by Calculated Risk on 5/09/2009 04:27:00 PM

Saturday, May 09, 2009

NY Times on Saving Rate

From the NY Times: Shift to Saving May Be Downturn’s Lasting Impact

The economic downturn is forcing a return to a culture of thrift that many economists say could last well beyond the inevitable recovery.The NY Times article notes the need to repair household balance sheets, but there is a second factor that will push up the saving rate too: changing demographics. Here is what I wrote a week ago:

This is not because Americans have suddenly become more financially virtuous or have learned the error of their free-spending ways. Instead, these experts say, Americans may have no choice but to continue pinching pennies.

This shift back to thrift may seem to be a healthy change for a consumer class known for spending more than it earns, but there is a downside: American businesses have become so dependent on consumer spending that any pullback sends ripples through the economy.

Click on graph for large image.

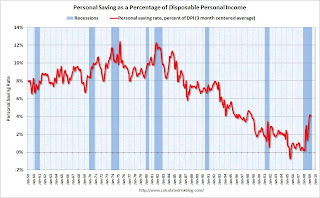

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report. The saving rate was 4.1% in March.I expect the saving rate to continue to rise to 8% or so, although the future increases will probably not be as rapid as the last few months.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but ... this will also keep pressure on personal consumption.

Saturday Morning Summary

by Calculated Risk on 5/09/2009 10:17:00 AM

Jon Lansner at the O.C Register has some quotes on housing: When will housing bottom? Depends on who is talking! I'll add my two cents later ...

And for those that missed them, here are some reset / recast charts.

And a graph comparing job losses with previous recessions.

And a video of a mothballed condo project in Irvine, CA

Best to all

Bank Failure #33: Westsound Bank, Bremerton, Washington

by Calculated Risk on 5/09/2009 12:37:00 AM

Bogus Kabuki theatre.

Truth remains hidden.

by Soylent Green is People

From the FDIC: Kitsap Bank, Port Orchard, Washington, Assumes All of the Deposits of Westsound Bank, Bremerton, Washington

Westsound Bank, Bremerton, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....

As of March 31, 2009, Westsound Bank had total assets of $334.6 million and total deposits of $304.5 million. ...

The transaction is the least costly resolution option, and the FDIC estimates the cost to its Deposit Insurance Fund will be $108 million. Westsound Bank is the 33rd FDIC-insured institution to be closed this year and the second in Washington. The last bank to be closed in the state was the Bank of Clark County on January 16, 2009.

Friday, May 08, 2009

WSJ Report: Banks Negotiated Concessions on Stress Tests

by Calculated Risk on 5/08/2009 08:31:00 PM

From the WSJ: Banks Won Concessions on Tests

The Federal Reserve at the last minute significantly scaled back the size of the capital hole facing some of the nation's biggest banks, following days of intense bargaining over the stringency of the stress tests.

...

When the Fed last month informed banks of its preliminary stress-test findings, executives at banks including Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. were furious ...

At Fifth Third, the Fed was preparing to tell the Cincinnati-based bank to find $2.6 billion in capital, but the final tally dropped to $1.1 billion.

Loan Reset / Recast Schedule

by Calculated Risk on 5/08/2009 06:13:00 PM

Before reading, please see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

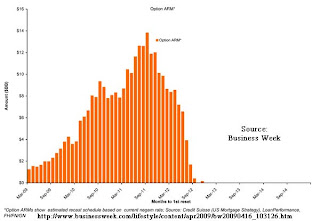

"Reset" refers to a rate change. "Recast" refers to a payment change.Here are two Credit Suisse charts:

Click on image for larger graph in new window.

Click on image for larger graph in new window.The first chart is from Business Week in April: Good News: Option ARM Resets Delayed

The reset and recast confusion continues! The x-axis is labeled "months to 1st reset", but the notes to the graph says: "estimated recast schedule".

And here is more from a Credit Suisse research report released in February (no link):

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.Looking at these charts it would be easy to conclude that the recast problem last through 2012. However there is a difference between the original recast date, and the actual recast date - because negatively amortizing loans hit the recast ceiling earlier than the original forecast. I suspect the peak in recasts for Option ARMs will be in 2010.