by Calculated Risk on 12/14/2005 10:40:00 AM

Wednesday, December 14, 2005

MBA: Mortgage Refinance Applications Continue To Decline

The Mortgage Bankers Association (MBA) reports: Refinance Applications Continue To Decline

Market Composite Index — a measure of mortgage loan application volume was 619.3 -- a decrease of 5.7 percent on a seasonally adjusted basis from 656.7, one week earlier. On an unadjusted basis, the Index decreased 8.1 percent compared with the previous week and was down 11.0 percent compared with the same week one year earlier.

The seasonally-adjusted Purchase Index decreased by 3.5 percent to 477.9 from 495.1 the previous week whereas the Refinance Index decreased by 9.7 percent to 1441.8 from 1596.4 one week earlier.

Click on graph for larger image.

The graph shows overall and purchase activity since June. Overall activity has fallen significantly due to the drop in refis. Purchase activity is steady.

Mortgage rates decreased slightly last week:

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.28 percent from 6.32 percent on week earlier ...Overall this report shows purchase activity is steady at a very high level.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.83 percent from 5.84 percent ...

Tuesday, December 13, 2005

October U.S. Trade Deficit at Record $68.9 Billion

by Calculated Risk on 12/13/2005 08:48:00 PM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for October was $68.9 Billion. Imports increased to a record $176.4 billion from $171.8 Billion in September.

Click on graph for larger image.

The October record was the result of the significant increase in imports and only a small increase in exports.

Imports from China set another record of $24.4 Billion, while exports to China increased slightly to $3.9 Billion. Imports from Japan increased to $12.2 billion from $10.9 Billion in September.

The Petroleum deficit set another record of $24.2 Billion, up from the previous record of $22.3 Billion in September. The increase in the petroleum deficit was mostly due to a 25% surge in the import of refined products that added almost $2 Billion to the October deficit.

November retail sales fall short

by Calculated Risk on 12/13/2005 01:24:00 PM

Reuters reports:

U.S. retail sales rose a smaller-than-expected 0.3 percent in November and fell when a surge in auto purchases was excluded, setting the stage for what could be a disappointing holiday shopping season, government data showed on Tuesday.I hope these two posts make the retail outlook clear.

Sales of motor vehicles and parts rose for the first time since July, surging 2.6 percent. But without the auto sales, retail demand fell 0.3 percent, the Commerce Department said. That was the first decline since April 2004.

...

"A report like this will continue to fuel the debate about how strong consumer spending will be over the holiday season," said Alan Gayle, a managing director at Trusco Capital Management in Atlanta.

...

Much of the weakness in November's sales was due to a 5.9 percent drop in sales at gasoline stations -- a direct result of the decline in gas prices last month and hardly bad news for consumers.

...

"Excluding autos, spending growth looks healthy -- not a blockbuster holiday season, but far better than it appeared a couple of months ago when gasoline prices were over $3 per gallon," economist Nigel Gault said.

When the drop in sales at gasoline stations is excluded, retail sales rose 1.0 percent in November.

October sales were also revised higher, helping take some sting out of the disappointing result. Total sales rose 0.3 percent that month, up from the 0.1 percent decline initially reported.

...

Still, with October and November sales weaker than expected, analysts said there could well be an outright decline in retail sales in the fourth quarter -- which in turn would hurt economic growth in the final three months of 2006.

"This was a disappointing number relative to expectations and certainly consistent with the idea that consumer spending is going to be a much smaller contributor to economic growth in the fourth quarter than in the third," said Chris Probyn, chief economist at State Street Global Advisors in Boston.

...

"Seasonal business remains below expectations," Redbook said. "An early-December lull was factored into most sales plans for the month, so retailers remained cautiously optimistic as they continued to sit out the pre-Christmas wait."

NRF: Strong November Retail Sales Surpass Expectations

by Calculated Risk on 12/13/2005 11:06:00 AM

The National Retail Federation reports:

Consumers started their holiday shopping with a bang, responding well to retailers' aggressive promotions. According to the National Retail Federation (NRF), retail industry sales for November (which exclude automobiles, gas stations, and restaurants) rose a strong 7.4 percent unadjusted over last year and increased 0.5 percent seasonally adjusted from the previous month. The increase is in line with NRF's holiday sales forecast of 6.0 percent growth.

"Consumers shook off concerns about higher energy costs and responded well to the seasonal promotions," said NRF Chief Economist Rosalind Wells. "If November is any indication of what consumers are capable of, retailers can expect a very happy holiday season."

November retail sales released today by the U.S. Commerce Department show that total retail sales (which include non-general merchandise categories such as autos, gasoline stations and restaurants) rose 0.3 percent seasonally adjusted from November, and increased 6.3 percent unadjusted year-over-year. Gasoline sales, which NRF does not include in its calculation of retail industry sales, rose 17.0 percent unadjusted from last November.

The rosy report was boosted by strong year-to-year growth across nearly every retail industry category, including building material and garden equipment and supplies stores, which jumped a whopping 14.3 percent over last year. The main drivers for this holiday, apparel and electronics, also experienced solid growth. Sales at clothing and clothing accessories stores rose 7.6 percent year-over year and electronics and appliance stores jumped 7.4 percent from November 2004.

Additionally, strong year-over-year gains were seen at health and personal care stores (6.7%), general merchandise stores (7.1%), furniture and home furnishing stores (5.9%) and grocery stores (5.3%).

NRF expects retail industry sales to increase 5.6 percent this year over 2004. Holiday sales, which are defined as retail industry sales in the full months of November and December, are expected to rise 6.0 percent to $438.5 billion.

Monday, December 12, 2005

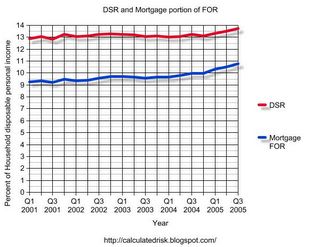

Household Debt Service and "Parabolic Debt"

by Calculated Risk on 12/12/2005 05:00:00 PM

Reuters quotes Prudent Bear fund manager David Tice expressing concern today that 'credit market debt as a percent of U.S. gross domestic product "has essentially gone parabolic"'.

I'm more concerned that Household Debt Service is at an all time high, even with low interest rates. See my Angry Bear post: FED: Household Debt Service Sets Record in Q3

First, here are some quotes from the Reuters article:

A possible hard landing for the U.S. housing market poses the risk of a secular bear market for equities, mutual fund manager David Tice said on Monday at the Reuters Investment Outlook 2006 Summit.

"The rollover in real estate could happen pretty quickly," said Tice, who runs the the Prudent Bear, a mutual fund which seeks to benefit from falling share prices.

The United States has leaned heavily on housing and related industries for economic growth in recent years.

That virtuous circle, fueled by rounds of cash-out mortgage refinancing that has propped up consumer spending, will give way in 2006 or 2007 to a vicious cycle that drags down corporate earnings and employment, he said.

...

"The excesses in mortgage finance are just astounding," he said at the summit, which is being held in New York this week.

...

Years of cheap credit provided by an accommodative Federal Reserve has made more difficult the task of running a bear fund and picking the right stocks to short, Tice said.

...

Tice said credit market debt as a percent of U.S. gross domestic product "has essentially gone parabolic," and policy-makers have seemed prepared to prevent recession at all costs.

"If you continue to goose the economy with more debt it's like keeping an eight-year-old on a sugar high," he said.

Click on graph for larger image.

Tice is referring to all debt, but it might be helpful to look at the fastest growing segment; mortgage debt. This graph shows the growth of mortgage debt as a % of GDP since 1999.

Although mortgage debt has grown substantially, both nominally and as a % of GDP, I wouldn't call it "essentially ... parabolic".

I think the greater concern is the recent rise in household debt service and financial obligations ratios. Both ratios are already at record levels.

DEFINITIONS: The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

Note: The graph only shows the mortgage portion of the FOR.

It appears households initially took on debt and kept their payments steady as interest rates dropped. However, recently the portion of disposable personal income dedicated to debt service has risen steadily. As interest rates rise, and with the new credit card minimum payments, the DSR and FOR will probably continue to rise, putting more pressure on household finances.