by Calculated Risk on 4/16/2009 01:05:00 PM

Thursday, April 16, 2009

Hotel Occupancy: RevPAR Off 28.1 Percent

More bad news for CRE today. General Growth (2nd largest mall owner) filed bankruptcy this morning. And Cushman & Wakefield reported the downtown office vacancy rate increased sharply in Q1.

And for lodging, occupancy and RevPAR (Revenue per available room), are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 11 April 2009

In year-over-year measurements, the industry’s occupancy fell 17.9 percent to end the week at 52.6 percent (64.1 percent in the comparable week in 2008). Average daily rate dropped 12.5 percent to finish the week at US$96.60 (US$110.36 in the comparable week in 2008). Revenue per available room for the week decreased 28.1 percent to finish at US$50.85 (US$70.76 in the comparable week in 2008).

emphasis added

Click on graph for larger image in new window.

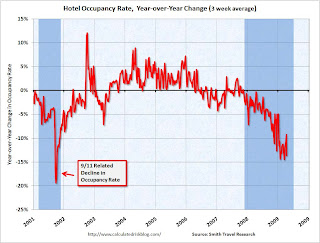

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 13.7% from the same period in 2008.

The average daily rate is down 12.5%, so RevPAR is off 28.1% from the same week last year.

Report: Downtown Office Vacancy Rate Rises to 12.5%

by Calculated Risk on 4/16/2009 11:22:00 AM

Note: This report just covers downtown areas. The REIS report covers more area and shows the nationwide U.S. office vacancy rate at 15.2% in Q1.

From Bloomberg: U.S. Office Vacancies Rise to Three-Year High, Cushman Says

Office vacancies in U.S. downtowns increased to 12.5 percent in the first quarter, the highest in three years, as companies cut jobs and new buildings came onto the market, Cushman & Wakefield said.You think?

The national [downtown] office vacancy rate climbed from 11.2 percent in the fourth quarter and 9.9 percent a year earlier ...

“This will be a very difficult year for commercial real estate and for office markets in particular,” said Maria Sicola, executive managing director and head of Americas Research for Cushman & Wakefield ...

On falling rents:

Downtown office landlords cut their asking rents by an average of 2.2 percent in the first quarter ... “We are just entering into what will be a very strong market for the tenant. We can see rents come down 10 or 15 percent or even 20 percent before this is over.” [Sicola said]CRE is getting crushed.

Philly Fed: Manufacturing "contracted less severely" this Month

by Calculated Risk on 4/16/2009 10:05:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector contracted less severely this month ... Indexes for general activity, new orders, and employment remained negative but improved somewhat from March. ... Most of the survey's broad indicators of future activity improved notably this month, suggesting that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -35.0 in March to -24.4 this month. Although clearly indicating continued overall decline, this reading is the highest since January. The index has been negative for 16 of the past 17 months, a span that corresponds to the current recession ...

Employment losses remained widespread this month, with over 45 percent of the firms reporting declines. The current employment index, though still negative at -44.9, increased seven points from its record low reading last month.

...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the fourth consecutive month and increased markedly from 14.5 in March to 36.2, its highest reading in 18 months (Note:click here for Philly Fed chart of future activity index).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 16 of the past 17 months, a period that corresponds to the current recession ."

Unemployment Insurance: Continued Claims above 6 Million

by Calculated Risk on 4/16/2009 08:47:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 610,000, a decrease of 53,000 from the previous week's revised figure of 663,000. The 4-week moving average was 651,000, a decrease of 8,500 from the previous week's revised average of 659,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 4 was 6,022,000, an increase of 172,000 from the preceding week's revised level of 5,850,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971. This is not adjusted for changes in population (I'll add that graph next week).

The four week moving average is at 651,000.

Continued claims are now at 6.02 million - the all time record.

The decline to 610,000 initial claims this week is potentially good news, but this is just one week of data, and this series is very volatile. As I mentioned in End of Recessions and Unemployment Claims, the four-week average of initial weekly unemployment claims is a closely watched indicator of the possible end of a recession. However, we need to see the four-week average decline by 20,000 to 40,000 or more from the peak before we get excited - and so far the four-week average is only off 8,500 from the peak of 659,500 last week.

Housing Starts: Near Record Low

by Calculated Risk on 4/16/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 510 thousand (SAAR) in March, just above the revised record low of 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 358 thousand in March; just above the revised record low in January (356 thousand).

Permits for single-family units were 361 thousand in March, suggesting single-family starts will remain at about the same level in April.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Note that single-family completions of 550 thousand are still significantly higher than single-family starts (358 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Total starts and single family starts declined in March (compared to February), and are both just above the record low set in January. This is the second month in a row with starts slightly above the record low - this is just a slight increase in total starts and single family starts are essentially flat with the record low.

It is still too early to call the bottom in January, however I do expect housing starts to bottom sometime in 2009.