by Calculated Risk on 12/15/2007 04:56:00 PM

Saturday, December 15, 2007

CRE Outlook Dims

From the Chicago Tribune: Commercial sales outlook turns darker

... since the summer, sales in the commercial real estate market have slowed radically as financial institutions and debt markets reel from the fallout of years of ill-advised financing."Reckless" lenders, slowing demand and more supply coming; those are key CRE fundamentals.

... as the economy slows, real estate fundamentals such as rents and vacancies seem destined to weaken, and some wonder if the frenzied commercial property deals of the recent past were wise.

Lenders competing for ever-larger shares of commercial property loans offered low- or no-interest financing for 90 percent or more of the asset value to buyers who might have rushed through their due diligence and bid up prices extravagantly, said Arthur Oduma, a senior analyst for Morningstar Inc.

"Lenders were almost reckless," he said.

Mark "Sam" Davis, senior managing director of real estate for Allstate Insurance, a commercial property lender and a unit of Northbrook-based Allstate Corp., agrees.

"In hindsight, some of these deals don't look so good and are unlikely to perform as the economy weakens," Davis said.

...

The Chicago office market could be further weakened because 6 million square feet of new office space is in development, with 3.6 million square feet of that scheduled for completion in 2009.

...

"With so much space rolling over, and tenants having more options, that makes investors back away," said Oduma.

One Good Bongwater Deserves Another

by Anonymous on 12/15/2007 04:06:00 PM

For those of you who might be new to this website, "drinking the bongwater" has been one of our favorite, er, "colorful" metaphors for the utter abandonment of sane underwriting standards during the great mortgage bubble. Not that anyone around here knows what a bong is or why it has water or what would happen if you drank it. It's undoubtedly something our children picked up in daycare.

As usual, though, we find that reality has a way of seeing you one and raising you one. Via Atrios, we learn about the bongwater housing economy:

Sheriff's Office narcotics detectives reported raiding three houses where hundreds of marijuana plants were being grown. . . .I'm guessing they went "stated income."

The investigation, which started 18 months ago, has led to a total of six raids at five addresses -- including the houses searched Thursday -- Carney said. Detectives have confiscated almost 2,000 plants, worth $2.4 million to $3.6 million on the street. The other houses are in South County and one has been busted twice by drug officers, Carney said.

The same group of people bought all the houses in 2005 and allegedly set up the grows, according to detectives. Investigators think the owners were using the marijuana grows to pay the mortgages on the homes.

"It appears they've been financing the houses with the cultivation and sales of marijuana," Carney said.

Moody's Lowers Bond Insurers Outlook

by Calculated Risk on 12/15/2007 12:17:00 AM

From Bloomberg: Moody's May Lower FGIC, XL Ratings; MBIA Outlook

FGIC Corp. and XL Capital Assurance Inc., two bond insurers, may lose their Aaa credit ratings at Moody's Investors Service after a slump in the value of the debt they guarantee.Just another Friday night ...

MBIA Inc., the largest bond insurer, and CIFG Guaranty had their outlooks lowered to ``negative'' by the New York-based ratings company today. The Aaa rankings of Ambac Financial Group Inc., Assured Guaranty Corp., and Financial Security Assurance Inc. were all affirmed, signaling no plans to change them, Moody's said. Radian Group Inc. was also affirmed.

Friday, December 14, 2007

Condo Conversions

by Calculated Risk on 12/14/2007 08:13:00 PM

The following story concerns how poorly the conversion from condos to apartments was apparently handled by a developer in D.C. From the WaPo: Condo Crunch

... Senate Square, was converting condos to apartment rentals. The Web site for the project confirmed the news with a new advertising pitch for "luxury apartments."More interesting - at least to me - is this story fits with my analysis of the rental market. (See Housing Inventory and Rental Units)

Since Q2 2004, there have been 2.6 million rental units added to the U.S. inventory according to the Census Bureau, but only 773 thousand units completed as 'built for rent' since Q2 2004.

The other 1.8+ million rental units added must be older out-of-service units being brought back to the rental market, condo "reconversions", flippers becoming landlords, or homeowners renting their previous homes instead of selling. As I noted in the earlier post, this shows the substantial excess inventory in 2004 and 2005 that didn't show up in the new home or existing home inventory numbers at the time (although many of us thought correctly that there was a huge unaccounted for inventory).

The 2nd part of the WaPo story is grim:

Danah Leeson, a registered nurse, agreed to pay $615,000 for a two-bedroom condo at the Phoenix in Arlington in July 2005. She put down a deposit of about $31,000. But this summer, when she tried to secure a loan to complete the purchase, the lender told her she would have to come up with an extra $100,000 to make up the difference between the purchase price and the current value of the unit. "The lender won't give us more than the appraised value," she said.Can you imagine a lender not wanting to loan more than the appraised value? How traditional. But Danah's choices aren't find $100K or lose her deposit. Her choices are renegotiate with the builder or walk away.

Her choice? Find $100,000 or lose her $31,000 deposit.

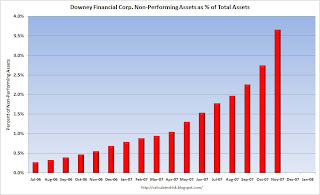

Downey Financial Non-Performing Assets

by Calculated Risk on 12/14/2007 03:51:00 PM

From the Downey Financial 8-K released today. (hat tip Credit Bubble Stocks and others)

| Click on graph for larger image. This would be a nice looking chart, except those are the percent non-performing assets by month. Yes, by month! |

BTW, Herb Greenberg provides this quote from an unidentified source: Extrapolating Downey to WaMu, others

DSL was supposed to be the best underwriter. That’s why I owned it at one point. They were the lowest loan-to-value lender, which is interesting considering the data we are seeing now. The problem is that lenders did a horrible job tracking if there was a second lien behind them. Borrowers have so much leverage (first lien + second) and house prices are falling so fast, that they are just deciding to walk away from the home. This is something the Paulsen plan does not address. It’s not a question of being able to make the next payment…it’s looking at the value of your home and thinking ‘wow I am going to be under water for a long time ...