by Calculated Risk on 12/01/2005 09:03:00 PM

Thursday, December 01, 2005

Housing: Remarks by Controller of the Currency

John C. Dugan, Controller of the Currency, remarked today on exotic mortgages and the housing market. The first half of his talk, before the Consumer Federation of America, concerned changes to credit card regulations. Here are his remarks (pdf) on negative amortization mortgage products:

"And so, just as we come to the end of the neg am story in credit card lending, I fear we are at the beginning of one in the mass marketing of home mortgages. One of the new “non-traditional” mortgage products you may have heard about is the so-called payment-option ARM – a mortgage that allows borrowers to select from a menu of payment possibilities, ranging from a fully amortizing monthly payment to the neg am payment option that does not cover the outstanding interest. Such products have been available for quite a long time, but until recently had been provided primarily to a narrow group of very creditworthy borrowers who found differing payment options to be an attractive “cash management” tool over time. In this niche market – which is different from the credit card market because of the collateral securing the loan – borrowers have generally had the wherewithal and sophistication to handle temporary periods of negative amortization without jeopardizing their ultimate repayment of principal.

In the last two years, however, we have seen a spike in the volume of payment-option ARMs, which are no longer largely confined to well-heeled borrowers who can clearly afford them. Increasingly, they are being mass marketed as “affordability products” to borrowers who appear to be counting on the fixed period of exceptionally low minimum payments – typically lasting the first five years of the loan – as the primary way to afford the large mortgages necessary to buy homes in many housing markets across the country. And as the loans become more popular, the prospect of using them to penetrate the subprime lending market cannot be far behind.

The fundamental problem with payment option ARMs, other than the growing principal balance due to negative amortization, is payment shock. A traditional 30-year fixed-rate mortgage requires the borrower to amortize the principal balance through equal payments over the 30-year life of the loan. In contrast, a typical payment-option ARM is a 30-year mortgage that permits five years of negative amortization by allowing a borrower to make very low minimum monthly payments during that period. Beginning in the sixth year, the borrower must begin paying the full amount of interest accruing each month, and must also begin amortizing the increased principal over the remaining 25-year life of the loan. The combination of these factors can produce sharply increased payments in year six. For example, a typical payment-option mortgage of $360,000 at 6 percent can produce a monthly payment increase of nearly 50 percent in that year, assuming no change in interest rates. If rates rise to just 8 percent, the payment increase when amortization begins would nearly double.

To the extent that they are planning for such contingencies, many payment-option-ARM borrowers calculate that they will be able to sell their property or refinance the mortgage by year six. But if real estate prices decline – and there already is evidence of softening in some markets – these borrowers could face the bleak prospect of loan balances that exceed the value of the underlying properties. In that case, selling the property or refinancing the loan would not be a viable escape valve for avoiding huge payment shocks.

In these circumstances, do consumers really understand the potential consequences of the neg am feature inherent in a payment-option ARM? Is this an appropriate product to mass market to customers who may be looking at the less than fully amortizing minimum payment as the only way to afford a larger mortgage – at least for the five years before the onset of payment shock? And are lenders really prepared to deal with the consequences – including litigation risk – of providing such products in markets where real estate prices soften or decline, or where interest rates substantially increase?

I fear the answer to all these questions may be “no.” That is one reason why, if all goes according to plan, the Federal banking agencies will propose new guidance with respect to nontraditional mortgage products by the end of this month. While the guidance will cover many other issues besides negative amortization and payment option ARMs, these will certainly be central among the topics addressed. I am mindful of the history of neg am products in credit cards, and I recognize that the nationwide mass marketing of neg am mortgages is in its infancy. As a result, I firmly believe that the guidance should draw clear lines about appropriate standards for qualifying borrowers for payment option ARMs that explicitly take into account potential payment shock. Put another way, lenders should not encourage or accept applications from borrowers who clearly cannot afford the dramatically increased payments that are likely to result at the end of the five-year, low minimum payment period. Disclosures should also be clear, timely, and meaningful. And lenders should have very substantial controls in place to manage the potential risk of such loans."

Quarterly House Appreciation by State

by Calculated Risk on 12/01/2005 03:04:00 PM

In addition to YoY appreciation rates, the OFHEO HPI also presents the quarterly appreciation by state. Every state had positive price increases for Q3 2005.

The worst performing states in Q3 were Michigan (0.89% quarterly increase, 3.6% annual rate) and Kansas (0.94% quarterly increase, 3.8% annual rate).

The best was Arizona (7.3% quarterly increase or a 32.6% annual rate). The following map shows the state by state quarterly appreciation:

Quarterly Appreciation:

Red: Greater than 5%

Dark Orange: 4% to 5%

Light Orange: 3% to 4%

Purple: 2% to 3%

Light Blue: 1% to 2%

Dark Blue: less than 1%

Its important to note these are quarterly rates.

Florida, the DC area and the West Coast continue to see the most price appreciation. Massachusetts has cooled substantially as inventories have increased, although prices still appreciated 1.4% for Q3 (or 5.7% annual rate).

House Price Index Shows 12 Percent Annual Increase

by Calculated Risk on 12/01/2005 10:19:00 AM

The Office of Federal Housing Enterprise Oversight (OFHEO) released (pdf) their Q3 House Price Index this morning.

UPDATE: See Kash's Post: House Prices. Kash breaks the numbers down by some of the hotter markets.

Average U.S. home prices increased 12.02 percent year over year from the third quarter of 2004 through the third quarter of 2005. This represents a two ercentage point decline from the previous four-quarter appreciation rate of approximately 14 percent. Appreciation for the most recent quarter was 2.86 percent. The figures were released today by OFHEO Acting Director Stephen A. Blumenthal, as part of the House Price Index (HPI), a quarterly report analyzing housing price appreciation trends.

“Appreciation rates in the third quarter were extremely strong, although some deceleration can be seen in a number of the faster-appreciating markets,” said OFHEO Chief Economist Patrick Lawler. “Price momentum in the Pacific and New England states, in particular, has pulled back.”

House prices grew more rapidly over the last year than did prices of non-housing goods and services reflected in the Consumer Price Index. House prices rose 12 percent, while prices of other goods and services rose only 4.5 percent.

Appreciation rates in the Pacific Census Division fell from last quarter, but remain higher than in other areas. At slightly less than 16.9 percent, the four-quarter appreciation rate in the South Atlantic Division now trails appreciation in the Pacific by less than one-half a percentage point.

Other significant findings in the HPI:

1. Price growth in Arizona continues to accelerate, with a one-year appreciation rate of 30 percent, the largest of any state by a wide margin.

2. Florida became the second fastest-appreciating state, with four-quarter appreciation of 25 percent and 11 of the 20 highest ranked Metropolitan Statistical Areas (MSAs).

3. Nevada’s four-quarter appreciation rate declined by more than 10 percentage points from the previous rate of 28.6 to 17.6 percent.

4. Two states that continue to show noticeable house price appreciation are Idaho and Utah. Idaho, with an appreciation rate of 15.1 percent on a four-quarter basis, is now ranked 12 among states, up from 20 in the previous HPI report. With annual price growth of 11.4 percent, Utah’s ranking jumped to 22, compared with 31 in the previous HPI report and last place in the fourth quarter of 2003.

5. With a four-quarter appreciation rate of 34.4 percent, Phoenix-Mesa-Scottsdale, AZ topped the list of the fastest appreciating MSAs for the first time since OFHEO began publishing its index in the fourth quarter of 1995. Last quarter’s top MSA, Naples-Marco Island, FL, dropped to number three.

6. For the first time since the fourth quarter of 2003, the list of the Top 20 MSAs having the highest appreciation does not contain any Nevada cities. Reno-Sparks, NV, the fourth ranked market last quarter is now 29 among the 265 ranked MSAs. Also, Las Vegas - Paradise, NV has fallen from 21 to 77, with four-quarter appreciation of 13.77 percent.

“Much of the recent run-up in mortgage rates occurred after the third quarter ended,” said Lawler. “To the extent that those increases may have affected prices, those effects will be evident in future quarters.”

Changes in the mix of data from refinancings and house purchase transactions can affect HPI results. This HPI report includes an index that is calculated using only purchase price data. The index shows an increase of 10.95 percent for the U.S. between the third quarter of 2004 and the third quarter of 2005.

Wednesday, November 30, 2005

The Indefatigable Consumer

by Calculated Risk on 11/30/2005 08:14:00 PM

Should the American consumer be labeled 'indefatigable' or 'incorrigible'? One thing is certain, the consumer crossed the savings Rubicon in the summer of 2005.

First, a warm welcome back to General Glut: How we achieved 4.3%! This graph from Professor Hamilton, from July, shows the declining savings rate over the last 20 years. See Dr. Hamilton's post: Which came first: the savings chicken or the deficit egg?

As Gen'l Glut points out, personal saving as a percentage of disposable personal income reached -1.5% in Q3 2005. So imagine the line on Dr. Hamilton's graph continuing its descent into negative territory.

The Rubicon has been crossed.

MBA: Refinance Applications Down Again

by Calculated Risk on 11/30/2005 11:14:00 AM

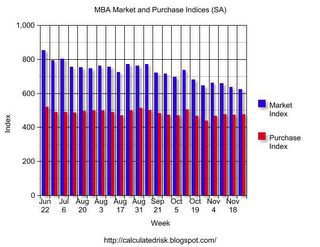

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Dips During Holiday Shortened Week

The Market Composite Index — a measure of mortgage loan application volume – was 624.1 a decrease of 1.8 percent on a seasonally adjusted basis from 635.4, one week earlier. On an unadjusted basis, the Index decreased 33.2 percent compared with the previous week but was down 8.0 percent compared with the same week one year earlier. The seasonally-adjusted indexes include an additional adjustment to account for the Thanksgiving holiday.

The seasonally-adjusted Purchase Index increased by 0.8 percent to 476.2 from 472.3 the previous week whereas the Refinance Index decreased by 6.3 percent to 1484.3 from 1584.1 one week earlier.

Click on graph for larger image.

The graph shows overall and purchase activity since June. Overall activity has fallen significantly due to the drop in refis. Purchase activity is steady.

As expected, mortgage rates declined again last week:

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.20 percent from 6.26 percent on week earlier...Mortgage rates will probably increase this week. Overall this report shows purchase activity is steady at a very high level, but refinance activity continues to decline significantly. It is possible that MEW (Mortgage Equity Withdrawal) is falling rapidly, and this would be expected to impact consumer spending - maybe early next year.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.72 percent from 5.83 percent...

See: Real-Estate Boom Soon May Sputter As an Engine of Retail Sales