by Calculated Risk on 12/17/2007 12:30:00 PM

Monday, December 17, 2007

National City Corp. Warns

From the WSJ: National City Warns of Loan Losses

National City Corp. expects to set aside about $700 million to cover loan losses in the fourth quarter and said it incurred mortgage-related charges of about $200 million in October and November.Here is the National City SEC filing.

"The mortgage business continues to be under stress," the financial-services company said in a Securities and Exchange Commission filing....

Click on graph for larger image.

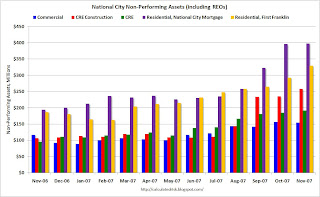

Click on graph for larger image.This graph shows the key nonperforming assets of National City Corp. Residential REO's are including in National City mortgage and First Franklin nonperforming assets.

According to the SEC filing:

Credit quality in the commercial and core consumer portfolios, including direct home equity lending, remains satisfactory. The areas of elevated risk continue to be in the run-off portfolios of First Franklin non-prime mortgages, especially seconds; broker-originated home equity loans and lines of credit associated with the former National Home Equity business; and certain sectors of investment real estate and residential construction. In particular, indirect home equity loans and lines that were transferred to portfolio in the third quarter have shown further deterioration beyond that which was anticipated at the time the September 30 loan loss allowance was established.Look at the graph. Most of the problems are in residential, but the nonperforming CRE (green) and nonperforming CRE construction (red) are definitely climbing.

emphasis added