanPerformance reported yesterday that house prices fell again in November.

Most people follow the Case-Shiller index (to be released next Tuesday), but the Fed uses the First American CoreLogic LoanPerformance House Price Index (HPI). This graph shows the three indices with January 2000 = 100.

This graph shows the three indices with January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months.

The Case-Shiller might show a decline in November too, but it is a 3 month average, so the decline might not show up until December.

For more graphs, here are real prices and the price-to-rent ratio using the LoanPerformance HPI.

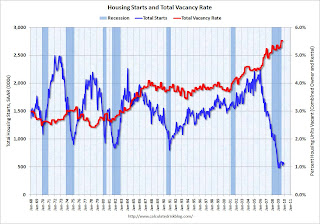

Vacant Housing Units The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

As I've noted several times, it is difficult to see a robust recovery without a recovery in residential investment. And it is hard to imagine a strong recovery in residential investment until the huge overhang of excess housing units are absorbed.

I don't expect another plunge in housing starts or new home sales, but as long as these indicators are moving sideways - or just recovering modestly - I think the economic recovery will be sluggish.

More on Bernanke

by Calculated Risk on 1/23/2010 12:52:00 PM

From Jim Hamilton at Econbrowser: Why Bernanke should be reconfirmed

I asked a senior Fed staff economist in 2008 how Bernanke was holding up personally under all the pressure. He used an expression I hadn't heard before, but seems very apt. He said he was extremely impressed by Bernanke's "intellectual stamina," by which he meant a tireless energy to continually re-evaluate, receive new input, assess the consequences of what has happened so far, and decide what to do next. That is an extremely rare quality. Most of us can be very defensive about the decisions we've made, and our emotional tie to those can prevent us from objectively processing new information. On the recent occasions I've seen Bernanke personally, that's certainly what I observed as well. Even with all he's been through, the man retains a remarkable openness to hear what others may have to say.From Brad DeLong: Don't Block Ben!

Please permit me to suggest that intellectual stamina is the most important quality we need in the Federal Reserve Chair right now.

I think Bernanke is one of the best in the world for this job--I cannot think of anyone clearly better.From Paul Krugman: The Bernanke Conundrum

As I see it, the two things that worry me about Bernanke stem from the same cause: to a greater degree than I had hoped, he has been assimilated by the banking Borg. In 2005, respectable central bankers dismissed worries about a housing bubble, ignoring the evidence; in the winter of 2009-2010, respectable central bankers are worried about nonexistent inflation rather than actually existing unemployment. And Bernanke, alas, has become too much of a respectable central banker.Krugman suggests we need someone with the "intellectual chops for the job", but who hasn't been assimilated by the "banking Borg" - and someone who would also be effective in leading the FOMC. I agree that Bernanke meets the first and last qualifications. And I think he is a far better Fed Chairman than Greenspan.

That said, however, what is the alternative? Calculated Risk says we can do better. But can we, really?

It’s not that hard to think of people who have the intellectual chops for the job of Fed chair but aren’t fully part of the Borg. But it’s very hard to think of people with those qualities who have any chance of actually being confirmed, or of carrying the FOMC with them even if named as chairman (which is one reason why this suggestion is crazy). Does it make sense to deny Bernanke reappointment simply in order to appoint someone who would follow the same policies?

And yet, the Fed really needs to be shaken out of its complacency.

As I said, I’m agonizing.

However I'd also prefer someone who expressed concerns about the asset bubbles fairly early on. Perhaps it is premature to name a specific person, but I think San Francisco Fed President Janet Yellen comes close to meeting all of the criteria.