by Calculated Risk on 1/24/2007 11:21:00 AM

Wednesday, January 24, 2007

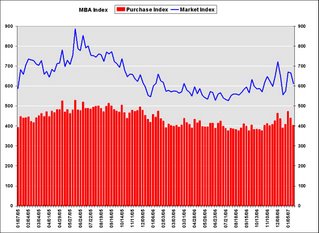

MBA: Mortgage Applications Decrease

The Mortgage Bankers Association (MBA) reports: Mortgage Refinance Applications and Purchase Applications Both Decrease (UPDATE: link added)

Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 611.3, a decrease of 8.4 percent on a seasonally adjusted basis from 667.2 one week earlier. On an unadjusted basis, the Index decreased 5.7 percent compared with the previous week and was up 3.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index decreased by 9.6 percent to 1848.8 from 2045.8 the previous week and the seasonally adjusted Purchase Index decreased by 8.4 percent to 402.7 from 439.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 from 6.19 percent ...

The average contract interest rate for one-year ARMs increased to 5.91 percent from 5.85 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.7 percent to 430.5 from 427.4 for the Purchase Index.

The refinance share of mortgage activity decreased to 47.8 percent of total applications from 49.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 20.3 from 21.2 percent of total applications from the previous week.