by Calculated Risk on 1/24/2007 11:47:00 AM

Wednesday, January 24, 2007

California Default Notices Increase

"We're in the midst of an adjusting market right now, and we won't know until spring or summer if this [foreclosure activity] is ominous or not,"UPDATE: Here is the DataQuick press release with some additional details: California Foreclosure Activity Jumps Again

Marshall Prentice, DataQuick president, Jan 24, 2007.

According to DataQuick, the number of default notices jumped significantly to 37,273 in Q4 2006.

Click on graph for larger image.

Click on graph for larger image.This graph shows Notices of Default (NOD) by year in California since 1992.

2006 had the highest number of NODs since 1998. And it now appears 2007 will see record or near record NODs.

From David Streitfeld at the LA Times: More Californians at risk of losing homes

Default notices are the initial step in the foreclosure process. In the fourth quarter of last year, lenders issued such notices to 37,273 borrowers across the state, warning them that they were at risk of foreclosure, compared with 15,196 during the same period a year earlier, DataQuick said.

Not every notice of default leads to a foreclosure, when a property is seized and sold to pay the mortgage. But foreclosures also are on the rise. There were 6,078 in the last quarter of 2006, up from 874 a year earlier.

MBA: Mortgage Applications Decrease

by Calculated Risk on 1/24/2007 11:21:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Refinance Applications and Purchase Applications Both Decrease (UPDATE: link added)

Click on graph for larger image.

Click on graph for larger image.

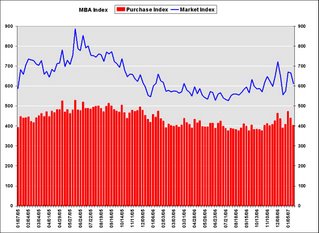

The Market Composite Index, a measure of mortgage loan application volume, was 611.3, a decrease of 8.4 percent on a seasonally adjusted basis from 667.2 one week earlier. On an unadjusted basis, the Index decreased 5.7 percent compared with the previous week and was up 3.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index decreased by 9.6 percent to 1848.8 from 2045.8 the previous week and the seasonally adjusted Purchase Index decreased by 8.4 percent to 402.7 from 439.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 from 6.19 percent ...

The average contract interest rate for one-year ARMs increased to 5.91 percent from 5.85 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.7 percent to 430.5 from 427.4 for the Purchase Index.

The refinance share of mortgage activity decreased to 47.8 percent of total applications from 49.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 20.3 from 21.2 percent of total applications from the previous week.

Tuesday, January 23, 2007

WSJ: Mortgage Delinquencies Mount

by Calculated Risk on 1/23/2007 11:25:00 PM

From the WSJ: Banks Move Earlier To Curb Foreclosures

Some 2.51% of mortgages were delinquent in the fourth quarter, according to new data from Equifax Inc. and Moody's Economy.com Inc. That is up from 2.33% in the third quarter and the highest level since a recent peak of 2.53% in the first quarter of 2002.Anyone notice a theme this week?

The increase in bad loans is broad based, with delinquencies rising in the past year in roughly 80% of the 250 local areas analyzed by Moody's Economy.com....

The rise in delinquencies is unusual because it comes at a time when the economy is relatively strong. Even though job growth remains healthy, "the total mortgage delinquency rate is the highest that it's been since the depths of the [2001] recession," says Mark Zandi, chief economist at Moody's Economy.com. He attributes the increase in part to the weaker housing market and the widespread use of adjustable-rate mortgages, many of which now are resetting at higher rates.

... Zandi ... expects that nationwide delinquency rates could rise by as much as a full percentage point from current levels in the next year, but he doesn't expect the trend will have a significant impact on the overall economy.

D.R. Horton: Housing Slowdown in "Early Stages"

by Calculated Risk on 1/23/2007 02:56:00 PM

"Most downturns are longer and deeper (than people expect), and we are not seeing anything on the horizon to change that opinion."

D.R. Horton Chief Executive Don Tomnitz, Jan 23, 2007

North Carolina: Record Foreclosures

by Calculated Risk on 1/23/2007 01:54:00 AM

From the StarNewsOnline: Foreclosure filings hit record high

The number of North Carolina homeowners threatened with foreclosure reached an all-time high last year, new state figures show.

More than 45,500 foreclosure filings were recorded in 2006, according to the Administrative Office of the Courts.

...

Experts blame the growing availability of mortgage loans - especially high-interest and adjustable rate subprime mortgages - in part for the increase.