by Calculated Risk on 11/30/2005 11:14:00 AM

Wednesday, November 30, 2005

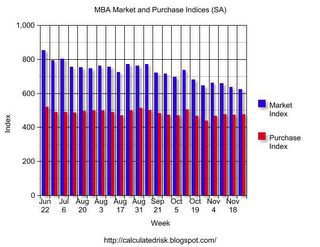

MBA: Refinance Applications Down Again

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Dips During Holiday Shortened Week

The Market Composite Index — a measure of mortgage loan application volume – was 624.1 a decrease of 1.8 percent on a seasonally adjusted basis from 635.4, one week earlier. On an unadjusted basis, the Index decreased 33.2 percent compared with the previous week but was down 8.0 percent compared with the same week one year earlier. The seasonally-adjusted indexes include an additional adjustment to account for the Thanksgiving holiday.

The seasonally-adjusted Purchase Index increased by 0.8 percent to 476.2 from 472.3 the previous week whereas the Refinance Index decreased by 6.3 percent to 1484.3 from 1584.1 one week earlier.

Click on graph for larger image.

The graph shows overall and purchase activity since June. Overall activity has fallen significantly due to the drop in refis. Purchase activity is steady.

As expected, mortgage rates declined again last week:

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.20 percent from 6.26 percent on week earlier...Mortgage rates will probably increase this week. Overall this report shows purchase activity is steady at a very high level, but refinance activity continues to decline significantly. It is possible that MEW (Mortgage Equity Withdrawal) is falling rapidly, and this would be expected to impact consumer spending - maybe early next year.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.72 percent from 5.83 percent...

See: Real-Estate Boom Soon May Sputter As an Engine of Retail Sales