by Calculated Risk on 12/17/2007 02:54:00 PM

Monday, December 17, 2007

ECB Offers Unlimited Funds at Below Market Rates

From the Financial Times: ECB steps up liquidity fight

Emergency help for financial markets entered new territory on Monday night as the European Central Bank announced it would on Tuesday offer unlimited funds at below market interest rates in a special operation to head off a year-end liquidity crisis.

The surprise move, which follows last week's co-ordinated barrage of measures by the world's central banks to increase market liquidity, suggests the ECB is still frustrated at the failure to ease market tensions.

NAHB: Builder Confidence Unchanged at Record Low

by Calculated Risk on 12/17/2007 01:11:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was unchanged at a record low 19 in December. |  |

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

“Builders continue to look for signs of improvement in the ongoing mortgage market crisis that is weighing on housing and the overall economy,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. ...

“Today’s report shows that builders’ views of housing market conditions haven’t changed in the past several months, and there clearly are signs of stabilization in the HMI,” noted NAHB Chief Economist David Seiders. “At this point, many builders are bracing themselves for the winter months when home buying traditionally slows, scaling down their inventories and repositioning themselves for the time when market conditions can support an upswing in building activity – most likely by the second half of 2008.”

...

In December, the index gauging current sales conditions for single-family homes improved by a single point, to 19, and the index gauging sales expectations for the next six months rose two points to 26. Meanwhile, the index gauging traffic of prospective buyers declined three points to 14.

Regionally, the HMI results were mixed in December. The Midwest and South each posted two-point gains in their HMI readings, to 15 and 21, respectively. The West held even at 18, and the Northeast, which experienced wetter weather conditions than normal in the survey period, posted a seven-point decline to 19. All regions were down on a year-over-year basis.

National City Corp. Warns

by Calculated Risk on 12/17/2007 12:30:00 PM

From the WSJ: National City Warns of Loan Losses

National City Corp. expects to set aside about $700 million to cover loan losses in the fourth quarter and said it incurred mortgage-related charges of about $200 million in October and November.Here is the National City SEC filing.

"The mortgage business continues to be under stress," the financial-services company said in a Securities and Exchange Commission filing....

Click on graph for larger image.

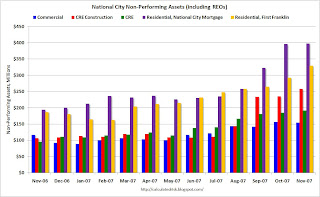

Click on graph for larger image.This graph shows the key nonperforming assets of National City Corp. Residential REO's are including in National City mortgage and First Franklin nonperforming assets.

According to the SEC filing:

Credit quality in the commercial and core consumer portfolios, including direct home equity lending, remains satisfactory. The areas of elevated risk continue to be in the run-off portfolios of First Franklin non-prime mortgages, especially seconds; broker-originated home equity loans and lines of credit associated with the former National Home Equity business; and certain sectors of investment real estate and residential construction. In particular, indirect home equity loans and lines that were transferred to portfolio in the third quarter have shown further deterioration beyond that which was anticipated at the time the September 30 loan loss allowance was established.Look at the graph. Most of the problems are in residential, but the nonperforming CRE (green) and nonperforming CRE construction (red) are definitely climbing.

emphasis added

Moody's Warnings on Monoline Guarantors Impacts $1.2 Trillion Debt

by Calculated Risk on 12/17/2007 10:05:00 AM

From Bloomberg: Moody's Warnings on FGIC, MBIA Cast Doubt on $1.2 Trillion Debt

Moody's Investors Service's warning that the top credit ratings of FGIC Corp. and three other bond insurers may be cut casts doubt on $1.2 trillion of municipal, corporate and asset-backed securities.Does everyone understand the systemic risk? I'm not so sure. This warning puts 89,709 public finance issues on negative watch and probably impacts most communities in the U.S..

...

``Everyone understands the systemic risk if even one of these companies is downgraded,'' said Peter Plaut, an analyst at hedge fund manager Sanno Point Capital Management in New York.

CRE: Centro Properties "struggling to refinance debt"

by Calculated Risk on 12/17/2007 09:38:00 AM

From Bloomberg: Centro Slumps 76% on Struggles to Refinance Debt (hat tip CG and Brian)

Centro Properties Group, the owner of 700 U.S. shopping malls ... say[s] it's struggling to refinance debt ...No one could have known.

Melbourne-based Centro suspended dividends and said in a statement that it may have to sell assets, after lenders set a Feb. 15 deadline to negotiate maturing debt. Traditional sources of funding are ``shut for business,'' Chairman Brian Healey said in the statement.

...

``We never expected nor could reasonably anticipate that the sources of funding that have historically been available to us and many other companies would shut for business,'' Centro's Healey said in the statement.

UPDATE: Last week I mentioned MBS (apartments) in Texas was delinquent on many loans. The WSJ had a story on Saturday: In Texas, MBS apartment Titan Battles Defaults

Massive Texas apartment-complex owner and operator MBS Cos. is in danger of defaulting on nearly $400 million in loans and has sought bankruptcy-law protection for many of its properties to stave off foreclosure.