by Calculated Risk on 4/13/2009 10:51:00 PM

Monday, April 13, 2009

WSJ: General Growth Bondholders Seek Lawsuit

From the WSJ: General Growth Bondholders Ask Trustee to Sue (ht bearly)

A group of bondholders have ratcheted up the pressure on General Growth Properties Inc. by asking their trustee to sue the debt-laden mall owner for payment of their past-due bonds.Here is the story from Reuters: General Growth bondholders seek to sue company--WSJ

...

The bondholders' action pushes General Growth closer to a bankruptcy filing but doesn't mean that one is imminent.

End of Recessions and Unemployment Claims

by Calculated Risk on 4/13/2009 08:54:00 PM

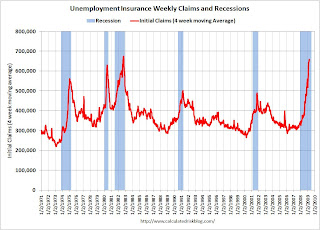

A number of forecasters have mentioned Unemployment Claims as an important indicator of the end of a recession. Professor Hamilton mentioned this last week: Initial unemployment claims and the end of recessions. Historically this is a useful indicator.

Back on March 28th, the WSJ quoted Robert J. Gordon, an economist at Northwestern University and a member of the National Bureau of Economic Research committee:

[Gordon] points to one indicator in particular with a remarkable track record: the number of Americans filing new claims for unemployment benefits. In past recessions, it has hit its peak about four weeks before the economy hit a trough and began to grow again. As of right now, the four-week average of new claims hit its peak of 650,000 in the week ended March 14. Based on the model, "if there's no further rise, we're looking at a trough coming in April or May," he said, which is far earlier than most forecasts currently anticipate.Since then, the four-week average has risen further (now at 657,250). So much for a trough in April ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the four-week average of initial unemployment claims and recessions.

Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

We need to see a significant decline in the four-week average before we start talking about the peak. In a note today, Goldman Sachs economist Seamus Smyth estimated a significant decline as:

Roughly speaking, a 20,000 decline in the 4-week moving average corresponds to a 50% probability that the peak has already been reached, and a 40,000 improvement to a 90% probability.So we need to see the four-week average decline by 20,000 to 40,000 or more. Don't hold your breathe ...

Mortgage Fraud in 2008: Part II

by Calculated Risk on 4/13/2009 06:29:00 PM

Here is the 2nd part of the VoiceofSanDiego article: A Staggering Swindle: How It Could Happen in 2008

In 2008, when the loans were made to McConville's buyers, some of the only companies still willing to buy these bundles of mortgages were Fannie Mae and Freddie Mac, even though the mortgage mess had affected them, too.Ask Wall Street what happens when they push back loans to the small lenders - they just close up shop.

At the tail end of McConville's deals, last September, the federal government took over Fannie and Freddie, assuming more direct control of the companies' day-to-day operation and pumped in funding to absorb their losses. Now the taxpayers own 79.9 percent of Fannie Mae and Freddie Mac.

"You and I are getting stuck with these inflated loans, via Fannie and Freddie," [Real estate appraiser Todd Lackner] said.

There is a way out, as long as the smaller lenders who made the loans to McConville's buyers still exist. On any loans Fannie and Freddie bought, if they discover fraud or faults in underwriting in the loans, they'll send them down the chain, requiring the investor that sold the loans to the giants to buy them back. Ultimately, the original lenders might face those buybacks, said Michael Lea, a former chief economist for Freddie Mac.

But the small lenders who made these mortgages might not be in business anymore -- like Nazari's All American Finance.

Here was Part I: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

And a related article: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Goldman Sachs Reports $1.8 Billion Profit

by Calculated Risk on 4/13/2009 04:29:00 PM

From MarketWatch: Goldman Sachs swings to profit, plans $5 billion offering

Goldman Sachs Group Inc. said Monday it swung to a profit in the first-quarter, and announced it has commenced a public offering of $5 billion of its common stock. Goldman Sachs said net earnings for the period ended in March were $1.8 billion ... compared to a loss of $2.1 billion ... in the same period a year earlier.The $5 billion will be used to repay the TARP money Goldman received last year.

Oregon Unemployment Rate Ties Record High in 60+ Years

by Calculated Risk on 4/13/2009 04:09:00 PM

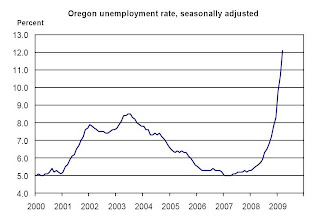

From Oregon.gov (ht Justin):  This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

The unemployment rate is at the peak level of the 1982 recession - the highest since record keeping started in 1947. The unemployment rate is increasing rapidly, and the rate of increase appears to be accelerating.

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent in March from 10.7 percent (as revised) in February. The state’s unemployment rate has risen rapidly and substantially over the past nine months, from a rate of 5.9 percent in June 2008.

...

Manufacturing shed 2,100 jobs in March, during a time of year when a flat employment pattern is typical. Employment stood at 171,600 in March, which was by far the lowest employment level since comparable records began in 1990.

...

Construction losses steepened, dropping 1,700 jobs at a time of year when a gain of 700 was the expected normal seasonal movement. The rate of seasonally adjusted losses in construction has quickened, as the industry is down 12,600 jobs or 13.6 percent over the past six months.

Seasonally adjusted construction employment, at 80,000, is now below its level of approximately 83,000 jobs seen during much of 1997 through 2000. Despite a drop of more than 25,000 jobs since reaching its peak in 2007, construction is still slightly above its low point over the past dozen years—75,500, which was reached in June 2003.

...

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent from 10.7 percent in February. This tied Oregon’s unemployment rate in November 1982, the highpoint of the early 1980s recession. While historical records prior to 1976 are not exactly comparable, it appears clear that the 12.1 percent level is Oregon’s highest since 1947, when the Employment Department first started publishing unemployment rates.