by Calculated Risk on 4/28/2009 01:21:00 PM

Tuesday, April 28, 2009

More Details on Making Home Affordable Second Lien Program

Press Release from the U.S. Treasury: Obama Administration Announces New Details on Making Home Affordable Program

Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.Here is the program update.

And a couple of examples of how the 2nd lien program would work.

Here are the basics (the interest rate reduction is for 5 years):

For amortizing loans (loans with monthly payments of interest and principal), we will share the cost of reducing the interest rate on the second mortgage to 1 percent. Participating servicers will be required to follow these steps to modify amortizing second liens:The interest only second lien structure is similar with the interest rate being reduced to 2%.Reduce the interest rate to 1 percent; Extend the term of the modified second mortgage to match the term of the modified first mortgage, by amortizing the unpaid principal balance of the second lien over a term that matches the term of the modified first mortgage; Forbear principal in the same proportion as any principal forbearance on the first lien, with the option of extinguishing principal under the Extinguishment Schedule; After five years, the interest rate on the second lien will step up to the then current interest rate on the modified first mortgage, subject to the Interest Rate Cap on the first lien, set equal to the Freddie Mac Survey Rate; The second mortgage will re-amortize over the remaining term at the higher interest rate(s); and Investors will receive an incentive payment from Treasury equal to half of the difference between (i) the interest rate on the first lien as modified and (ii) 1 percent, subject to a floor.

Although this is a serious reduction in the interest rate, this will probably attractive to 2nd lien investors - since the loss severity on second liens is so high. What happens in five years when the rates change for all these borrowers with negative equity?

Chrysler: Deal Reached with Creditors

by Calculated Risk on 4/28/2009 12:23:00 PM

From the NY Times: Deal Is Set on Chrysler Debt That May Avert Bankruptcy

The Treasury Department has worked out a preliminary agreement with Chrysler’s largest secured creditors ...The initial Treasury offer was $1.0 billion, and the banks countered at $4.5 billion and 40% equity in the new Chrysler. These is no mention of equity in the story.

Chrysler has about $6.9 billion in secured debt owned by big banks such as Citigroup and JPMorgan Chase and a group of hedge funds. Under the proposal, all of the debt would be canceled in exchange for $2 billion in cash...

Case-Shiller: City Data

by Calculated Risk on 4/28/2009 11:22:00 AM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell by 1% or more in most Case-Shiller cities in February, with Phoenix off 5.0% for the month alone.

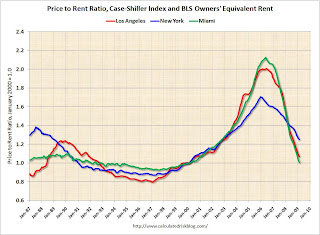

And here is the price-to-rent ratio for a few cities ... The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

This ratio is getting close to normal for LA and Miami (Miami is back to the Jan 2000 ratio), but still has further to fall in NY.

Note: The Owners' Equivalent Rent (OER) is still increasing according to the BLS, however there are many reports of falling rents that isn't showing up yet in the OER.

House Prices: Compared to Stress Test Scenarios, and Seasonal Pattern

by Calculated Risk on 4/28/2009 10:14:00 AM

For more on house prices, please see: Case-Shiller: Prices Fall Sharply in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, February: 154.70

Stress Test Baseline Scenario, February: 157.26

Stress Test More Adverse Scenario, February: 154.01

It has only been two months, but prices are tracking the More Adverse scenario so far.

But we have to remember the headline Case-Shiller is not seasonally adjusted, and there is a strong seasonal pattern. Update: there is a seasonally adjusted data set here. This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

Prices usually decline at the fastest rate in the winter months (or increase the least with rising prices), and prices decline the slowest during the summer. Just something to remember when the month-to-month price declines slow this summer.

This is why we use the year-over-year (YoY) price change too (in previous post). The YoY change for the Composite 10 is -18.8%, the worst YoY change was last month (January 2009 at -19.4%). About the same.

I'll have some Case-Shiller city data soon.

Case-Shiller: House Prices Fall Sharply in February

by Calculated Risk on 4/28/2009 09:05:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for February this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.8% over the last year.

The Composite 20 is off 18.6% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have more on house prices including a comparison to the stress test scenarios soon.