by Calculated Risk on 4/13/2009 08:54:00 PM

Monday, April 13, 2009

End of Recessions and Unemployment Claims

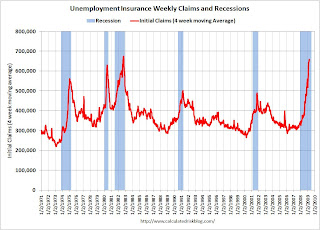

A number of forecasters have mentioned Unemployment Claims as an important indicator of the end of a recession. Professor Hamilton mentioned this last week: Initial unemployment claims and the end of recessions. Historically this is a useful indicator.

Back on March 28th, the WSJ quoted Robert J. Gordon, an economist at Northwestern University and a member of the National Bureau of Economic Research committee:

[Gordon] points to one indicator in particular with a remarkable track record: the number of Americans filing new claims for unemployment benefits. In past recessions, it has hit its peak about four weeks before the economy hit a trough and began to grow again. As of right now, the four-week average of new claims hit its peak of 650,000 in the week ended March 14. Based on the model, "if there's no further rise, we're looking at a trough coming in April or May," he said, which is far earlier than most forecasts currently anticipate.Since then, the four-week average has risen further (now at 657,250). So much for a trough in April ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the four-week average of initial unemployment claims and recessions.

Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

We need to see a significant decline in the four-week average before we start talking about the peak. In a note today, Goldman Sachs economist Seamus Smyth estimated a significant decline as:

Roughly speaking, a 20,000 decline in the 4-week moving average corresponds to a 50% probability that the peak has already been reached, and a 40,000 improvement to a 90% probability.So we need to see the four-week average decline by 20,000 to 40,000 or more. Don't hold your breathe ...